Topic Cluster Planning – Boost Topical Authority Like a Pro!

Topic Cluster Planning – Boost Topical Authority Like a Pro!

Automotive Composites Market Size and Trends Detailed (2028) Forecast and Analysis

Written by varun » Updated on: June 17th, 2025

According to a TechSci Research report, “Global Automotive Composites Market – Global Industry Size, Share, Trends, Competition Forecast & Opportunities, 2028,” the global automotive composites market stood at USD 25 billion in 2022 and is anticipated to grow with a CAGR of 9.3% in the forecast period, 2024-2028.

The market is experiencing significant growth driven by various factors, including stringent emission norms, the increasing demand for high-performance vehicles, advancements in manufacturing processes, the growing adoption of composites in electric vehicles (EVs), and the trend toward sustainability.

Overview of Automotive Composites Market

Market Size and Growth

The global automotive composites market, valued at USD 25 billion in 2022, is projected to grow at a CAGR of 9.3% during the forecast period from 2024 to 2028. This growth is attributed to several factors, including advancements in composite materials, stringent emission standards, and the increasing demand for lightweight and high-performance vehicles.

The market's robust growth reflects the automotive industry's broader trend towards innovation and efficiency, where composite materials are being increasingly recognized for their potential to enhance vehicle performance and sustainability.

Browse over XX market data Figures spread through XX Pages and an in-depth TOC on "Automotive Composites Market.” @ https://www.techsciresearch.com/report/global-automotive-composites-market/2609.html

Key Market Drivers

Stringent Emission Norms

Stringent emission norms, such as those implemented by the European Union and various state agencies in the United States, have led to a push for lightweight materials, promoting the use of composites in the automotive industry. These regulations aim to reduce greenhouse gas emissions and improve air quality, driving automakers to explore alternatives that can achieve these goals.

Lightweight materials help reduce vehicle weight, contributing to improved fuel efficiency and reduced emissions, which is crucial for meeting stringent regulatory requirements. The adoption of composites is seen as a vital strategy to comply with these regulations without compromising vehicle performance or safety.

Demand for High-Performance Vehicles

The increasing demand for high-performance vehicles is a significant growth driver for the automotive composites market. Consumers seek vehicles offering better performance, durability, and safety, prompting automotive manufacturers to turn to composites for producing lightweight yet strong vehicle components.

Composites, with their superior mechanical properties, provide the necessary strength and stiffness while significantly reducing the weight of the vehicle, which is essential for enhancing acceleration, handling, and fuel efficiency. This demand is particularly prominent in the luxury and sports car segments, where performance and aesthetics are critical differentiators.

Advancements in Manufacturing Processes

Rapid advancements in manufacturing processes have made composites more accessible and cost-effective for automotive applications. Innovations such as automated fiber placement (AFP), resin transfer molding (RTM), and additive manufacturing have significantly improved production efficiency and reduced manufacturing costs. These advancements enable the mass production of composite parts with high precision and consistency, making composites viable for broader applications in the automotive industry.

The development of new techniques and the integration of advanced robotics and AI in manufacturing processes continue to push the boundaries of what is possible with composite materials.

Adoption in Electric Vehicles (EVs)

The growing adoption of composites in electric vehicles (EVs) acts as a significant growth catalyst. Composites offer several advantages for EVs, including lightweight construction, improved energy efficiency, and increased range. As the demand for EVs rises, driven by global initiatives to reduce carbon emissions and dependence on fossil fuels, the use of composites in their manufacturing is expected to increase.

The lightweight properties of composites help to offset the weight of batteries, a critical factor in improving the range and performance of EVs. Additionally, composites provide excellent thermal and electrical insulation, further enhancing the safety and efficiency of EVs.

Sustainability Trends

The trend towards sustainability drives market expansion. Hybrid composites, combining natural fibers with synthetic materials, offer a more sustainable alternative to traditional composites. These materials are gaining traction in the automotive industry, reflecting increasing concerns about environmental impact. The use of renewable and biodegradable fibers, such as hemp, flax, and jute, in combination with synthetic resins, creates composites that reduce the carbon footprint of vehicles. Furthermore, the development of recycling technologies for composites is an emerging area of focus, aiming to create a circular economy for composite materials and minimize waste.

Market Segmentation of Automotive Composites

By Material Type

Glass Fiber Reinforced Plastic (GFRP)

Glass fiber reinforced plastic (GFRP) is widely employed due to its exceptional mechanical properties, providing enhanced strength and durability. It is commonly used in automotive components such as body panels, chassis, and underbody shields. GFRP offers a cost-effective solution for mass-produced vehicles, balancing performance with affordability. Its resistance to corrosion and impact also makes it suitable for exterior applications exposed to harsh environmental conditions.

Carbon Fiber Reinforced Plastic (CFRP)

Carbon fiber reinforced plastics (CFRP) are increasingly preferred due to their high strength-to-weight ratio, making them ideal for high-performance vehicles that prioritize both strength and reduced weight. CFRP components are used extensively in sports cars, luxury vehicles, and motorsports applications where performance and aesthetics are paramount. The use of CFRP in structural parts, such as monocoque chassis and suspension elements, significantly enhances vehicle agility and safety.

