5 Blockchain Trends Investors Should Prepare for in 2025

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

If you’ve been in crypto long enough to remember gas wars, unsolicited airdrops, and meme coin hype, 2025 may feel… different.

✍️ NFTs are a hot trend, but few understand the technology behind them. Our blockchain NFT guide explains their origins, uses, and challenges in 2025.

That’s because it is.

Crypto isn’t dying—it’s consolidating. The noise is giving way to actual use cases. Blockchains are more efficient, regulation is catching up, and the average investor is no longer a thrill-seeker but a strategist.

This is especially true in the United States, where access, privacy, and legal clarity are becoming as important as portfolio allocation. Whether you're a cautious first-time investor or a seasoned DeFi participant, you’ll need more than a MetaMask and a dream to navigate what's coming.

In this guide, we break down five blockchain trends that matter right now—and offer practical insights for staying secure, informed, and ahead of the curve in 2025.

Trend 1: Layer 2 Scaling Is No Longer Optional

Ethereum has long been the backbone of DeFi, NFTs, and DAOs. But it’s also known for high fees and limited throughput during peak activity. Layer 2 (L2) solutions have stepped up to fix that.

Platforms like Arbitrum, Optimism, Base, and zkSync now process millions of transactions daily. They allow apps to operate faster and cheaper, all while benefiting from Ethereum’s security guarantees.

Here’s why it matters:

- Transaction costs drop from $20+ to under $0.30

- Speed improves dramatically, often with sub-10-second finality

- Ecosystem depth grows—most new apps now launch directly on L2s

This means as an investor, you’ll need to:

- Learn how to bridge assets safely

- Manage approvals across multiple chains

- Track airdrops and incentive programs that reward L2 activity

🔒 Security Tip: Many Layer 2 dApps are still experimental. When bridging assets or interacting with unfamiliar platforms—especially over public networks—it’s wise to encrypt your connection.

Using a trusted VPN service like X-VPN can help secure wallet traffic, mask IP activity, and reduce the chance of data leaks during on-chain operations.

Layer 2s are no longer the future—they’re now the entry point. Don’t get left behind simply because you stayed on Layer 1.

Trend 2: Regulation Is Finally Catching Up

The U.S. isn’t banning crypto—but it is regulating it.

In 2025, the SEC, CFTC, IRS, and state-level agencies are moving forward with legal frameworks that touch every corner of the crypto experience.

Key areas evolving:

- Stablecoins may require full cash backing or regulated issuers

- Decentralized exchanges may fall under broker-dealer classification

- IP-based access controls are increasing—some apps restrict U.S. residents or specific states (e.g., NY, CA)

For example, in late 2024, a U.S. investor using a decentralized derivatives platform was disconnected mid-session after the platform implemented IP-based restrictions. These kinds of access shifts are becoming common.

As an investor, you should:

- Monitor jurisdictional access rules before allocating capital

- Read platform terms—many now define what constitutes “participation”

- Segment wallets by activity (e.g., one for KYC-required apps, one for anonymous protocols)

🔐 Why Use a VPN? Not to break rules—but to view interfaces, test simulations, or export transaction data if your region is blocked. Think of it as a transparency and due diligence tool.

You don’t need to fear regulation—just stay informed. In fact, those who adapt early are often the ones who gain better opportunities and avoid forced liquidations or offboarding.

Trend 3: DeFi 2.0 Focuses on Real Yield

Forget 1000% APY pools with zero explanation. The new wave of DeFi platforms—often called DeFi 2.0—prioritizes revenue, governance, and sustainability.

What’s changing:

- Protocol-owned liquidity: Projects manage their own capital instead of renting it

- Real-yield models: Investors earn from actual trading fees, not inflation

- Multi-chain support: Apps launch simultaneously on multiple L2s and sidechains

Examples:

- GMX: Users earn real trading fees from derivatives markets

- Pendle: Tokenizes future yield, allowing for fixed income streams

- Morpho: Offers undercollateralized lending with institutional partners

As a user, the shift is clear:

- Read beyond APY—look at fee distribution models

- Track TVL retention instead of peak hype

- Check if token holders get governance or revenue utility

🧠 Security Stack:

- Connect from a clean browser profile

- Use a VPN and hardened DNS to block wallet analytics

- Disconnect MetaMask when not in use

Real yield requires real caution. But the upside is clear—more people are now treating DeFi as a long-term passive income source, not a gambling pit.

