DA 70+ Guest Post Placements – Elite Authority at Your Fingertips!

DA 70+ Guest Post Placements – Elite Authority at Your Fingertips!

Automotive Exhaust Aftertreatment Systems Market Latest Report Highlights USD 25 Billion Valuation and Growth Trends

Written by varun » Updated on: June 17th, 2025

The global automotive exhaust aftertreatment systems market is experiencing significant growth, driven by the need to reduce harmful emissions from internal combustion engines and the increasing stringency of emission regulations. In 2022, the market was valued at USD 25 billion, and it is projected to grow at a CAGR of 13.3% during the forecast period from 2024 to 2028.

This report provides a comprehensive analysis of the market dynamics, trends, challenges, and opportunities shaping the future of the automotive exhaust aftertreatment systems market. The report also highlights the contributions of major companies and the technological advancements driving the industry forward.

Introduction

Market Overview

The automotive exhaust aftertreatment systems market has emerged as a critical component in the automotive industry. With the growing concerns over air quality and climate change, governments and regulatory bodies worldwide have imposed stringent emission standards to reduce pollutants from vehicles.

Browse over XX market data Figures spread through XX Pages and an in-depth TOC on "Automotive Exhaust Aftertreatment Systems Market.” @ https://www.techsciresearch.com/report/automotive-exhaust-aftertreatment-systems-market/16326.html

These systems are designed to minimize the release of harmful substances such as nitrogen oxides (NOx), carbon monoxide (CO), and particulate matter (PM). This report delves into the key factors driving market growth, technological advancements, and the competitive landscape of the industry, providing insights into the future direction of the market.

Dynamics of Automotive Exhaust Aftertreatment Systems Market

Key Drivers

-

Stringent Emission Regulations: Governments across the globe are implementing stringent emission regulations to reduce air pollution and combat climate change. These regulations mandate the use of advanced exhaust aftertreatment systems, driving market growth. For instance, the Euro 6 standards in Europe and the Tier 3 standards in the United States have set rigorous limits on vehicle emissions, compelling automakers to adopt sophisticated aftertreatment technologies.

-

Technological Advancements: Continuous innovations in exhaust aftertreatment technologies, such as Selective Catalytic Reduction (SCR), Diesel Particulate Filters (DPF), and Gasoline Particulate Filters (GPF), have improved the efficiency and cost-effectiveness of these systems, further boosting their adoption. Advances in materials science, such as the development of high-performance catalysts and ceramic filters, have enhanced the performance and durability of aftertreatment systems.

-

Increasing Vehicle Production: The automotive industry is expanding, with a growing production of both internal combustion engine (ICE) vehicles and electric vehicles (EVs). This increase in vehicle production necessitates the incorporation of advanced exhaust aftertreatment systems. According to the International Organization of Motor Vehicle Manufacturers (OICA), global vehicle production reached nearly 92 million units in 2022, highlighting the scale of demand for aftertreatment solutions.

-

Rising Environmental Awareness: Consumers are becoming more environmentally conscious, leading to increased demand for eco-friendly vehicles that comply with stringent emission standards. This shift in consumer preferences is driving the demand for advanced exhaust aftertreatment systems. Automakers are responding by incorporating cutting-edge emission control technologies to meet the expectations of environmentally aware consumers and to differentiate their products in a competitive market.

Market Challenges of Automotive Exhaust Aftertreatment Systems Market

-

High Costs: The development and implementation of advanced exhaust aftertreatment systems can be costly, posing a challenge for automakers, especially in developing regions. The high initial investment in research and development, as well as the cost of integrating these systems into vehicles, can be a barrier for manufacturers operating on tight budgets.

-

Technological Complexity: The integration of advanced aftertreatment technologies requires significant technical expertise and resources, which can be a barrier for some manufacturers. Ensuring the compatibility of aftertreatment systems with various engine types and vehicle models adds to the complexity, necessitating specialized knowledge and extensive testing.

-

Regulatory Compliance: Keeping up with constantly evolving emission regulations and standards requires continuous innovation and adaptation, which can be challenging for market players. Regulatory bodies frequently update emission limits and testing procedures, requiring manufacturers to stay agile and invest in ongoing research to meet compliance.

