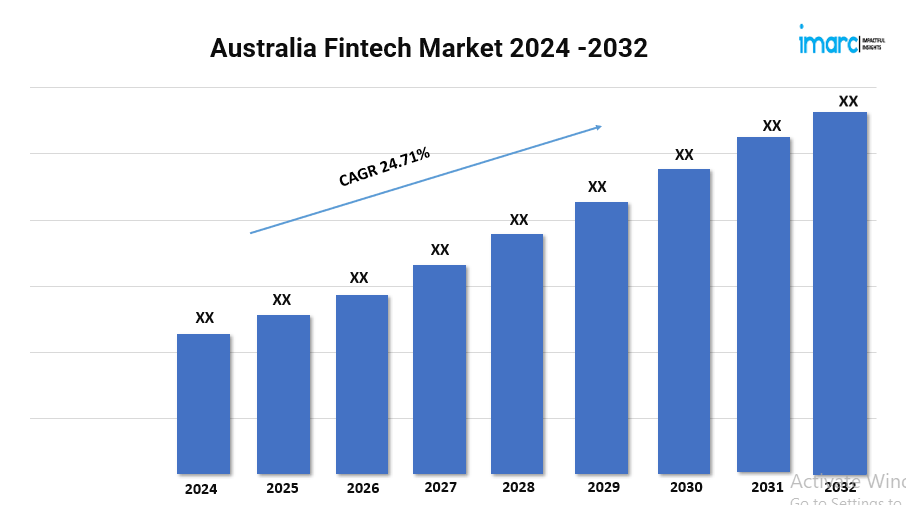

Australia Fintech Market Trends, Growth, and Demand Forecast 2024-2032

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Australia Fintech Market Overview

Base Year: 2023

Market Size in 2023: USD 2.8 Billion

Market Forecast in 2032: USD 20.0 Billion

Market Growth Rate: 24.71% (2024-2032)

The rising adoption of digital banking and payment solutions in Australia is one of the major factors propelling the growth in the market. According to IMARC Group, The market size is expected to exhibit a CAGR of 24.71% during 2024-2032.

Download sample copy of the Report: https://www.imarcgroup.com/australia-fintech-market/requestsample

Australia Fintech Industry Trends and Drivers:

The rising adoption of digital banking and payment solutions in Australia is one of the major factors propelling the growth in the market. As consumers are shifting towards cashless transactions, fintech companies are capitalizing on this trend by offering innovative services, such as mobile wallets, peer-to-peer payment platforms, and contactless payments. The convenience and efficiency of these digital solutions are attracting an increasing number of users, which is stimulating the market growth.

Additionally, the utilization of digital financial services is enabling fintech firms to expand their customer base, creating a competitive environment that encourages continuous innovations. Governing agencies and financial authorities in Australia are also supporting the development of the fintech sector to ensure user protection and financial stability. The introduction of the Consumer Data Right (CDR) and open banking is further impelling the market growth by offering more personalized and competitive financial products.

Moreover, the growing integration of advanced technologies, such as artificial intelligence (AI), machine learning (ML), and blockchain is offering a favorable market outlook in Australia. Fintech companies are employing these technologies to provide more sophisticated financial products and services like robo-advisors, automated trading platforms, and decentralized finance (DeFi) solutions.

Besides this, rising investments in fintech startups is fueling innovations and market expansion, as venture capital firms and financial institutions are investing in fintech companies, thereby offering lucrative growth opportunities to industry investors. The development of neobanks, which are digital-only banks without physical branches, is another factor strengthening the market growth, as they offer lower fees, higher interest rates, and a more user-friendly banking experience compared to traditional banks.

Furthermore, the shift in user behavior towards digital financial management tools is supporting the market growth. As more users are preferring digital platforms to manage their finances, fintech companies are responding by offering intuitive apps and services that enable real-time financial tracking, budgeting, and investment management. This is catalyzing the demand for transparent and accessible financial services and prompting traditional financial institutions to collaborate with fintech firms, thereby positively influencing the market in the country.

We explore the factors propelling the Australia fintech market growth, including technological advancements, consumer behaviors, and regulatory changes.r

Australia Fintech Industry Segmentation:

The report has segmented the market into the following categories:

Breakup by Deployment Mode:

- Cloud

- On-Premises

Breakup by Technology:

- Application Programming Interface (API)

- Artificial Intelligence (AI)

- Blockchain

- Data Analytics

- Robotic Process Automation (RPA)

- Others

Breakup by Application:

- Payments and Fund Transfer

- Loans

- Insurance and Personal Finance

- Wealth Management

- Others

Breakup by End-User:

- Banking

- Insurance

- Securities

- Others

Breakup by States:

- New South Wales

- Victoria

- Queensland

- Western Australia

- South Australia

- Tasmania

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Key highlights of the Report:

- Market Performance (2018-2023)

- Market Outlook (2024-2032)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

Street: Morgan Park QLD 4370

City/Town: Warwick

State/Province/Region: Queensland

Country: Australia

Zip/Postal Code: 4370

Email: [email protected]

Phone Number: +1-631-791-1145

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.