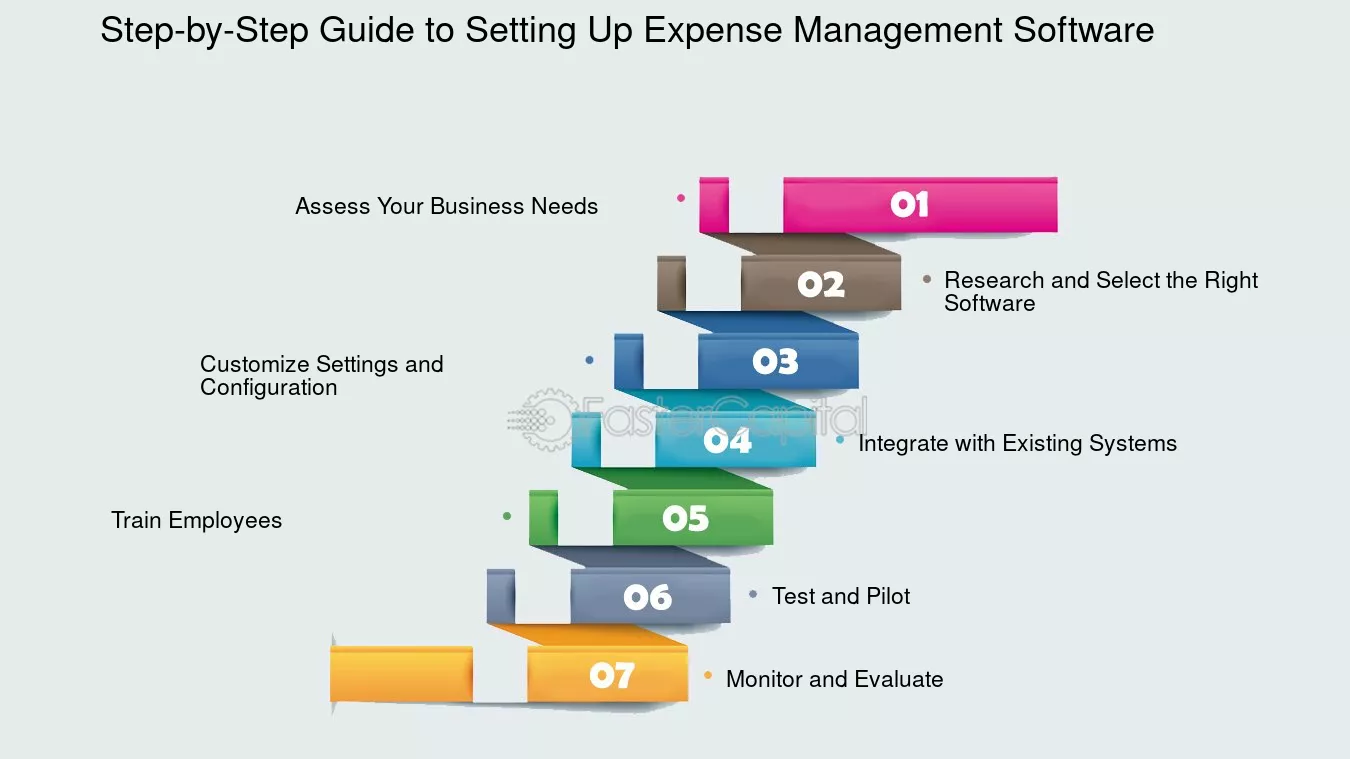

A Step-by-Step Guide to Setting Up an Effective Employee Expense Management System

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Managing employee expenses can quickly become overwhelming if you don’t have a clear system. Whether you run a small startup or a growing business, setting up an effective employee expense management system is essential to keeping your finances organised, controlling spending, and reducing errors.

In this guide, you’ll learn how to build an expense management system that works smoothly for your business. By the end, you’ll know how to set up a system that saves time and reduces headaches for both your finance team and employees.

What is Employee Expense Management?

Employee expense management is the process of tracking, approving, and reimbursing business expenses made by your people. This could include anything from coffee for a client meeting to flights for a business trip or even random office supplies.

You might be thinking, “Why bother?” If you don’t handle it right, you’re looking at late reimbursements, missing receipts, unauthorised spending, and a bookkeeping nightmare. Sounds stressful? Yep. But that’s exactly why a clear, reliable system is essential.

How to Build Your Expense Management System

Building an expense management system might seem like a big task, but breaking it down makes it much easier. Here are the steps you need to follow to get started:

Step 1: Define Your Expense Policy Clearly

Before you set up any system, you need to define your expense policy. This is the foundation of your entire expense management process. Your policy should clearly state:

- What expenses are allowed: For example, travel, meals, supplies, software subscriptions, etc.

- Spending limits: daily or per-item maximum amounts.

- Required approvals: who needs to approve expenses and in what order.

- Receipt and documentation rules: When receipts are required and what documentation employees must provide.

- Reimbursement timelines: How quickly employees will be reimbursed.