Market Opportunities

-

Electric Vehicle Expansion: The rapid growth of the electric vehicle market presents opportunities for the development of innovative exhaust aftertreatment solutions tailored for hybrid and plug-in hybrid vehicles. These vehicles, which combine internal combustion engines with electric powertrains, require specialized aftertreatment systems to manage emissions during engine operation.

-

Emerging Markets: Developing regions with growing automotive industries offer significant growth opportunities for the adoption of advanced exhaust aftertreatment systems. Countries such as China, India, and Brazil are witnessing rapid urbanization and increased vehicle ownership, driving the need for effective emission control solutions.

-

Technological Innovation: Continued advancements in aftertreatment technologies and materials present opportunities for creating more efficient and cost-effective solutions. Research into new catalytic materials, advanced sensor technologies, and integrated system designs holds the potential to enhance the performance and reduce the costs of aftertreatment systems.

Segmentation or Automotive Exhaust Aftertreatment Systems Market

By Technology

-

Selective Catalytic Reduction (SCR): SCR technology is a leading solution for reducing nitrogen oxides (NOx) emissions from diesel engines. It involves the injection of a urea-based solution into the exhaust stream, which reacts with NOx to form harmless nitrogen and water. This technology is widely adopted due to its high efficiency and effectiveness. Recent developments in SCR systems include the use of dual dosing strategies and improved catalyst formulations to enhance NOx conversion rates.

-

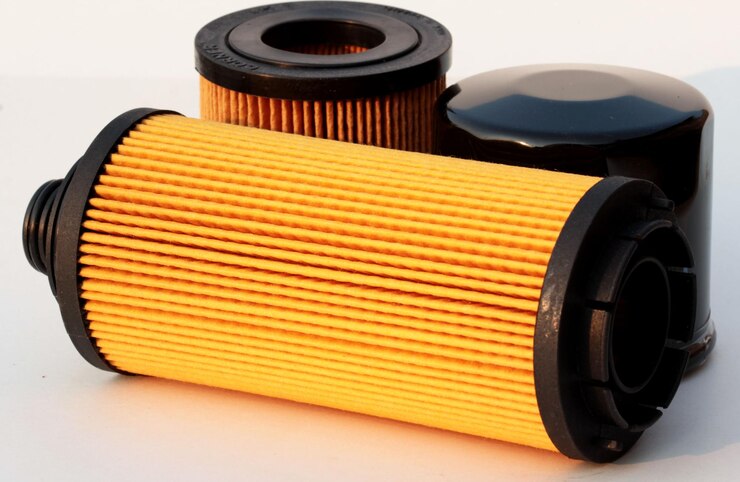

Diesel Particulate Filters (DPF): DPF technology is used to trap and remove particulate matter (PM) from diesel exhaust gases. DPFs are essential for meeting stringent PM emission standards and are commonly used in both light-duty and heavy-duty diesel vehicles. Advanced regeneration techniques, such as active and passive regeneration, help maintain DPF performance and longevity.

-

Gasoline Particulate Filters (GPF): GPF technology is similar to DPF but is used for gasoline engines to reduce particulate emissions. With the increasing adoption of direct injection gasoline engines, GPFs are becoming more prevalent in the automotive industry. Innovations in GPF design focus on minimizing backpressure and enhancing filtration efficiency.

-

Others: Other exhaust aftertreatment technologies include Lean NOx Traps (LNT), Ammonia Slip Catalysts (ASC), and combined systems that integrate multiple technologies to achieve comprehensive emission control. These technologies address specific emission challenges and are often used in conjunction with SCR, DPF, and GPF systems to meet the most stringent standards.

By Vehicle Type

-

Passenger Cars: The passenger car segment is the largest market for exhaust aftertreatment systems, driven by high vehicle production volumes and stringent emission regulations. The adoption of advanced aftertreatment technologies in passenger cars is critical for meeting urban air quality standards and consumer expectations for environmentally friendly vehicles.