Despite their higher cost, the performance benefits of CFRP make it a valuable material for premium automotive segments.

Natural Fiber Composites

The demand for natural fiber composites is on the rise, driven by growing environmental consciousness and the push for sustainable alternatives. These eco-friendly composites help reduce vehicle weight, leading to improved fuel efficiency and lower carbon emissions.

Natural fibers, such as hemp, flax, and kenaf, are combined with polymer matrices to create biodegradable and recyclable composite materials. The automotive industry is increasingly adopting these materials for interior components, such as door panels, dashboards, and seat structures, aligning with consumer preferences for sustainable and eco-friendly products.

Download Free Sample Report @ https://www.techsciresearch.com/sample-report.aspx?cid=2609

Customers can also request 10% free customization on this report.

By Application

Exterior Components

Composites are extensively used in exterior components like body panels, bumpers, and roof structures due to their lightweight and high-strength properties. The use of composites in these applications not only reduces the overall weight of the vehicle but also enhances its structural integrity and impact resistance. Additionally, composites offer greater design flexibility, allowing for the creation of complex shapes and aerodynamic profiles that improve vehicle aesthetics and performance.

Interior Components

Interior components such as dashboards, door panels, and seats benefit from the use of composites for their durability and lightweight characteristics. Composites provide superior impact resistance, thermal stability, and acoustic insulation, improving the overall comfort and safety of the vehicle interior. Furthermore, the integration of natural fiber composites in interior applications aligns with the growing consumer demand for sustainable and eco-friendly vehicle interiors.

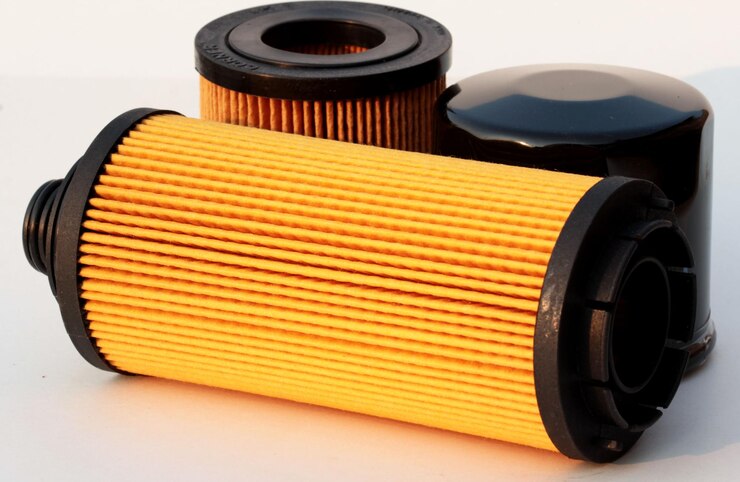

Powertrain and Engine Components

Composites are increasingly used in powertrain and engine components to reduce weight and enhance fuel efficiency without compromising strength. Applications include engine covers, intake manifolds, and transmission casings, where the thermal and mechanical properties of composites offer significant performance advantages. The use of composites in powertrain components helps to reduce vibration and noise, improving the overall driving experience and vehicle longevity.

Regional Analysis of Automotive Composites Market

Asia-Pacific

Asia-Pacific is the largest market for automotive composites, led by countries like China, Japan, and India. The region's growth can be attributed to a burgeoning automotive industry, rapid industrialization, and a growing population with increasing disposable income.

China, as the largest automotive market globally, is a major driver of composite demand, with significant investments in EV production and advanced manufacturing technologies. Japan's emphasis on technological innovation and lightweight materials in automotive manufacturing further bolsters the market. India, with its expanding automotive sector and rising middle class, presents substantial growth opportunities for composite applications.

North America

The North American market, with the United States at the forefront, is also a significant player due to its advanced automotive sector and high demand for luxury and electric vehicles.

The presence of leading automotive manufacturers and a robust supply chain network supports the growth of the composites market. Additionally, stringent emission regulations and government incentives for EV adoption drive the demand for lightweight materials. The U.S. is a hub for innovation in composite materials, with numerous research institutions and companies focusing on developing advanced composites for automotive applications.

Europe

Europe follows closely, with Germany leading the pack, thanks to its strong automotive industry, which hosts some of the world's leading car manufacturers. The region's commitment to sustainability and stringent emission standards drives the adoption of composites in automotive manufacturing.

Germany's expertise in engineering and materials science positions it as a key player in the development and application of advanced composites. Other European countries, such as France, Italy, and the UK, also contribute significantly to the market, with a focus on high-performance and luxury vehicles.

Competitive Landscape

Key Players of Automotive Composites Market

The global automotive composites market is highly competitive, with numerous players vying for market share. Major companies operating in the market include:

- Hexcel Corporation: A leading provider of advanced composite materials, Hexcel Corporation supplies high-performance carbon fiber, honeycomb, and other composite solutions for automotive applications.

- Mitsubishi Chemical Carbon Fiber and Composites, Inc.: Specializes in carbon fiber and composite materials, offering innovative solutions for lightweight and high-strength automotive components.

