Atherectomy Devices Market : A Comprehensive Overview

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

In recent years, the healthcare industry has witnessed significant advancements, particularly in cardiovascular care. One such advancement is the rise of atherectomy devices, which play a crucial role in treating atherosclerosis—a condition characterized by the buildup of plaque in the arteries. As we delve into the Atherectomy Devices Market, we will explore its growth, key players, segments, and overall impact on healthcare.

What is Atherectomy?

Atherectomy is a minimally invasive surgical procedure that involves the removal of plaque from the arteries. This procedure is vital for patients suffering from peripheral artery disease (PAD) and coronary artery disease (CAD). Atherectomy devices are specialized tools used to perform this procedure, helping to restore blood flow and prevent serious complications, such as heart attacks and strokes.

Market Overview of Atherectomy Devices

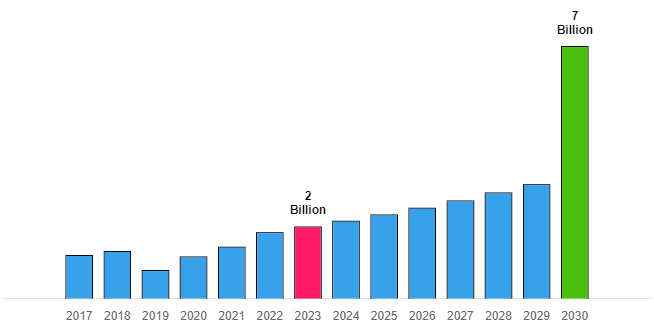

The atherectomy devices market has seen remarkable growth over the years. In 2023, the market size was valued at 2.00 billion, and projections indicate that it will grow to 5.00 billion in 2024 and reach 7.00 billion by 2030. This growth is driven by an 8.00% compound annual growth rate (CAGR), highlighting the increasing demand for effective cardiovascular treatments.

Key Players of Atherectomy Devices

Several prominent companies dominate the atherectomy devices market, including:

- Boston Scientific Corp.

- Cardiovascular Systems Inc.

- Medtronic Plc

- Spectranetics Corp.

- Avinger Inc.

- Royal Philips NV

- Terumo Corp.

These companies are at the forefront of innovation, continuously developing new technologies and devices to improve patient outcomes.

Key Segments of Atherectomy Devices

The atherectomy devices market can be segmented based on type and application.

Type of Atherectomy Devices Market:

- Directional Atherectomy Devices: These devices are designed to remove plaque in a specific direction, minimizing damage to healthy tissue. They are particularly useful for treating lesions that are hard to access.

- Orbital Atherectomy Devices: These devices utilize a rotating mechanism to ablate plaque from the artery walls, allowing for more efficient plaque removal.

- Rotational Atherectomy Devices: Similar to orbital devices, these use a rotating burr to break down plaque, providing effective results in difficult cases.

- Laser Atherectomy Devices: Utilizing laser technology, these devices precisely target and vaporize plaque, offering a less invasive option for patients.

Applications of Atherectomy Devices Market:

- Hospitals: The majority of atherectomy procedures are performed in hospitals, where patients have access to comprehensive care and advanced facilities.

- Ambulatory Surgical Centers (ASCs): ASCs are increasingly adopting atherectomy devices due to their focus on outpatient care, allowing patients to recover at home.

- Clinics: Smaller healthcare facilities and specialty clinics are also integrating atherectomy devices into their services, expanding access to this vital procedure.

Regional Insights of Atherectomy Devices Market

The atherectomy devices market is globally diversified, with key regions including:

- North America: The largest market for atherectomy devices, primarily due to advanced healthcare infrastructure and a high prevalence of cardiovascular diseases.

- Europe: The European market is growing steadily, driven by increasing healthcare expenditures and a rising awareness of cardiovascular health.

- Asia Pacific: This region is expected to witness the fastest growth, fueled by a growing aging population and rising incidences of lifestyle-related diseases.

- Latin America and the Middle East & Africa: These regions are gradually adopting atherectomy devices, driven by improving healthcare access and increasing investment in medical technology.

Market Dynamics

- Drivers of Market Growth

Aging Population: As populations age, the prevalence of cardiovascular diseases, including atherosclerosis, increases. Older adults are more susceptible to plaque buildup in arteries, leading to a higher demand for atherectomy procedures.

Lifestyle Changes: Sedentary lifestyles, poor dietary habits, and rising obesity rates contribute to cardiovascular diseases, driving the need for effective treatment options such as atherectomy. Increasing Healthcare Expenditure: Rising healthcare budgets across various countries are enabling better access to advanced medical technologies, including atherectomy devices. Governments and private sectors are investing in healthcare innovations, fostering market growth.