-

Commercial Vehicles: Commercial vehicles, including trucks and buses, are significant contributors to overall vehicle emissions. The adoption of robust aftertreatment systems in this segment is crucial for reducing NOx and PM emissions from diesel engines. Regulatory frameworks such as the Euro VI and EPA 2027 standards are driving the adoption of advanced aftertreatment technologies in commercial vehicles.

-

Electric Vehicles: While electric vehicles (EVs) primarily rely on electric powertrains, hybrid and plug-in hybrid vehicles require advanced aftertreatment systems to manage emissions during internal combustion engine operation. The integration of aftertreatment technologies in hybrid vehicles is essential for achieving low emission targets and enhancing overall vehicle efficiency.

Download Free Sample Report @ https://www.techsciresearch.com/sample-report.aspx?cid=16326

Customers can also request 10% free customization on this report.

By Region

-

North America: North America is a significant market for automotive exhaust aftertreatment systems, driven by stringent emission regulations and high adoption rates of advanced technologies. The presence of major automakers and technology providers in the region further supports market growth. Initiatives such as the Clean Air Act and California's Low-Emission Vehicle (LEV) program have set high standards for vehicle emissions.

-

Europe: Europe is at the forefront of implementing strict emission standards, making it a crucial market for exhaust aftertreatment systems. The European Union's ambitious targets for reducing vehicle emissions drive the demand for advanced aftertreatment technologies. The Euro 7 standards, expected to be implemented in the coming years, will further tighten emission limits and boost market growth.

-

Asia-Pacific: The Asia-Pacific region is witnessing rapid growth in the automotive industry, particularly in countries like China and India. Increasing vehicle production and tightening emission regulations in these countries are boosting the demand for exhaust aftertreatment systems. China's National VI standards and India's Bharat Stage VI (BSVI) norms are examples of stringent regulations driving market growth in the region.

-

Latin America: Latin America presents growth opportunities due to the expanding automotive sector and the implementation of emission regulations. Countries like Brazil and Mexico are key markets in this region. The adoption of emission control technologies in Latin America is supported by regulatory initiatives aimed at improving air quality and reducing vehicle emissions.

-

Middle East & Africa: The Middle East & Africa region is gradually adopting stricter emission standards, creating opportunities for the adoption of advanced exhaust aftertreatment systems. The growing automotive industry in this region also contributes to market growth. Initiatives to curb air pollution and improve public health are driving the demand for effective emission control solutions.

Technological Advancements of Automotive Exhaust Aftertreatment Systems Market

Selective Catalytic Reduction (SCR)

SCR technology is a leading solution for reducing nitrogen oxides (NOx) emissions from diesel engines. It involves the injection of a urea-based solution, commonly known as diesel exhaust fluid (DEF), into the exhaust stream, which reacts with NOx to form harmless nitrogen and water. This technology is widely adopted due to its high efficiency and effectiveness. Recent advancements in SCR systems include the development of compact and lightweight designs, enhanced catalyst formulations, and improved dosing strategies to optimize NOx conversion rates and reduce ammonia slip.

Diesel Particulate Filters (DPF)

DPF technology is used to trap and remove particulate matter (PM) from diesel exhaust gases. DPFs are essential for meeting stringent PM emission standards and are commonly used in both light-duty and heavy-duty diesel vehicles. Advanced DPF systems incorporate features such as active and passive regeneration techniques to maintain filter performance and extend service life. Active regeneration involves the injection of fuel into the exhaust stream to increase the temperature and burn off accumulated soot, while passive regeneration relies on exhaust gas temperatures to achieve the same effect.

Gasoline Particulate Filters (GPF)

GPF technology is similar to DPF but is used for gasoline engines to reduce particulate emissions. With the increasing adoption of direct injection gasoline engines, GPFs are becoming more prevalent in the automotive industry. Innovations in GPF design focus on minimizing backpressure and enhancing filtration efficiency. Advanced GPFs incorporate optimized cell structures and advanced catalyst coatings to improve particulate capture and reduce the formation of secondary pollutants.

Regional Analysis

North America

North America is a significant market for automotive exhaust aftertreatment systems, driven by stringent emission regulations and high adoption rates of advanced technologies. The presence of major automakers and technology providers in the region further supports market growth. Initiatives such as the Clean Air Act and California's Low-Emission Vehicle (LEV) program have set high standards for vehicle emissions. The U.S. Environmental Protection Agency (EPA) and the California Air Resources Board (CARB) are key regulatory bodies enforcing these standards.

