Automotive Steel Market Growing Popularity and Emerging Trends to 2033

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

According to the Market Statsville Group (MSG), the Global automotive steel Market was valued at USD 112,931.9 million in 2023 and is expected to grow from USD 126,390.1 million in 2024 to USD 161,757.6 million by 2033, by exhibiting a CAGR of 3.1% during the forecast period (2024-2033)

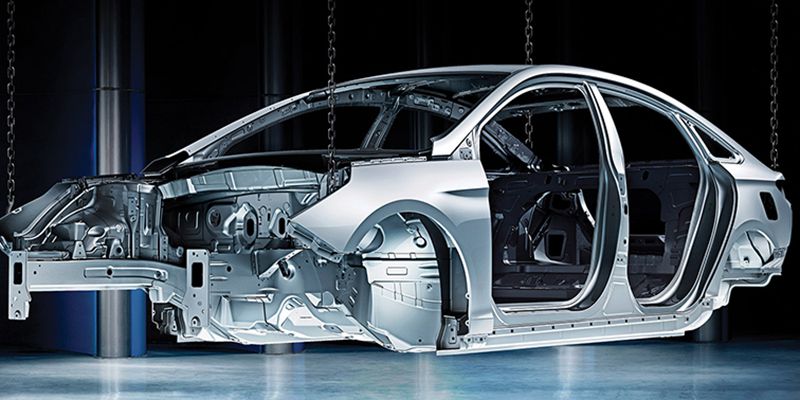

The automotive steel market is a sub-sector of the overall steel industry whose main concern is centered on the manufacturing use of steel in automobiles. Thus, as vehicles are now being featured with more complex structures and higher performance levels, the need for these steel products has changed as well. Automotive steel is the kind of steel used in automobile production, and it has a wide category such as structural steel, bodywork steel, and safety steel. It includes several steels and their treatments relating to the performance characteristics required. The key drivers that affect the automotive steel market include production quantities of vehicles, new developments in automobile design, and laws and policies. It has undergone growth due to the need for cars in the market and the need to come up with better cars to meet the market needs for safe and efficient cars. New steel materials and technological advancements in the production of metallic materials such as steel are to lower vehicle weight while at the same time enhancing structural integrity and safety. Enhanced coatings and treatments are employed for refurbishing steel parts to increase their life and the working life. Automotive steel is 100% recyclable, and its use by the automotive industry is leaning more toward the use of recycled steel to cut its impacts on the environment.

Request Sample Copy of this Report: https://www.marketstatsville.com/request-sample/automotive-steel-market?utm_source=free&utm_medium=harsh

Scope of the Automotive Steel Market

The study categorizes the automotive steel market based on steel type, steel processing type, application, and vehicle type area at the regional and global levels.

By Steel Type Outlook (Sales, USD Million, 2019-2033)

Advanced High-Strength Steel (AHSS)

High-Strength Low-Alloy (HSLA) Steel

Mild Steel

Coated Steel

Stainless Steel

Galvanized Steel

Carbon Steel

By Steel Processing Type Outlook (Sales, USD Million, 2019-2033)

Hot-Rolled Steel

Cold-Rolled Steel

Hot-Dip Galvanized Steel

By Application Outlook (Sales, USD Million, 2019-2033)

Body Structure

Safety Components

Powertrain

Suspension and Axles

Electric Vehicles (EVs)

Engine Components

By Vehicle Type Outlook (Sales, USD Million, 2019-2033)

Passenger Vehicles

Commercial Vehicles

Electric Vehicles (EVs)

By Region Outlook (Sales, USD Million, 2019-2033)

North America

US

Canada

Mexico

Europe

Germany

Italy

France

UK

Spain

Poland

Russia

The Netherlands

Norway

Czech Republic

Rest of Europe

Asia Pacific

China

Japan

India

South Korea

Indonesia

Malaysia

Thailand

Singapore

Australia & New Zealand

Rest of Asia Pacific

South America

Brazil

Argentina

Colombia

Rest of South America

The Middle East & Africa

Saudi Arabia

UAE

South Africa

Northern Africa

Rest of MEA

Direct Purchase Report: https://www.marketstatsville.com/buy-now/automotive-steel-market?opt=3338&utm_source=free&utm_medium=harsh

Advanced High-Strength Steel (AHSS) segment accounts for the largest market share by steel type