- mouldCAM Pty Ltd.: Focuses on composite tooling and manufacturing, providing custom solutions for automotive parts and assemblies.

- SGL Carbon: A global leader in carbon-based products, SGL Carbon develops and manufactures advanced composites for various automotive applications, including structural and body components.

- Toho Tenex (Teijin Ltd): A subsidiary of Teijin Ltd, Toho Tenex produces high-performance carbon fiber and composite materials for the automotive industry.

- Toray Industries Inc: A major player in the composites market, Toray Industries provides a wide range of carbon fiber and composite materials, known for their high quality and performance.

- Nippon Sheet Glass Company, Limited: Offers advanced glass fiber composites used in automotive applications, focusing on lightweight and durable solutions.

- Sigmatex: Specializes in the design and manufacture of carbon fiber textiles, supplying high-performance materials for automotive composite applications.

- Nippon Carbon Co., Ltd.: Produces high-quality carbon fibers and composite materials, contributing to the development of lightweight and high-strength automotive components.

- Solvay: A global leader in specialty chemicals and materials, Solvay provides innovative composite solutions for the automotive industry, emphasizing sustainability and performance.

These companies are continually innovating to stay ahead in the competitive market, investing in research and development to create advanced composite materials and manufacturing processes.

Challenges in the Automotive Composites Market

High Production Costs

One of the major hurdles is the high production costs associated with advanced materials. The cost factor remains a significant challenge for the wider adoption of composites in the automotive industry. Despite the advantages offered by composites, their higher production costs compared to traditional materials like steel and aluminum limit their use in high-end and performance vehicles.

Reducing production costs through advancements in manufacturing techniques and economies of scale is essential for broader market penetration.

Recycling Issues

The lack of efficient recycling processes for automotive composites complicates the market landscape. Developing sustainable recycling practices is crucial to addressing environmental concerns and promoting long-term growth.

The current recycling infrastructure for composites is underdeveloped, and the complexity of composite materials makes recycling challenging. Innovations in recycling technologies, such as chemical recycling and repurposing composite waste, are necessary to create a circular economy for composites and minimize environmental impact.

Future Outlook

Technological Advancements

Looking ahead, the global automotive composites market is set to continue its upward trajectory, propelled by technological advancements. Ongoing research and development efforts focus on developing low-cost production techniques and efficient recycling methods.

Innovations in composite materials, such as thermoplastic composites and bio-based resins, offer promising alternatives to traditional composites. These advancements aim to enhance the performance, durability, and sustainability of composite materials, driving their adoption in a wider range of automotive applications.

Environmental Awareness

Increasing environmental awareness and the shift towards electric and high-performance vehicles will further drive market growth. The trend towards sustainability will continue to shape the future of the automotive composites market. Consumers and regulators are placing greater emphasis on the environmental impact of vehicles, pushing manufacturers to adopt materials and processes that reduce carbon emissions and promote sustainability. The development of eco-friendly composites and sustainable manufacturing practices will play a crucial role in meeting these demands.

Emerging Applications

The emergence of new applications of composites in the automotive industry will offer additional opportunities for market expansion. Innovations in composite materials and manufacturing processes will pave the way for broader adoption across various automotive components.

Potential applications include advanced battery enclosures, hydrogen storage tanks, and integrated structural components that combine multiple functions into a single composite part. These innovations will drive the evolution of automotive design and manufacturing, enhancing vehicle performance, safety, and sustainability.

Download Free Sample Report @ https://www.techsciresearch.com/sample-report.aspx?cid=2609

Customers can also request 10% free customization on this report.

Conclusion

The global automotive composites market is a dynamic and rapidly evolving field with significant growth potential. Driven by stringent emission norms, demand for high-performance vehicles, advancements in manufacturing processes, and sustainability trends, the market is poised for continued expansion.

Despite challenges such as high production costs and recycling issues, ongoing research and development efforts aim to address these obstacles and foster growth. Major players in the industry are continually innovating to maintain their competitive edge, while new applications and emerging markets offer additional opportunities for growth. As the automotive industry evolves, composites will play a critical role in the development of vehicles that meet the evolving needs and expectations of consumers.

The future of the global automotive composites market is promising, with technological advancements and sustainability efforts driving its growth. With continuous innovation and development, the market is expected to witness further expansion and transformation in the coming years. As automotive manufacturers seek to balance performance, efficiency, and environmental impact, composites will remain at the forefront of material innovation, shaping the future of the automotive industry.

You may also read:

Automotive Light Bars Market Overview USD 18 Billion Valuation and 7.9% Growth Rate Through 2028

Moto Taxi Market Share & Trends USD [14 Billion] and [8.2% CAGR] Growth

Semi-Trailer Market Forecasting USD 30 Billion Value and 5.6% CAGR Insights

Automotive Transfer Case Market Analysis USD 17.2 Billion Value and 7.9% CAGR Forecast

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.

Copyright © 2019-2025 IndiBlogHub.com. All rights reserved. Hosted on DigitalOcean for fast, reliable performance.