Australia Automotive Financing Market Size | Worth USD 19.92 Billion by 2033 | With a CAGR 6.43%

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

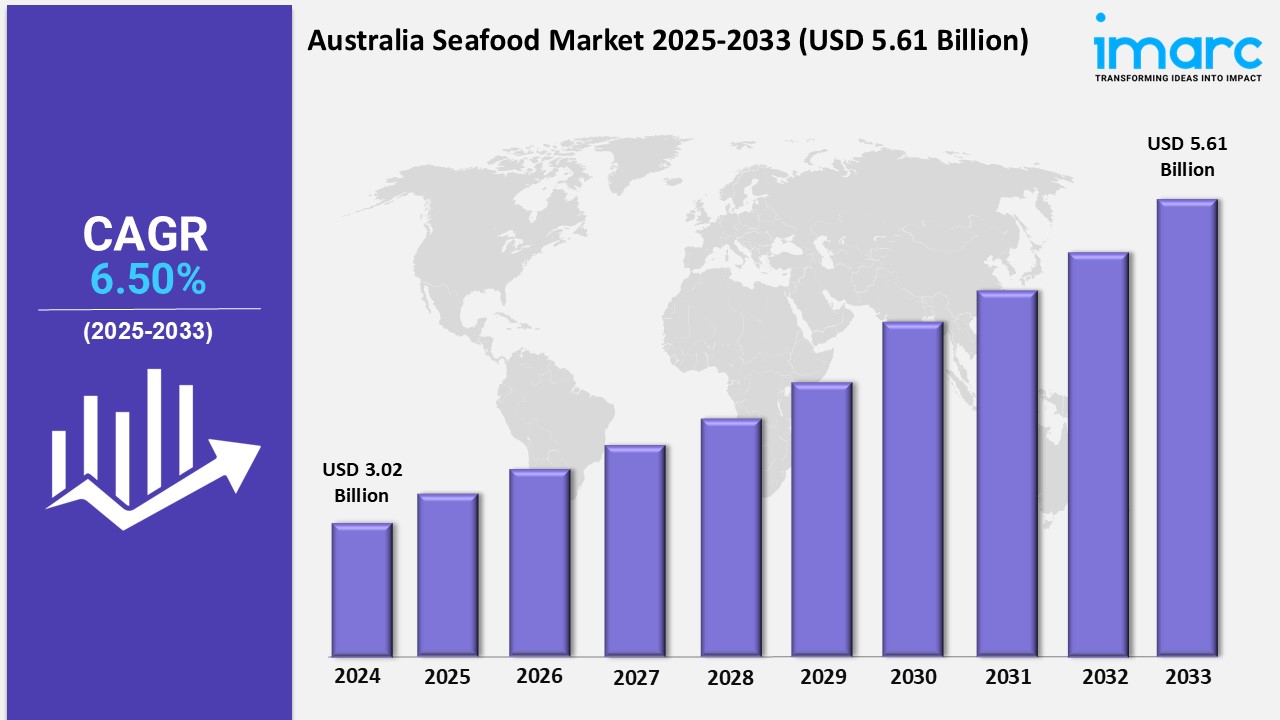

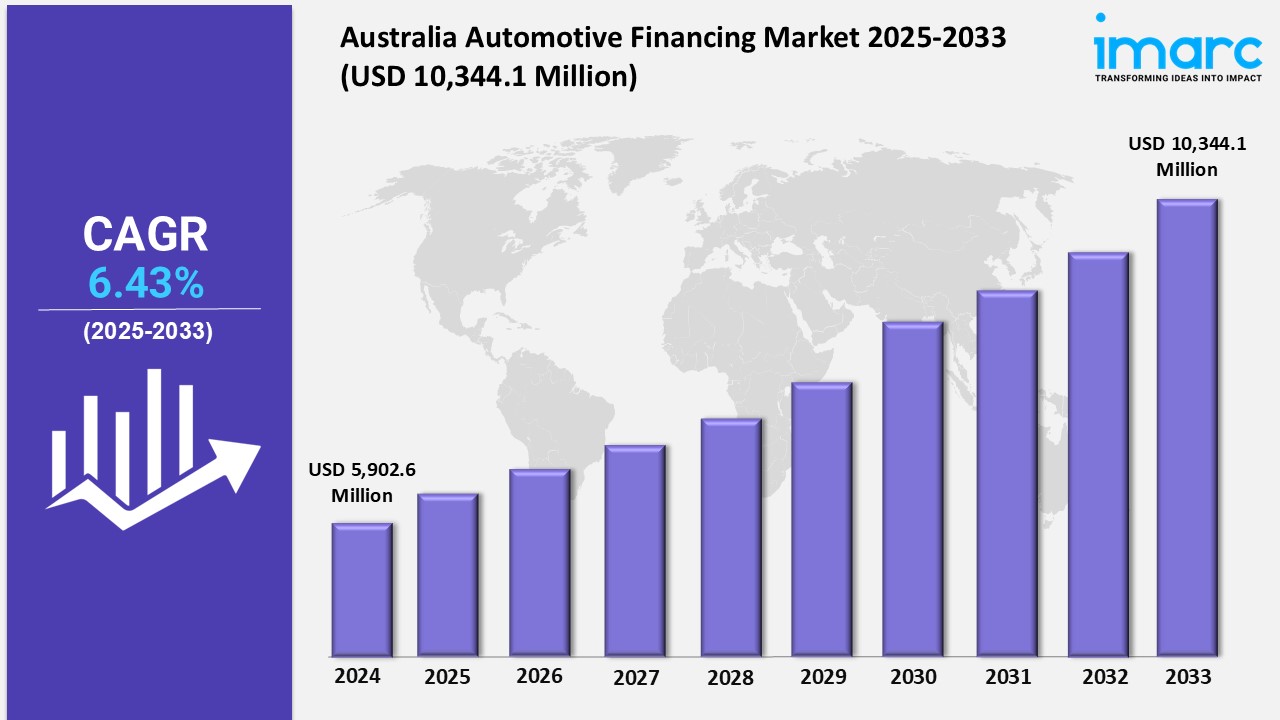

The latest report by IMARC Group, “Australian Automotive Financing Market Report by Type (New Vehicle, Used Vehicle), Source Type (OEM, Banks, Credit Unions, Financial Institution), Vehicle Type (Passenger Cars, Commercial Vehicles), and Region 2025-2033,” provides an in-depth analysis of the Australian automotive financing market. The report also includes competitor and regional analysis, along with a breakdown of segments within the Australian automotive financing industry. The market size reached USD 5,902.6 Million in 2024. The market size is to reach USD 10,344.1 Million by 2033, exhibiting a growth rate (CAGR) of 6.43% during 2025-2033.

https://www.imarcgroup.com/australian-automotive-financing-market

Report Attributes and Key Statistics:

Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 5,902.6 Million

Market Forecast in 2033: USD 10,344.1 Million

Market Growth Rate 2025-2033: 6.43%

Australia Automotive Financing Market Overview:

The Australia automotive financing market is growing rapidly as consumers increasingly use digital platforms to apply for loans, submit documents, and e-sign. Lenders and financial institutions are expanding their offerings to meet the rising demand for financing new and used vehicles. Government policies support transparency and consumer protection in the industry, while the shift toward electric vehicles and sustainable mobility creates new financing opportunities. Factors like economic stability, attractive interest rates, and the growing popularity of online financing options are reshaping the market. Banks, OEMs, and fintechs compete to improve customer experience and accessibility.

Request For Sample Report: https://www.imarcgroup.com/australian-automotive-financing-market/requestsample

Australia Automotive Financing Market Trends and Drivers:

The market is quickly digitalizing, with fintech platforms and online lenders providing instant approvals and personalized loan products. The increase in used vehicle financing is driven by affordability concerns and changing consumer preferences. Specialized EV financing products are emerging as electric vehicle adoption rises, aided by government incentives and infrastructure investments. Banks and OEMs are focusing on flexible repayment plans and value-added services, while comparison websites improve price transparency. Subscription-based vehicle models and the use of data analytics for credit assessment are also changing the competitive landscape.