Europe

Europe is at the forefront of implementing strict emission standards, making it a crucial market for exhaust aftertreatment systems. The European Union's ambitious targets for reducing vehicle emissions drive the demand for advanced aftertreatment technologies. The Euro 7 standards, expected to be implemented in the coming years, will further tighten emission limits and boost market growth. European countries are also investing in low-emission zones and promoting the adoption of clean vehicle technologies to improve air quality in urban areas.

Asia-Pacific

The Asia-Pacific region is witnessing rapid growth in the automotive industry, particularly in countries like China and India. Increasing vehicle production and tightening emission regulations in these countries are boosting the demand for exhaust aftertreatment systems. China's National VI standards and India's Bharat Stage VI (BSVI) norms are examples of stringent regulations driving market growth in the region. The rapid urbanization and industrialization in Asia-Pacific also contribute to the increasing focus on emission control technologies.

Latin America

Latin America presents growth opportunities due to the expanding automotive sector and the implementation of emission regulations. Countries like Brazil and Mexico are key markets in this region. The adoption of emission control technologies in Latin America is supported by regulatory initiatives aimed at improving air quality and reducing vehicle emissions. The introduction of Euro 5 and Euro 6 equivalent standards in various Latin American countries is expected to drive the demand for advanced exhaust aftertreatment systems.

Middle East & Africa

The Middle East & Africa region is gradually adopting stricter emission standards, creating opportunities for the adoption of advanced exhaust aftertreatment systems. The growing automotive industry in this region also contributes to market growth. Initiatives to curb air pollution and improve public health are driving the demand for effective emission control solutions. Countries such as Saudi Arabia and South Africa are implementing emission regulations that align with international standards, fostering the growth of the exhaust aftertreatment systems market.

Competitive Landscape

Major Companies of Automotive Exhaust Aftertreatment Systems Market

-

CDTi Advanced Materials Inc.

- CDTi Advanced Materials Inc. is a leading provider of advanced materials and technologies for emission control. The company offers innovative solutions for reducing harmful emissions from vehicles, including proprietary catalyst formulations and advanced coating technologies. CDTi's products are designed to meet the highest emission standards and provide cost-effective solutions for automakers.

-

Continental Reifen Deutschland GmbH

- Continental is a global leader in automotive technologies, including exhaust aftertreatment systems. The company's advanced solutions are widely used by automakers to meet stringent emission standards. Continental's product portfolio includes SCR systems, DPFs, and GPFs, which are designed to deliver superior performance and durability. The company also invests in research and development to stay at the forefront of emission control technology.

-

Cummins Inc.

- Cummins Inc. is a prominent player in the automotive exhaust aftertreatment systems market, offering a range of solutions for reducing emissions from diesel engines. The company's technologies are known for their efficiency and reliability. Cummins' aftertreatment systems include advanced SCR and DPF technologies, which are used in various applications, from light-duty vehicles to heavy-duty trucks and buses. The company's commitment to innovation and sustainability drives its success in the market.

-

DCL International Inc.

- DCL International Inc. specializes in emission control technologies for various applications, including automotive. The company's products are designed to meet the highest emission standards and reduce environmental impact. DCL's offerings include SCR systems, DPFs, and GPFs, which are engineered to deliver optimal performance and longevity. The company's focus on quality and customer satisfaction has earned it a strong reputation in the industry.

-

Delphi Technologies PLC

- Delphi Technologies PLC is a leading provider of advanced automotive technologies, including exhaust aftertreatment systems. The company's innovative solutions help automakers achieve compliance with stringent emission regulations. Delphi's product portfolio includes advanced catalysts, filters, and integrated aftertreatment systems designed to optimize emission control and fuel efficiency. The company's commitment to technological excellence and sustainability drives its market leadership.

