10 Effective Strategies to Create High-Converting Insurance Services Ads

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Insurance services ads play a critical role in reaching potential clients, building trust, and driving conversions in the competitive insurance market. In this article, we will explore 10 effective strategies to create high-converting insurance services ads, using techniques that leverage modern trends, technology, and audience psychology. Whether you're a marketing professional or an insurance business owner, these tips will help you stand out in the saturated insurance advertising landscape.

Why Insurance Services Ads Are Crucial

The insurance industry thrives on trust and personalized connections. Unlike other industries, selling insurance services demands a tailored approach that resonates with the unique needs of individual clients. High-quality insurance services ads address these needs while building credibility and encouraging engagement.

Understand Your Target Audience

Creating impactful insurance services ads begins with a deep understanding of your target audience. Identify their demographics, financial goals, and pain points. For example:

- Young professionals may seek affordable life insurance plans.

- Parents might prioritize health or child education insurance.

- Small business owners could focus on liability or property insurance.

By segmenting your audience and tailoring your messaging accordingly, you can craft ads that resonate on a personal level and boost conversions.

Use Clear and Compelling Headlines

Your headline is the first thing potential customers notice. It should immediately grab attention and communicate your offer's value. Examples of strong headlines for insurance advertising include:

- "Protect Your Family’s Future for Less Than $1 a Day!"

- "Affordable Health Insurance Plans Tailored for You."

- "Is Your Business Fully Covered? Get a Free Quote Today!"

Pair these headlines with subheadings or supporting text that adds credibility and detail to your offer.

Showcase Real Benefits with Emotional Appeal

Insurance ads are not just a product—it’s a promise of security and peace of mind. Highlight how your services make a difference in the lives of customers. For example:

- Use testimonials or case studies to demonstrate how your plans have helped real families or businesses.

- Employ emotionally charged imagery, such as happy families or successful entrepreneurs, to create a connection with your audience.

Leverage Insurance Native Ads

Insurance native ads seamlessly blend with the content of a platform, making them less intrusive while increasing engagement. These ads work well on blogs, social media feeds, and financial advice websites. To optimize your native ad strategy:

- Ensure your content matches the tone and style of the platform.

- Use storytelling to present your insurance product as a solution to a relatable problem.

- Include a clear call-to-action (CTA) that encourages users to take the next step, such as requesting a quote or learning more about coverage options.

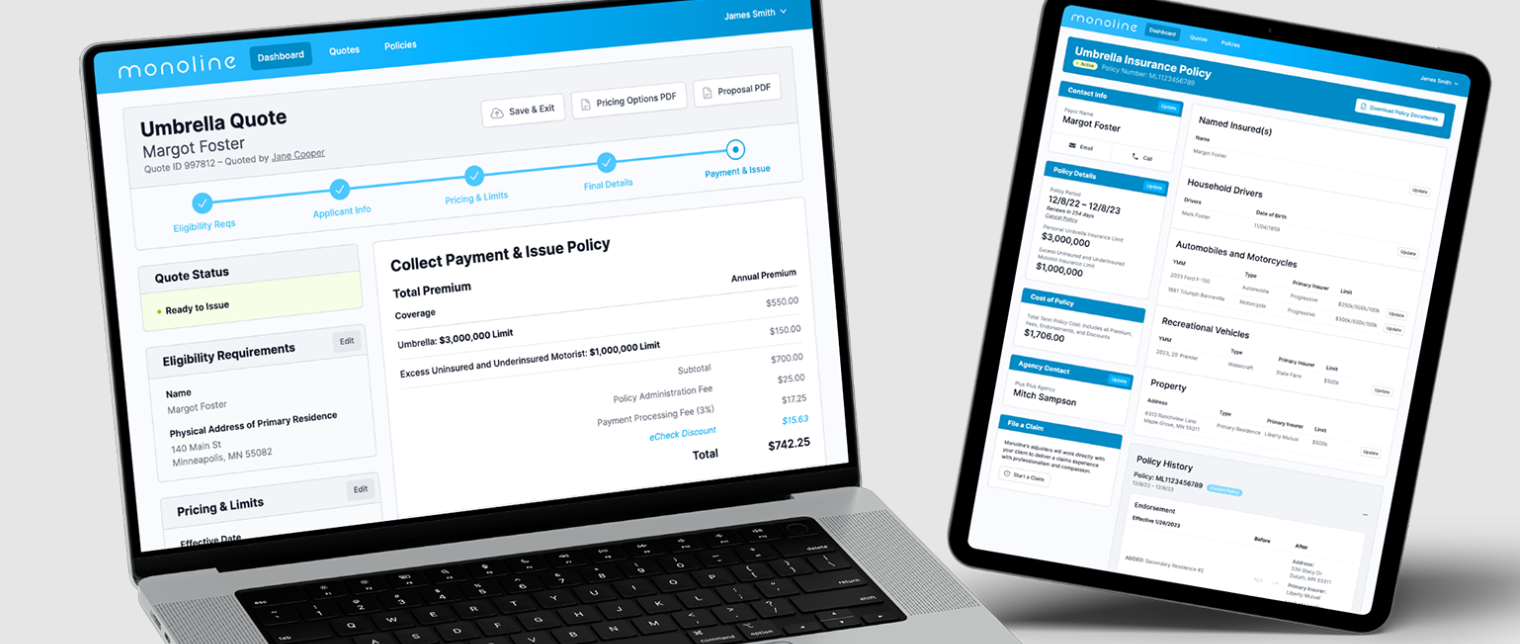

Focus on Visual Appeal

The design of your insurance services ads can significantly impact their performance. Use visuals that are professional, relatable, and aligned with your brand identity. Tips for effective ad design include:

- Incorporating warm, inviting colors that evoke trust (e.g., blue or green).