Make sure your policy is easy to understand and accessible to all employees. The clearer the rules, the less confusion and fewer disputes you will face later.

Step 2: Choose the Right Tools for Expense Tracking

Handling employee expenses manually, through spreadsheets or paper forms, is time-consuming and prone to errors. You need tools that simplify tracking and approval to set up an effective system.

Look for software or platforms that:

- Allow employees to submit expenses digitally, including uploading receipts via mobile apps.

- Automatically match receipts with transactions where possible.

- Enable custom approval workflows based on employee roles or departments.

- Integrate with your accounting system to reduce manual data entry.

- Provide real-time visibility into company spending.

Many spend management platforms offer corporate cards linked to the system. These cards can be topped up with budgets, and transactions automatically appear in the system, making tracking instant and accurate.

Step 3: Set Up Employee Corporate Cards (Optional but Recommended)

If your business issues many expenses regularly, consider providing employees with corporate cards. Unlike personal credit cards, these are prepaid or top-up based, and your finance team controls spending limits.

Benefits of corporate cards include:

- Instant transaction recording in your expense system.

- Easier receipt matching because purchases are linked to card transactions.

- Spending limits and vendor restrictions are used to control expenses.

- Reduced need for out-of-pocket employee reimbursements.

- Built-in security features include instant card freezing if lost or misused.

You can assign cards to employees or departments and customise spending rules, ensuring better control.

Step 4: Define Approval Workflows and Roles

Not all expenses need the same level of approval. Some businesses use simple one-step approvals, while others require multiple layers for higher-value or sensitive expenses.

Define who approves what, for example:

- Junior employees expenses require approval from their immediate manager.

- Managers expenses might need approval from finance or senior leadership.

- Specific expense categories, such as travel or client entertainment, may need additional scrutiny.

Set these rules clearly within your expense management tool so approvals happen automatically in the right order. This reduces delays and prevents unauthorised spending.

Step 5: Train Your Employees and Finance Team

Even the best system fails if employees don’t know how to use it properly. Once you have your policy and tools ready, organise training sessions to explain:

- How to submit expenses.

- What documentation to upload.

- Your company’s spending rules.

- Approval processes and timelines.

Ensure employees understand the benefits too — faster reimbursements, less paperwork, and clear guidelines. Your finance team should also be trained to manage approvals, run reports, and handle exceptions smoothly.

Step 6: Launch the System with a Pilot Program

Start with a pilot program before rolling out the new expense management system company-wide. Choose a department or small team to use the system exclusively for a set period, such as one month.

During the pilot, gather feedback on:

- Ease of use.

- Any technical issues.

- Gaps in your expense policy.

- Approval bottlenecks.

Use this feedback to improve, update policies, and refine workflows before launch.

Step 7: Monitor Expenses and Review Reports Regularly

Once the system is live, don’t set it and forget it. Regularly review expense reports and dashboards to:

- Track spending trends by category, department, or project.

- Identify unusual or suspicious transactions.

- Check compliance with your expense policy.

- Spot areas where costs can be controlled better.

Modern spend management platforms offer AI-powered insights, such as alerts for duplicate receipts, missing invoices, or unusual spending patterns. Use these features to reduce errors and increase control.

Step 8: Automate Accounting Integration and VAT Compliance

Managing employee expenses isn’t just about approvals — it also impacts your accounting and tax filings. Make sure your expense system integrates with your accounting software to:

- Automatically sync expense data.

- Generate accounting entries with the right cost codes.

- Prepare VAT-compliant records and track input VAT claims where applicable.

This automation reduces manual bookkeeping and the risk of mistakes, saving time during month-end closes.

Step 9: Encourage Receipt Digitisation and Paperless Processes

One of the biggest headaches in expense management is lost or misplaced receipts. Encourage employees to upload receipts digitally as soon as they incur expenses. Your system should allow uploading via mobile apps or browser extensions.

Digitised receipts not only reduce clutter but also make it easier to:

- Match receipts with transactions automatically.

- Flag errors like missing or incorrect amounts.

- Retain proof for audits and VAT compliance.

This simple practice improves transparency and reduces manual effort.

Step 10: Keep Improving Your System

Expense management is not a “set it once” task. Your expense policies and tools may need adjustments as your business grows and changes.

So, periodically look for:

- Review your spending data and approval efficiency.

- Update policies to reflect new business needs or compliance requirements.

- Explore new features offered by your spend management platform.

- Collect employee feedback to address pain points.

Continuous improvement ensures your system stays effective and supports your company’s financial goals.

Conclusion

Setting up an effective employee expense management system is critical for controlling costs, reducing manual work, and improving financial accuracy in your business. By defining clear policies, choosing the right tools, automating wherever possible, and training your team, you create a process that works well for everyone.

Remember, the goal is to make expense management simple, transparent, and efficient. The time and effort you invest in building a solid system will pay off with better control over your company’s spending and happier employees who get reimbursed promptly. Take the first step today by reviewing your current process and planning how you can improve it step-by-step. Your finance team and employees will thank you.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.