Key drivers include rising vehicle ownership, the expansion of digital and online financing platforms, and supportive government policies. The market is also driven by attractive interest rates, flexible financing choices, and the growing demand for new and used cars. Technological advancements, such as automated underwriting and real-time approvals, enhance efficiency. The shift toward sustainable mobility, including electric vehicles, and the rising use of data analytics for risk management also support market growth.

Australia Automotive Financing Key Growth Drivers:

• Growing demand for new and used vehicle financing

• Expansion of digital and online loan platforms

• Attractive interest rates and flexible repayment options

• Supportive government policies and economic stability

• Rise of electric vehicle and sustainable mobility financing

• Increasing use of data analytics and fintech innovation

Key Highlights of the Report:

• Comprehensive market size and forecast for 2024-2033

• Detailed segmentation by type, source type, vehicle type, and region

• Analysis of digitalization, EV financing, and regulatory trends

• Competitive landscape with profiles of major banks, OEMs, and fintechs

• Insights into consumer behavior and online lending adoption

• Evaluation of government policies and market challenges

Australia Automotive Financing Market Segmentation:

Type Insights:

• New Vehicle

• Used Vehicle

Source Type Insights:

• OEM

• Banks

• Credit Unions

• Financial Institution

Vehicle Type Insights:

• Passenger Cars

• Commercial Vehicles

Regional Insights:

• Australia Capital Territory & New South Wales

• Victoria & Tasmania

• Queensland

• Northern Territory & Southern Australia

• Western Australia

Competitive Landscape:

• Detailed profiles of all major companies

• Market structure and key player positioning

• Top winning strategies and competitive dashboard

• Company evaluation quadrant

Australia Automotive Financing Market News:

• March 2024: ARENA announces $4.76 million in funding for Europcar Mobility Group to deploy 3,100 rental EVs and install 256 charging stations across Australia.

• January 2024: Major banks and fintech lenders launch new digital platforms for instant automotive loan approvals, enhancing customer experience and market accessibility.

Note: If you require specific information not currently within the scope of the report, we can provide it as part of the customization.

Ask an analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=24090&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St., Brooklyn, NY 11249, USA

Email: [email protected]

Tel. No.: (D) +91 120 433 0800

Americas: +1 631 791 1145

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.