AI in Corporate Banking Market: Building Smarter Banking Models Through AI

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

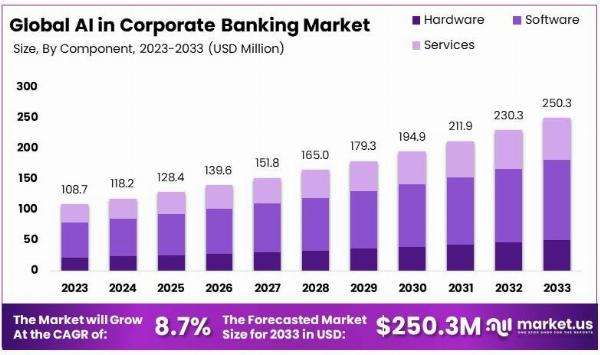

AI is reshaping the corporate banking market by introducing advanced technologies that streamline operations, enhance security, and improve customer experiences. With artificial intelligence, banks can analyze vast amounts of data quickly and accurately, automate routine tasks, and offer tailored financial services. This transformation is making banking more efficient and responsive to the needs of businesses, setting the stage for a new era in financial services.The Global AI in Corporate Banking Market size is expected to be worth around USD 250.3 Million by 2033, from USD 108.7 Million in 2023, growing at a CAGR of 8.7% during the forecast period from 2024 to 2033

Major Drivers

Several factors are fueling the growth of AI in corporate banking. The explosion of digital data from transactions and customer interactions creates a need for sophisticated tools to analyze and leverage this information effectively. Additionally, banks are under constant pressure to reduce costs and improve efficiency, and AI can automate many repetitive tasks to achieve this. Regulatory pressures for better risk management and fraud prevention also push banks to adopt AI solutions. Moreover, the demand for personalized and faster customer service drives banks to invest in AI technologies that can deliver customized financial solutions.

Read More @https://market.us/report/ai-in-corporate-banking-market/

Emerging Trends

AI is bringing several new trends to corporate banking. One trend is the rise of predictive analytics, where AI algorithms forecast market trends and help banks make better decisions. Another trend is the use of AI-powered chatbots and virtual assistants that provide around-the-clock customer support and handle routine queries. Banks are also integrating AI with big data analytics to offer more personalized financial products and services. Additionally, AI-driven cybersecurity measures are becoming increasingly important for protecting sensitive financial data from fraud and cyber threats.

Top Use Cases

AI is being utilized in various impactful ways within corporate banking. In risk management, AI models analyze financial data to predict and mitigate potential risks. Credit scoring is another key area where AI enhances accuracy by considering a wider range of factors than traditional methods. AI is also revolutionizing fraud detection by identifying unusual patterns and flagging suspicious activities in real-time. Customer service is improved through AI-powered chatbots and virtual assistants that efficiently handle a high volume of inquiries and provide instant support.

Challenges

Despite its benefits, the integration of AI in corporate banking comes with challenges. Ensuring the quality of data is crucial, as AI systems depend on accurate information to function properly. There are also concerns about the transparency of AI decision-making processes, especially in areas like credit scoring. High costs associated with implementing and maintaining AI systems can be a barrier for smaller banks. Additionally, managing regulatory compliance and data privacy issues is essential to avoid legal complications and maintain customer trust.

Opportunities

AI offers numerous opportunities for corporate banking. It allows banks to improve operational efficiency by automating routine tasks, leading to cost savings. The ability to deliver personalized services enhances customer satisfaction and loyalty. AI also provides advanced tools for better risk management and fraud detection, helping banks protect their assets and sensitive information. Furthermore, AI-driven insights support more strategic decision-making, giving banks a competitive edge in a rapidly changing market.

Conclusion

In summary, AI is transforming the corporate banking market by enhancing efficiency, security, and customer service. While there are challenges related to data quality, transparency, and costs, the advantages of AI are significant. Embracing AI technologies enables banks to streamline operations, offer personalized services, and stay competitive. As AI continues to evolve, it presents exciting opportunities for innovation and growth in the corporate banking sector, shaping the future of financial services.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.