- Restraints and Challenges

Cost-Effectiveness: While atherectomy procedures can be life-saving, their high costs may limit patient access. Health insurance coverage variations can also affect the adoption rates of these devices.

Patient Awareness: Despite advancements in cardiovascular treatments, some patients may be unaware of atherectomy as a viable treatment option. Educational initiatives are necessary to improve patient understanding and acceptance.

Technical Expertise Required: Performing atherectomy procedures requires specialized skills and training, which may limit the number of healthcare providers who can offer these services, particularly in rural or underdeveloped areas.

- Technological Advancements

Integration of Robotics and AI: The development of robotic-assisted atherectomy devices is enhancing precision and reducing recovery times. AI technologies are being integrated to assist physicians in making real-time decisions during procedures.

Enhanced Imaging Techniques: Advanced imaging modalities, such as intravascular ultrasound (IVUS) and optical coherence tomography (OCT), are increasingly used in conjunction with atherectomy devices. These technologies help physicians visualize arterial blockages more clearly, leading to better procedural outcomes.

Hybrid Procedures: There is a growing trend towards hybrid procedures, where atherectomy is combined with other techniques like angioplasty or stenting. This approach can provide comprehensive treatment for complex cases.

- Regulatory Environment

Regulatory Approvals: Atherectomy devices must undergo rigorous testing and validation before receiving approval from regulatory bodies like the FDA (U.S. Food and Drug Administration) and EMA (European Medicines Agency). This process ensures safety and efficacy but can also be a barrier to rapid market entry for new products.

Post-Market Surveillance: Continuous monitoring of atherectomy devices post-approval is essential to ensure ongoing safety and effectiveness. Manufacturers are required to conduct post-market studies, leading to improvements in device design and functionality.

Product Type:

Directional Atherectomy Devices: These devices are ideal for treating focal lesions in arteries.

Orbital Atherectomy Devices: These are particularly effective in calcified lesions, enabling more thorough plaque removal.

Rotational Atherectomy Devices: These devices are used for tougher, fibrotic plaques and are effective in various arterial locations.

Laser Atherectomy Devices: Laser technology allows for precise removal of plaque, minimizing damage to surrounding tissues.

By End User:

Hospitals: The primary users of atherectomy devices, where most complex cardiovascular interventions occur.

ASCs: Increasingly popular for outpatient procedures, providing efficient care and lower costs.

Clinics: Growing adoption in specialty clinics for peripheral vascular interventions.

Factors Driving Market Growth of Atherectomy Devices

Several factors contribute to the growth of the atherectomy devices market:

- Rising Prevalence of Cardiovascular Diseases: The increasing incidence of heart-related ailments, fueled by factors like obesity, diabetes, and sedentary lifestyles, is driving demand for effective treatment options.

- Technological Advancements: Continuous innovations in atherectomy technology are enhancing the efficiency and safety of procedures, leading to greater adoption among healthcare providers.

- Increasing Awareness: Growing awareness about cardiovascular health and preventive measures is encouraging patients to seek treatment, thereby boosting market growth.

- Government Initiatives: Supportive government policies and initiatives aimed at improving healthcare infrastructure and access to advanced medical technologies are contributing to market expansion.

Challenges of Atherectomy Devices Market

While the atherectomy devices market is on an upward trajectory, it also faces certain challenges:

- High Costs: The cost of atherectomy procedures and devices can be a barrier for some patients and healthcare facilities, limiting widespread adoption.

- Competition from Alternative Treatments: Other treatment options, such as stenting and balloon angioplasty, present competition, making it essential for atherectomy devices to demonstrate clear advantages.

- Regulatory Hurdles: Navigating regulatory requirements for new devices can be complex, potentially delaying product launches and market entry.

Future Outlook of Atherectomy Devices Market

The future of the atherectomy devices market looks promising. As technology continues to advance and the prevalence of cardiovascular diseases rises, the demand for effective treatment options will only increase. Key players in the market are likely to focus on developing innovative devices that offer enhanced performance and patient safety. Moreover, as healthcare systems evolve, there will be a growing emphasis on minimally invasive procedures that promote quicker recovery times and reduce hospital stays. This trend is expected to drive the adoption of atherectomy devices further.

Concluding Atherectomy Devices Market

In conclusion, the atherectomy devices market is poised for significant growth in the coming years. With a projected market size of 5.00 billion in 2024 and 7.00 billion by 2030, the industry is set to expand rapidly, driven by advancements in technology, rising cardiovascular disease prevalence, and increasing awareness of treatment options. As we move forward, continued collaboration between healthcare providers, manufacturers, and regulatory bodies will be crucial in ensuring that atherectomy devices remain at the forefront of cardiovascular care, ultimately improving patient outcomes and quality of life.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.