Trend 4: Privacy Isn’t Optional—It’s a Strategy

Web3 claims to be decentralized—but it's ultra-trackable. Every wallet action is public. Every NFT bid, token swap, DAO vote, and contract interaction is forever stamped on-chain.

That’s a privacy nightmare.

2025 sees an explosion in privacy tooling, not to hide malicious behavior, but to shield strategic behavior.

Major technologies gaining adoption:

- zkRollups: Prove you did something without showing what

- Stealth wallets: Rotate addresses on each interaction

- Selective disclosure IDs: Show KYC when needed, but keep it private elsewhere

Even passive actions are exposing investors:

- Some portfolio trackers auto-index all wallet activity

- “Whale watchers” ping high-value wallets to anticipate moves

- Airdrop hunters analyze which addresses are “engaged” for targeting

🛡️ What serious investors are doing:

- Using burner wallets for interaction and voting

- Delegating from cold wallets to separate voting keys

- Running dApp sessions inside a VPN + private browser combo

Think of it like seatbelts. You’re not expecting a crash—you’re preparing just in case. Privacy isn’t about hiding. It’s about controlling how you’re perceived and profiled.

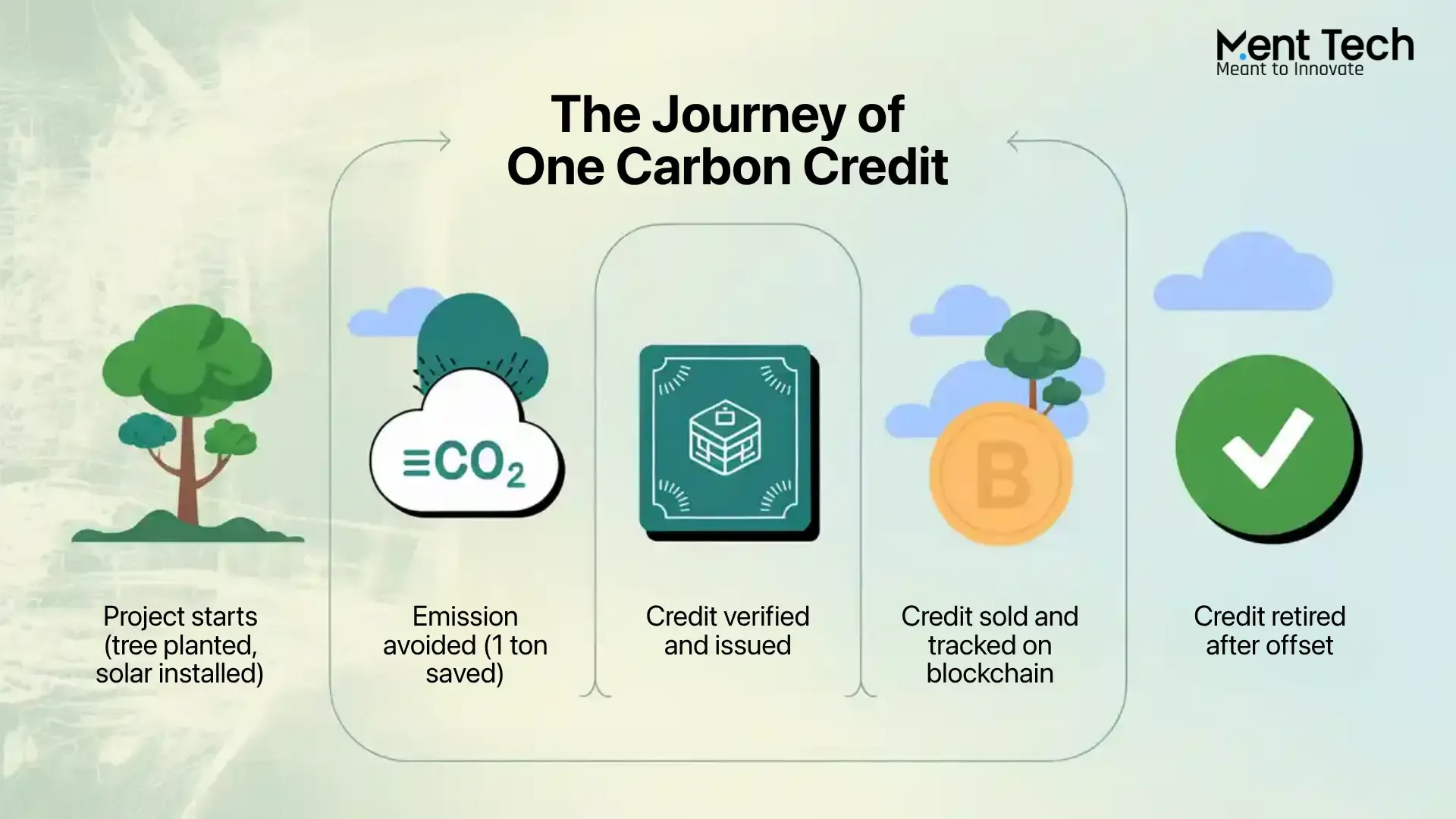

Trend 5: Real-World Assets Enter the On-Chain Portfolio

The hottest thing in crypto right now isn’t crypto—it’s U.S. Treasuries.

Welcome to the world of tokenized real-world assets (RWAs), where government bonds, real estate shares, and even carbon credits are available on-chain in liquid, accessible formats.

Why this is huge:

- Yield: U.S. Treasuries currently offer 4–5% yield, now claimable via smart contracts

- Diversification: RWAs are less volatile and less correlated to BTC/ETH

- Access: Projects are onboarding both retail and institutions via token wrappers

Popular RWA types:

- Tokenized T-Bills: You stake stablecoins and receive a yield-bearing token

- Fractional Property Tokens: Buy into real estate and receive stable income

- Green Assets: Tradeable carbon credits linked to on-chain usage

⚠️ Challenges:

- Many platforms are geo-restricted

- Some offer only read-only interfaces to U.S. users

- KYC is often required—even just to simulate the interface

