Agricultural Biologicals Market Size, Share, and Growth Analysis Through 2032

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

The global agricultural biologicals market was valued at USD 15.29 billion in 2024 and is projected to grow to USD 17.42 billion in 2025, reaching USD 44.70 billion by 2032. This reflects a strong compound annual growth rate (CAGR) of 14.41% during the forecast period. North America dominated the market in 2024, holding a 31.46% share. The U.S. market alone is anticipated to hit USD 10.09 billion by 2032, primarily driven by the growing incidence of plant diseases and a surge in product registrations and approvals.

Market Drivers and Trends

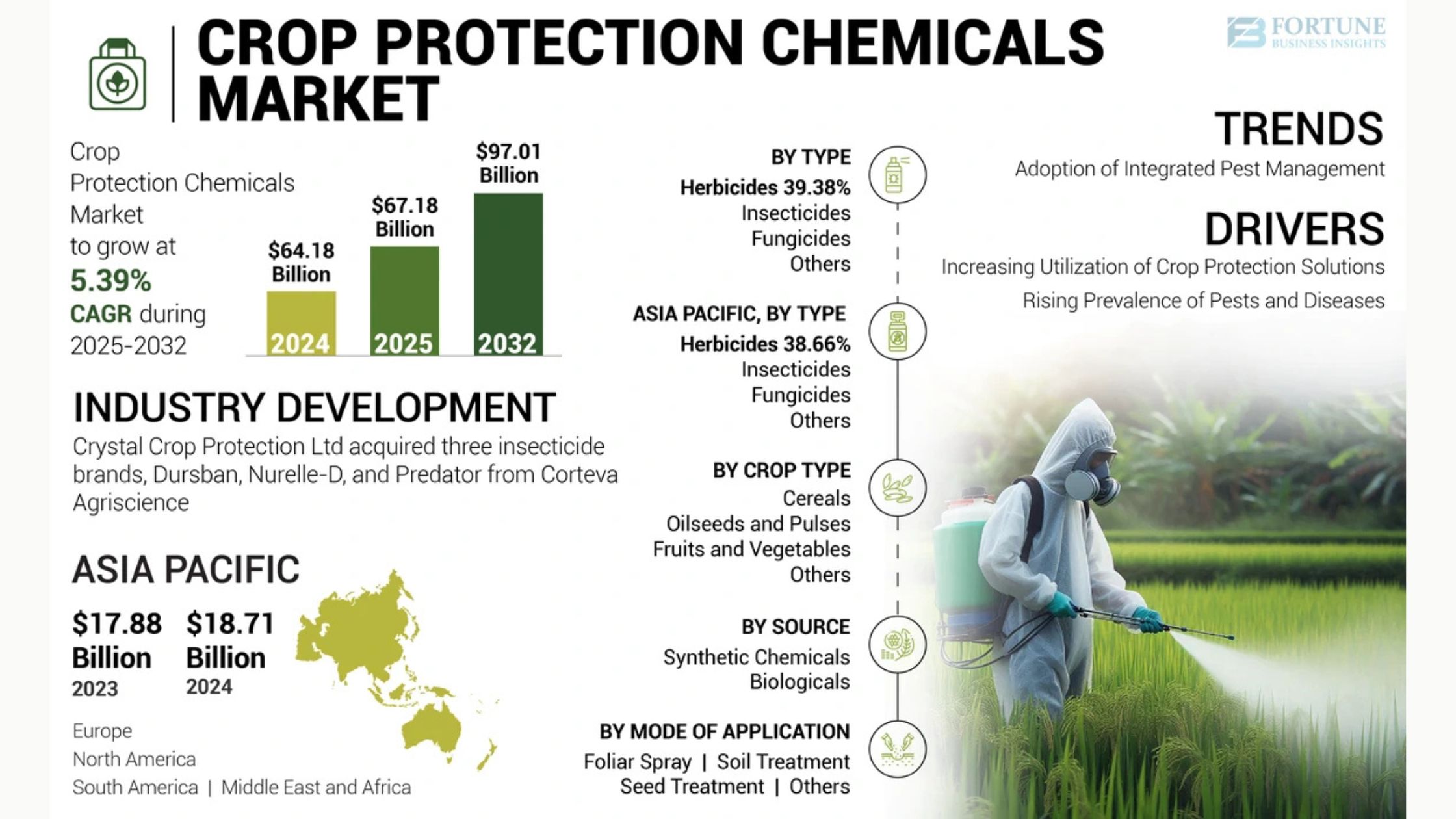

Rising environmental concerns related to the excessive use of synthetic chemical fertilizers and pesticides are accelerating the shift toward eco-friendly biological alternatives. Agricultural biologicals—used either independently or in conjunction with chemical crop protection solutions—are gaining traction due to their diverse applications. Increased adoption during both pre-harvest and post-harvest phases, coupled with improved marketing efforts, expanded distribution networks, and strong last-mile delivery infrastructure, are further propelling market growth.