- Using high-quality images or illustrations.

- Avoiding clutter—keep the design clean and focused on the message.

Interactive content, such as short videos or animated infographics, can further engage audiences and improve recall rates.

Highlight Unique Selling Propositions (USPs)

What sets your insurance services apart? Whether it’s lower premiums, 24/7 customer support, or customized plans, clearly communicate your USPs in your advertising. Examples include:

- "Save up to 30% with Our Family Discount!"

- "Instant Approval for Term Life Insurance—No Medical Exam Needed!"

- "Coverage That Grows with Your Needs."

When customers understand why your service is unique, they’re more likely to choose your product over competitors.

Optimize for Mobile Users

With more than half of all internet traffic coming from mobile devices, ensuring your ads are mobile-friendly is essential. Key considerations include:

- Creating responsive designs that adjust seamlessly to different screen sizes.

- Using concise messaging that is easy to read on small screens.

- Simplifying your landing pages for mobile users, with straightforward CTAs like “Call Now” or “Get a Free Quote.”

Mobile optimization helps you reach audiences on the go and ensures a smooth user experience.

Implement Retargeting Campaigns

Most potential clients don’t convert on their first interaction with an ad. Retargeting campaigns allow you to reconnect with users who have previously visited your site or clicked on an ad. Strategies for effective retargeting include:

- Displaying personalized ads based on their browsing history.

- Offering incentives, such as discounts or exclusive deals, to encourage them to complete the purchase.

- Using dynamic retargeting ads to show specific policies they viewed.

Use Data-Driven Insights

Analytics tools provide valuable insights into how your ads perform and how your audience behaves. Leverage these insights to:

- Test different ad formats, headlines, and CTAs to identify the most effective combinations.

- Refine your targeting criteria to focus on the most promising customer segments.

- Monitor key performance indicators (KPIs) such as click-through rates (CTR) and conversion rates to measure success.

Data-driven decision-making ensures your campaigns are cost-effective and impactful.

Create a Strong Call-to-Action (CTA)

Every successful ad includes a compelling CTA that motivates users to take action. Effective CTAs for insurance services ads include:

- "Get Your Free Quote in 30 Seconds!"

- "Schedule a Consultation with Our Experts Today."

- "Protect Your Future—Sign Up Now!"

Ensure your CTA is clear, prominent, and aligned with the overall goal of the ad.

Best Practices for Insurance Advertising

Build Trust with Transparency

Insurance is a sensitive purchase that requires trust. Avoid using overly salesy language or making exaggerated claims. Instead:

- Be upfront about costs, coverage limits, and exclusions.

- Include certifications, customer reviews, and security assurances to build credibility.

Target the Right Platforms

Not all advertising platforms are created equal. Choose channels where your audience is most active, such as:

- Social Media: Platforms like Facebook and LinkedIn allow you to target specific demographics and professions.

- Search Engines: Use pay-per-click (PPC) ads to capture users actively searching for insurance services.

- Content Sites: Partner with finance and lifestyle blogs to feature your insurance native ads in a contextual setting.

Conclusion

Crafting high-converting insurance services ads requires a strategic approach that combines creativity, data insights, and customer-centric messaging. By understanding your audience, leveraging insurance native ads, and focusing on trust-building techniques, you can design campaigns that not only capture attention but also drive meaningful results.

Start implementing these strategies today to transform your insurance advertising efforts and achieve long-term success.

FAQs About Insurance Services Ads

What Are Insurance Services Ads?

Ans: Insurance services ads are promotional messages designed to market insurance products or services to potential clients. These ads can appear in various formats, including digital banners, video ads, native ads, and social media posts.

How Can I Make My Insurance Ads Stand Out?

Ans: To make your ads stand out:

- Focus on the unique benefits your services offer.

- Use high-quality visuals and attention-grabbing headlines.

- Leverage emotional appeal and storytelling to connect with your audience.

What Are Insurance Native Ads?

Ans: Insurance native ads are advertisements that blend seamlessly into the surrounding content on a platform, making them appear less intrusive. They are particularly effective for building brand awareness and engagement.

What Metrics Should I Track for My Insurance Ads?

Ans: Key metrics to monitor include:

- Click-through rates (CTR)

- Conversion rates

- Cost per acquisition (CPA)

- Engagement metrics, such as time spent on the landing page

How Can I Improve My Insurance Advertising ROI?

Ans: To boost your return on investment (ROI):

- Use data-driven strategies to refine targeting and messaging.

- Optimize your ads for mobile users.

- Invest in retargeting campaigns to re-engage potential clients.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.