Based on the steel type, advanced high-strength steel has been the leading segment in the automotive steel market, surpassed all grades of traditional steel in its aspect due to superior properties. AHSS is an important innovation in the automotive material as it offer the benefits of strength, durability, and weight efficiency. It plays an important role in meeting the constantly increasing requirements of the automotive industry towards safer, fuel-efficient, and environmentally friendly vehicles. AHSS has a high strength-to-weight ratio, which helps in reducing the weight of the vehicle without losing on safety and structural strength. Such criteria are important to achieve the very stringent targets for improving fuel efficiency and reduction in emission. High strength and ductility in AHSS mean better absorption of energies during collisions, which in turn improve crashworthiness as well as occupants' safety in vehicles.

Additionally, AHSS is used in auto parts such as body panels, chassis components, and structural reinforcements. The flexibility of AHSS facilitated its usage in wide variations of car ranges, specifically between economy, middle ranged, and high-end vehicles. Increasing pressure on the demand for fuel efficiency and emission standards forces automotive companies to be more accepting of AHSS. According to the claims made by governments about demands for lighter vehicles, AHSS is the most feasible option. Customers of different types are becoming concerned about fuel efficiency and safety regarding the use of a vehicle. AHSS satisfies these needs with improved strength while also reducing vehicle weight. The continuous innovation in manufacturing AHSS, which includes advanced manufacturing processes and material science, is broadening the scope of application and performance. This will lead to increased uptake within the industry of automobiles.

North America accounted for the largest Market share by Region.

Based on the region, North America is set to grow steadily as a result of increased vehicle production and advanced steel solution demand, making it a dominant region during the entire forecast period. Major steel-producing firms such as ArcelorMittal, U.S. Steel, and Nucor are based in this region. These are large automotive producers: General Motors, Ford, and Stellantis-they account for a large share of the market in North America. The North American OEMs are fixated on lightening up the vehicle to meet the expectations of fuel efficiency and emission. The trend will drive up the demand for AHSS, the lightweight material.

The U.S. and Canadian governments impose severe rules on fuel economy and emissions standards, forcing the manufacturers to opt for more advanced steel solutions to meet these standards. There has been a movement toward reshoring, bringing steel production and automotive manufacturing back into local regions to reduce risks in supply chain vulnerability and develop local capabilities. The U.S. automotive steel market is significant in size considering the high volumes of vehicle production and high emphasis on novel steel technologies. The adoption of AHSS and advanced coatings is prevalent in the U.S. automotive sector. Canada’s automotive steel market is influenced by both domestic production and imports. The country is investing in steel technologies to support its automotive industry and reduce carbon emissions.

Competitive Landscape: Automotive Steel Market

The automotive steel showcase is a critical competitor and amazingly ferocious in the division. It is utilizing methodologies counting organizations, item dispatches, acquisitions, understandings, and development to upgrade their positions in the advertiser. Most divisions of businesses center on expanding their operations around the world and developing long-lasting partnerships.

Major players in the automotive steel market are:

ArcelorMittal

TATA Steel

China Steel Corporation

Hyundai Steel

United States Steel Corporation

JSW Group

POSCO

Nippon Steel & Sumitomo Metal Corporation

JFE Steel Corporation

U.S. Steel

NUCOR Corporation

Jindal Steel & Power

Grow Ever Steel

HBIS Group

Outokumpu OYJ

Kobe Steel

Request For Report TOC: https://www.marketstatsville.com/table-of-content/automotive-steel-market

Recent Development

In August 2024, Automakers are shifting to more use of Advanced High-Strength Steel (AHSS) in their production to meet new safety and fuel efficiency regulations. The superior strength-to-weight ratio of AHSS along with excellent crashworthiness have made it very popular for the body manufacturing of a vehicle. The primary steel producers are raising their production capacities to fulfill this ever-escalating demand, and deals between the vehicle companies and steel suppliers are also becoming more frequent to ensure the supply of high-quality AHSS.

In July 2024, Automotive steel is to be improved concerning the properties and reduced in cost by introducing new steel manufacturing technologies. For example, EAF technology and advanced alloying techniques will lay channels for further efficiency and sustainability in the production of high-strength steel. Thereby, car makers will further reduce vehicle weight and increase fuel efficiency.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.