Automated Test Equipment Market: Scaling with the Growth of IoT and 5G Technologies

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

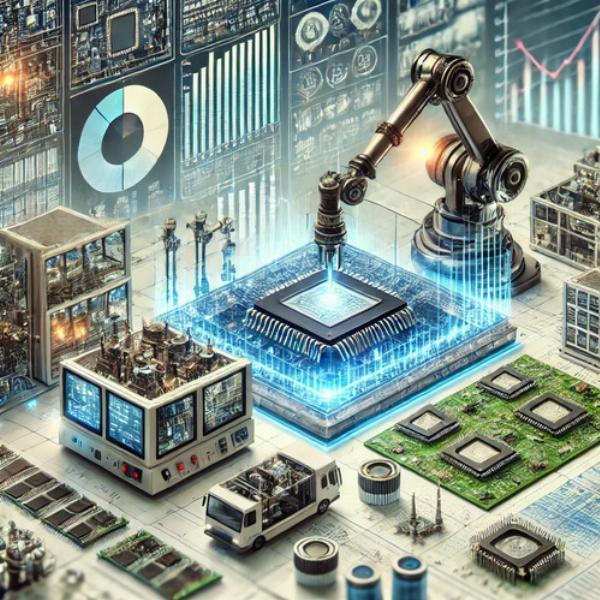

The Automated Test Equipment Market focuses on providing high-precision, automated solutions for testing and analyzing the functionality and performance of electronic components, semiconductors, and integrated circuits. As the complexity of electronic devices has increased, manual testing methods have become inefficient and error-prone. Automated Test Equipment solves this problem by offering faster, more accurate testing processes, ensuring that electronic components meet strict quality and performance standards. This is especially crucial in industries such as consumer electronics, automotive, aerospace, and telecommunications, where even minor defects can lead to significant financial and operational repercussions.

For consumers, ATE has brought about a revolution in how products are tested and delivered. Before ATE, testing was labor-intensive, slow, and susceptible to human error, resulting in inconsistent quality. Now, with the adoption of automated testing, manufacturers can quickly identify and fix issues, ensuring that only reliable and high-quality products reach the market. This shift has significantly reduced production times, lowered costs, and improved the overall reliability of electronic devices. As a result, consumers benefit from faster product releases, better-performing gadgets, and fewer defects, all thanks to the advancements in the Automated Test Equipment market.

Automated Test Equipment Market Size and Growth in 2023-2030

The Automated Test Equipment (ATE) Market was valued at approximately USD 7.5 billion in 2023 and is projected to reach around USD 10.9 billion by 2030, growing at a CAGR of 5.5% during the forecast period. This growth is driven by increasing demand for semiconductors, advancements in consumer electronics, and the rapid expansion of 5G technology. The need for efficient, high-precision testing solutions in industries like automotive, aerospace and telecommunications is also propelling the market forward.

Automated Test Equipment Market Segmentation by Type

In the Automated Test Equipment (ATE) Market, segmentation by type can be metaphorically aligned with the characteristics of Low Viscosity Cements, Medium Viscosity Cements, and High Viscosity Cements to reflect the different levels of complexity and precision required for testing various electronic components.

Low Viscosity Cements represent basic testing solutions in the ATE market. These are typically used for simpler electronic devices where standard testing procedures are sufficient, such as consumer electronics and small-scale applications. This type of ATE focuses on speed and efficiency, offering cost-effective testing solutions for high-volume, low-complexity products.

Medium Viscosity Cements align with intermediate ATE solutions, offering a balance between cost and functionality. These systems are used for testing more complex devices, like automotive electronics and telecommunications components, where a moderate level of precision and customization is necessary. These ATE systems provide a higher level of flexibility, making them suitable for mid-tier products requiring more in-depth testing.

High Viscosity Cements represent advanced ATE systems designed for high-end, intricate electronics such as semiconductors, aerospace components, and critical medical devices. These systems handle highly complex testing processes, ensuring precision and reliability for industries where failure is not an option. They are equipped with sophisticated features like multi-functionality and high throughput, catering to industries with stringent quality standards.

Automated Test Equipment Market Applications on the Global Stage

The Automated Test Equipment (ATE) Market plays a pivotal role in advancing multiple industries by ensuring that electronic components and systems meet rigorous quality and performance standards. By automating testing processes, ATE systems reduce human error, enhance testing speed, and improve product reliability. Here’s a detailed look at the key sectors and how they are impacted by automated testing.

1. Semiconductor Industry: Ensuring Precision and Efficiency

The semiconductor industry is the largest consumer of automated test equipment, as these devices are critical for testing integrated circuits (ICs) and microchips. Leading companies like Advantest and Teradyne provide ATE systems that ensure precision in the testing of complex semiconductors used in consumer electronics, automotive, telecommunications, and industrial applications. With the increasing demand for smaller, more powerful chips in devices such as smartphones, laptops, and IoT devices, the semiconductor industry relies heavily on ATE to deliver accurate and efficient testing at every stage of production. As the global semiconductor market grows, so does the need for high-quality automated testing solutions.

2. Automotive Sector: Advancing Safety and Autonomy

In the automotive sector, the use of ATE systems has become essential due to the rising adoption of electronic components in modern vehicles. Advanced Driver Assistance Systems (ADAS), electric vehicle (EV) components, and autonomous driving technologies all require rigorous testing to ensure reliability and safety. ATE systems are used to test a range of automotive electronics, including sensors, control systems, and battery management units, ensuring they perform under various environmental and operational conditions. With automotive companies like Tesla, Ford, and BMW integrating more electronics into their vehicles, the demand for advanced ATE systems in the automotive market is growing rapidly.