👨💼 Real Use Case:A U.S.-based investor wants to evaluate whether to allocate into 90-day treasury tokens. By connecting through a VPN routed via a U.S. server, he accesses the front-end of a European platform that’s geo-restricted in Florida. He uses the UI to simulate a position and review daily payout models. No transaction is made—but the insight is valuable.

🎯 Takeaway: RWAs are serious finance. They bring on-chain fixed income. But to use them wisely, you need both the access tools (e.g., VPNs for viewing) and traditional diligence habits (checking risk, term, issuer).

How These Trends Fit Together

None of these trends exist in a vacuum.

In 2025, a single investor might:

- Use a VPN to explore geo-blocked interfaces

- Allocate capital to a real-yield DeFi vault on Layer 2

- Shield behavior using rotating wallets and privacy chains

- Rebalance with on-chain T-Bills for steady income

- Track DAO participation across governance networks

This is the modular stack of modern blockchain investing.

And it's no longer optional. To preserve opportunity, reduce risk, and remain compliant, your tools—and your mindset—must evolve together.

Investor Profiles: 3 Personas, 3 Strategies

1. The Passive Allocator (Age 45–65)

- Focus on tokenized bonds and stable DeFi

- Use cold wallets and VPNs for dashboard access

- Choose projects with real-world entities and insurance

2. The Curious Climber (Age 25–40)

- Learn bridging and gas mechanics

- Chase L2 airdrops and explore DeFi protocols

- Set up VPN + Brave browser combo as default

3. The Web3 Maximalist (Any age)

- Run multiple wallet layers and DNS firewalls

- Use governance tools and vote via smart delegation

- Treat on-chain behavior like a resume—curate it

Conclusion

In 2025, blockchain isn’t about speculation—it’s about structure.

The smartest investors are no longer just coin-pickers. They are tool users, privacy guardians, and regulatory readers. They don’t just protect funds—they protect behavior. They view tools like VPNs, private wallets, Layer 2 bridges, and tokenized T-Bills not as hacks, but as infrastructure.

And most importantly—they act early, test often, and plan around what others react to.

In crypto, your behavior is part of your portfolio. So protect it, optimize it, and use it wisely.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.