Australia Car Subscription Market Size, Share & Trends – “Drive Flexibly, Lead Sustainably

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

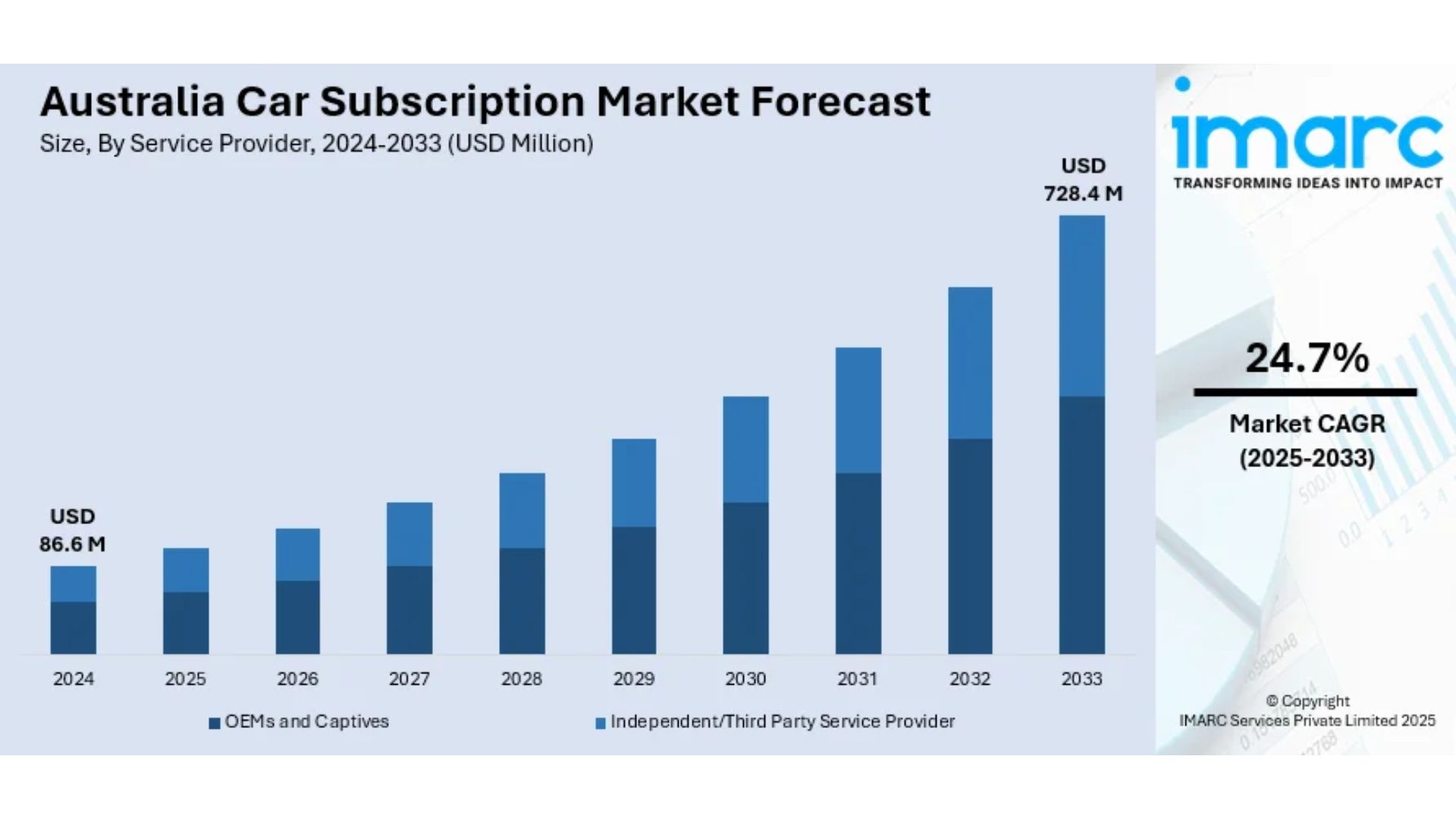

Base Year: 2024

Forecast Years: 2025–2033

Historical Years: 2019–2024

Market Size in 2024: USD 86.6 Million

Market Forecast in 2033: USD 728.4 Million

Market Growth Rate 2025–2033: 24.7 %

The latest report by IMARC Group, titled “Australia Car Subscription Market: Size, Share, Trends and Forecast by Service Provider, Vehicle Type, Subscription Period, End Use, and Region, 2025–2033,” is offering a comprehensive analysis of the Australia car subscription market growth. The market size reached USD 86.6 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 728.4 Million by 2033, exhibiting a growth rate (CAGR) of 24.7 % during 2025–2033.