3. Telecommunications: Supporting the Growth of 5G Networks

The telecommunications industry is undergoing rapid transformation with the deployment of 5G networks, requiring highly reliable and efficient electronic components. ATE systems are critical in testing the performance of network infrastructure components, such as antennas, base stations, and routers. Companies like National Instruments and Keysight Technologies are leading the charge in providing ATE solutions for the telecommunications sector. These systems ensure that 5G hardware meets performance standards and can handle the high-speed data transfer demands of modern communication networks.

4. Consumer Electronics: Enhancing Product Quality and User Experience

In the consumer electronics sector, the development of increasingly sophisticated gadgets—from smartphones to smart home devices—has amplified the need for comprehensive testing solutions. ATE systems are used to test everything from processors and memory chips to touchscreens and battery performance. This ensures that devices function seamlessly and meet consumer expectations for quality and durability. Major electronics companies such as Apple, Samsung, and Sony rely on ATE systems to maintain high standards and deliver reliable products in a competitive market.

5. Aerospace and Defense: Meeting Strict Regulatory and Safety Standards

The aerospace and defense industries demand the highest level of precision and reliability in electronic components due to the critical nature of their applications. ATE systems are used to test avionics systems, radar systems, communication equipment, and navigation systems to ensure they function flawlessly in extreme conditions. Companies like Lockheed Martin, Raytheon, and Boeing invest heavily in ATE systems to meet strict regulatory standards and ensure the safety of their products. Testing with ATE helps avoid potential failures that could result in significant operational or safety risks.

Legal Constraints and Limitations of the Automated Test Equipment Market: A Global Perspective

The Automated Test Equipment (ATE) Market faces a range of legal and regulatory challenges globally, which can significantly impact the market’s growth and operations. These constraints revolve around industry-specific standards, import-export regulations, and evolving compliance requirements related to the testing of electronic components. Let's explore how different regions and countries approach these regulatory challenges.

1. United States: Compliance with Industry-Specific Standards

In the United States, the ATE market must adhere to a series of industry-specific regulations, particularly in sectors like defense, aerospace, and telecommunications. The Federal Communications Commission (FCC) and Federal Aviation Administration (FAA) enforce stringent testing standards for electronics used in telecommunications and aerospace, ensuring that all components meet critical safety and performance benchmarks. Additionally, the International Traffic in Arms Regulations (ITAR) pose challenges for ATE manufacturers working with defense contractors, requiring strict export controls and compliance with national security standards. These regulations can complicate cross-border collaboration and trade for ATE companies.

2. European Union: Navigating CE Marking and RoHS Compliance

In the European Union (EU), the regulatory environment focuses heavily on product safety and environmental standards. ATE systems, particularly those used for testing consumer electronics and automotive components, must comply with CE marking regulations, indicating that products meet the EU's health, safety, and environmental protection requirements. Additionally, the Restriction of Hazardous Substances (RoHS) directive poses a significant challenge, as it restricts the use of certain hazardous materials in electronic equipment. ATE manufacturers must ensure that their systems comply with RoHS standards, which can increase production costs and limit the availability of materials.

3. China: Data Security and Intellectual Property Concerns

In China, the ATE market faces regulatory challenges related to data security and intellectual property protection. With the rise of automation and the use of digital data in testing processes, China’s Cybersecurity Law imposes strict guidelines on how data is handled, particularly when testing involves sensitive technologies like semiconductors or military equipment. Moreover, foreign companies operating in the Chinese market often face concerns about intellectual property rights, as regulations around technology transfer and local manufacturing partnerships can put proprietary technologies at risk. This has led many ATE manufacturers to approach the Chinese market cautiously, balancing the opportunities with the legal complexities.

4. India: Evolving Regulations and Manufacturing Standards

In India, the regulatory landscape for the ATE market is still evolving, especially as the country works to bolster its electronics manufacturing sector under initiatives like Make in India. While India’s regulatory framework is not as stringent as the EU or the U.S., the government is moving toward stricter standards for electronics testing and certification. For ATE companies, this creates both opportunities and challenges, as they must navigate the changing landscape while adhering to global standards to ensure that Indian-manufactured products are competitive in international markets.

5. Japan: Stringent Quality and Safety Regulations in Electronics

In Japan, a global leader in electronics and automation, the regulatory environment for ATE systems is centered around ensuring high-quality standards. The Japanese Industrial Standards (JIS) dictate rigorous testing procedures for electronic components, particularly those used in sectors like automotive, robotics, and consumer electronics. For ATE manufacturers, compliance with these standards is essential to operating in Japan’s highly competitive electronics market. However, the stringent nature of these regulations can increase the time-to-market for new ATE systems and raise production costs, as companies must invest in R&D to meet these quality benchmarks.

Conclusion

Over the next five years, the Automated Test Equipment (ATE) Market is expected to experience steady growth, driven by the increasing complexity of electronics, advancements in 5G, and the rise of autonomous vehicles and AI-powered devices. Future developments in this market will focus on enhancing testing speed, improving the efficiency of semiconductor testing, and integrating AI and machine learning for more predictive testing capabilities. Companies such as Advantest, Teradyne, and National Instruments are expected to continue leading the market, but emerging players like Xcerra and Marvin Test Solutions could challenge the dominance of established giants with innovative and cost-effective solutions. Ongoing R&D efforts are focusing on improving miniaturization of testing devices, power-efficient ATE systems, and advanced sensor testing technologies. For investors and professionals, the increasing demand for semiconductors, coupled with the growth of industries like electric vehicles, IoT, and telecommunications, presents a promising outlook for the ATE market, making it a compelling area for continued investment and development.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.