Information Source: https://www.fortunebusinessinsights.com/industry-reports/agricultural-biologicals-market-100411

Segmentation Analysis

The market is segmented based on type, source, application, crop type, and region. Biopesticides led the type segment in 2023, driven by the growing demand for natural crop protection solutions that enhance yield and crop health. Among sources, microbials held the largest share due to their effectiveness in addressing agricultural challenges through the use of naturally occurring organisms. In terms of application, foliar sprays remained the most widely adopted method, appreciated by both organic and conventional farmers for their ease of use and efficacy.

Row crops dominated the crop type segment, supported by increasing consumer interest in organic and minimally processed food products. Regionally, the market spans North America, Europe, Asia Pacific, and the Middle East & Africa, with each region exhibiting unique agricultural practices and regulatory environments influencing market dynamics.

Key Report Insights

This report delivers a comprehensive examination of growth catalysts, market restraints, and ongoing trends. It also assesses the implications of the COVID-19 pandemic and presents strategic moves and innovations from leading market participants.

Growth Drivers and Limitations

Integrated Pest Management (IPM): Increasing adoption of IPM practices—where biopesticides play a central role—is significantly contributing to market expansion.

Regulatory Barriers: However, the lack of harmonized international regulations for agricultural biologicals could restrain further growth.

Regional Insights

North America: Continued leadership is supported by rising cultivation of crops like soybeans, wheat, and cotton, alongside a growing demand for disease control through biological means.

Europe: The soaring prices of synthetic fertilizers based on nitrogen and phosphorus are encouraging a shift to biologically sustainable and economically viable alternatives.

Competitive Landscape

The agricultural biologicals sector is moderately consolidated, comprising a mix of established companies and emerging startups. Leading firms are investing heavily in research and development, leveraging strong brand equity, and capitalizing on extensive distribution capabilities. Innovation remains a key focus for gaining competitive advantage and expanding market presence.

Major Market Participants:

Bayer AG (Germany)

BASF SE (Germany)

Syngenta AG (Switzerland)

UPL Limited (India)

Marrone Bio Innovations (U.S.)

SEIPASA S.A. (Spain)

Koppert Biological Systems (Netherlands)

PI Industries (India)

Novozymes A/S (Denmark)

Gowan Group (U.S.)

Get Sample PDF Brochure: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/agricultural-biologicals-market-100411

Recent Industry Development

In August 2022, Chambal Fertilizers and Chemicals Limited (CFCL) launched UTTAM SUPERRHIZA, a Mycorrhiza-based biofertilizer. The product blends advanced plant growth-enhancing technology with native biological agents to improve plant vitality and Mycorrhiza effectiveness.

Global Market Perspective

This segment offers a holistic view of the market’s global significance and its contribution to economic growth. It evaluates the role of market in boosting revenues, market capitalization, and financial performance. By identifying high-potential regions and current market dynamics, the report uncovers strategic opportunities likely to drive sustainable industry growth in the coming years.

Influence of the Agriculture Sector

The report explores how the agriculture industry is influencing the demand. It examines evolving consumer preferences, advancements in agricultural technologies, and cross-sector collaborations that are driving market trends. Special emphasis is placed on the rising demand for specialty and niche applications, which is significantly contributing to market expansion.

Key Highlights from the Table of Contents

Major sections include:

Market Dynamics and Growth Drivers

Technological Innovations Influencing the Sector

Recent Industry Developments

Regulatory Frameworks and Compliance Issues

Market Forecast (2025–2032)

1 Introduction

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.4 Unit Considered

1.5 Stakeholders

1.6 Summary Of Changes

2 Research Methodology

2.1 Research Data

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Research Assumptions

2.5 Limitations And Risk Assessment

2.6 Recession Impact Analysis

3 Executive Summary

4 Premium Insights

5 Market Overview

5.1 Introduction

5.2 Macroeconomic Indicators

5.3 Market Dynamics

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.