Australia Car Subscription Market Overview

• The Australia car membership showcase is encountering fast extension, impelled by rising request for adaptable vehicle proprietorship arrangements.

• Buyers are progressively selecting membership models for comfort and cost-saving over long-term commitments.

• Car producers and dealerships are growing offerings, reshaping conventional proprietorship designs.

• Electric vehicle (EV) selection is upgrading advertise elements and supporting green versatility patterns.

Request for Sample Report: https://www.imarcgroup.com/australia-car-subscription-market/requestsample

Key Features and Trends of Australia Car Subscription Market

• Computerized stages and portable apps are encouraging consistent membership encounters and vehicle administration.

• Key combination is happening, prove by Karmo procuring Motopool in February 2025 to reinforce armada capabilities.

• Suppliers are joining EVs and half breed vehicles to draw in ecologically cognizant shoppers.

• AI-powered personalization and real-time following are upgrading client fulfillment and operational productivity.

Growth Drivers of Australia Car Subscription Market

• Urban professionals seeking adaptable mobility without tied ownership commitments.

• Technological integration through advanced digital platforms and app-based services.

• Increased inclusion of EVs in subscription fleets, supporting sustainability goals.

• OEM and dealership participation offering bundled maintenance and insurance.

• Strategic M&A activities amplifying fleet scale and market reach.

Innovation & Market Demand

• Propelling AI-driven apps for custom-made membership bundles and prescient upkeep.

• Presenting EV trial programs like Carly’s pilot to lighten buyer concerns.

• Shaping associations with automakers and tech firms for coordinates benefit offerings.

• Improving real-time vehicle following and client interfacing for consistent client ventures.

Market Opportunities and Challenges

• Leveraging rising EV awareness to expand subscription options with clean-energy fleets.

• Targeting urban populations seeking mobility flexibility with short-term plans.

• Addressing operational risks like vehicle upkeep and fleet utilization efficiency.

• Overcoming regulatory hurdles related to insurance, registration, and taxation.

• Mitigating consumer hesitation through transparent pricing and trial incentives.

Australia Car Subscription Market Analysis

• Segmenting by service providers: OEM-backed vs. independent models, with varied value propositions.

• Vehicle types spanning IC engines to hybrid and fully electric models.

• Subscription durations spanning short-term flexibility to longer multi-month agreements.

• Serving both private individual users and corporate clients for workforce mobility.

Australia Car Subscription Market Segmentation:

By Service Provider:

• OEM and captives

• Independent/third-party providers

By Vehicle Type:

• Internal combustion engine (ICE)

• Electric vehicle (EV)

• Hybrid

By Subscription Period:

• 1–6 months

• 6–12 months

• 12 months

By End Use:

• Private

• Corporate

By Region:

• New South Wales

• Victoria

• Queensland

• Rest of Australia

Australia Car Subscription Market News & Recent Developments

• Feb 2025: Karmo is becoming Australia’s largest car subscription provider by acquiring Motopool, adding 5,000 vehicles and scaling operations.

• Apr 2024: Carly has launched an EV trial subscription to give customers an environmentally friendly driving experience.

Key Highlights of the Report:

• Market Performance (2019–2024)

• Market Outlook (2025–2033)

• COVID 19 Impact on the Market

• Porter’s Five Forces Analysis

• Strategic Recommendations

• Historical, Current and Future Market Trends

• Market Drivers and Success Factors

• SWOT Analysis

• Structure of the Market

• Value Chain Analysis

• Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Ask analyst for your customized sample:https://www.imarcgroup.com/request?type=report&id=33622&flag=E

🔍 FAQs: Australia Car Subscription Market

Q1: Who is the primary customer segment for car subscriptions?

A: Urban professionals and millennials seeking convenience, flexibility, and a digital-first mobility experience.

Q2: Are electric vehicles part of subscription services?

A: Yes, EVs are increasingly featured in subscription offerings, boosting green mobility credentials.

Q3: What is the average subscription period?

A: Plans range from flexible 1–6-month options to longer-duration commitments of over 12 months.

Q4: Are subscription models cost-effective?

A: They are offering bundled maintenance, insurance, and usage flexibility—lowering total cost-of-use compared to ownership.

Q5: Is the subscription model sustainable in Australia?

A: Yes, the rapid rise in green vehicle inclusion and regulatory support is making subscriptions a sustainable mobility solution.

About Us:

IMARC Group is a leading market research company that provides management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses. Our solutions include comprehensive market intelligence, custom consulting, and actionable insights to help organizations make informed decisions and achieve sustainable growth.

Contact Us:

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No: (D) +91 120 433 0800

United States: +1-631-791-1145

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.