-

Dinex

- Dinex is a global supplier of emission control and aftertreatment systems for the automotive industry. The company's products are widely used in both light-duty and heavy-duty vehicles. Dinex's offerings include advanced SCR, DPF, and GPF technologies, which are engineered to meet the most stringent emission standards. The company's focus on innovation and customer satisfaction drives its success in the market.

-

Donaldson Company Inc.

- Donaldson Company Inc. offers a range of filtration and emission control solutions for the automotive sector. The company's advanced technologies help reduce harmful emissions from vehicles. Donaldson's product portfolio includes high-performance DPFs and GPFs, which are designed to deliver superior filtration efficiency and durability. The company's commitment to innovation and quality has earned it a strong reputation in the industry.

-

ESW Group

- ESW Group specializes in emission control technologies for diesel engines. The company's products are designed to meet the latest emission standards and reduce environmental impact. ESW's offerings include advanced SCR and DPF systems, which are engineered to deliver optimal performance and reliability. The company's focus on sustainability and customer satisfaction drives its success in the market.

-

European Exhaust and Catalyst Ltd

- European Exhaust and Catalyst Ltd is a leading provider of emission control systems for the automotive industry. The company's innovative solutions are used by automakers to meet stringent emission regulations. European Exhaust and Catalyst's product portfolio includes advanced SCR, DPF, and GPF technologies, which are designed to deliver superior performance and durability. The company's commitment to quality and innovation drives its market leadership.

-

Nett Technologies Inc.

- Nett Technologies Inc. offers a range of emission control solutions for various applications, including automotive. The company's products are designed to reduce emissions and improve air quality. Nett Technologies' offerings include advanced SCR and DPF systems, which are engineered to meet the highest emission standards. The company's focus on innovation and customer satisfaction drives its success in the market.

Future Outlook

Anticipated Trends

-

Stricter Emission Standards: The ongoing pressure from regulatory bodies to further reduce emissions will drive the demand for advanced exhaust aftertreatment systems. Future regulations are expected to impose even stricter limits on NOx, PM, and CO emissions, necessitating continuous innovation in aftertreatment technologies.

-

Growth of Electric Vehicles: The expansion of the electric vehicle market will create opportunities for innovative aftertreatment solutions tailored for hybrid and plug-in hybrid vehicles. These vehicles, which combine internal combustion engines with electric powertrains, require specialized aftertreatment systems to manage emissions during engine operation.

-

Technological Innovations: Continued advancements in aftertreatment technologies will lead to more efficient and cost-effective solutions, driving market growth. Research into new catalytic materials, advanced sensor technologies, and integrated system designs holds the potential to enhance the performance and reduce the costs of aftertreatment systems.

Market Forecast

The global automotive exhaust aftertreatment systems market is poised for significant growth in the coming years. With increasing regulatory pressures, technological advancements, and the expansion of the electric vehicle market, the market is expected to continue its upward trajectory, reaching new heights by 2028. The adoption of advanced aftertreatment systems will be driven by the need to comply with stringent emission standards and the growing demand for eco-friendly vehicles.

Download Free Sample Report @ https://www.techsciresearch.com/sample-report.aspx?cid=16326

Customers can also request 10% free customization on this report.

Conclusion

The global automotive exhaust aftertreatment systems market is undergoing a dynamic transformation driven by stringent emission regulations, technological advancements, and rising environmental awareness. The market's growth trajectory is supported by the increasing production of vehicles, both conventional and electric, and the need for advanced aftertreatment systems to meet emission standards.

As the industry continues to evolve, major companies are investing in innovative solutions to reduce harmful emissions and contribute to a cleaner environment. The future of the automotive exhaust aftertreatment systems market looks promising, with ample opportunities for growth and technological innovation.

You may also read:

Concierge Service Market Report USD 702.3 Million Valuation and 5.5% CAGR Forecast

Automotive Horn Systems Market Analysis $8 Billion in 2022 and 8.8% Growth Rate

Stolen Vehicle Security System Market Latest Report Size, Share, and Forecast Through 2028

Automotive Active Purge Pump Market Analysis USD 2.8 Billion Valuation with 6.2% CAGR

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.

Copyright © 2019-2025 IndiBlogHub.com. All rights reserved. Hosted on DigitalOcean for fast, reliable performance.