Blockchain in BFSI Market Overview, Growth, Trends Analysis, Forecast 2024-2032

According to IMARC Group's latest research report, titled "Blockchain in BFSI Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2024-2032," offers a comprehensive analysis of the industry, which comprises insights on the blockchain in BFSI market statistics. The report also includes competitor and regional analysis, and contemporary advancements in the market.

✍️ For entrepreneurs and developers, blockchain is a goldmine of opportunities. Explore our blockchain business guide to see how you can leverage it for innovation.

The global blockchain in BFSI market size reached US$ 1.5 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 44.4 Billion by 2032, exhibiting a growth rate (CAGR) of 44.66% during 2024-2032.

Blockchain in BFSI Market Overview:

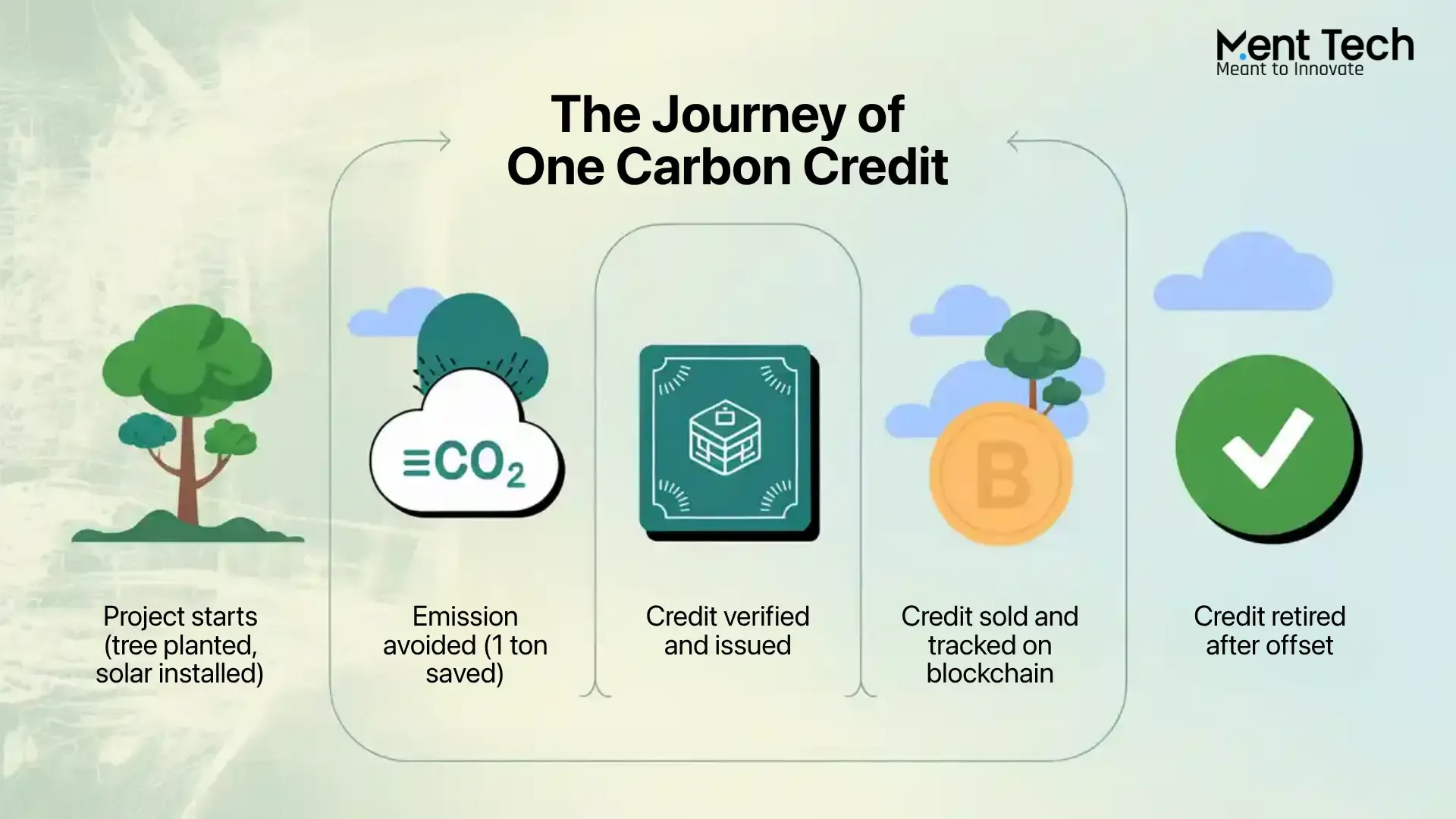

Blockchain technology has revolutionized the Banking, Financial Services, and Insurance (BFSI) sector by enhancing security, transparency, and efficiency. Its decentralized ledger system ensures secure and tamper-resistant transactions, reducing fraud risks and enhancing data integrity. In the BFSI industry, blockchain facilitates faster and more cost-effective cross-border payments, streamlines complex processes like settlements and clearing, and enables smart contracts for automated and transparent agreements. The technology enhances customer trust by providing real-time, traceable transaction records while mitigating the need for intermediaries. As blockchain continues to evolve, its application in the BFSI sector promises to reshape traditional financial operations, fostering innovation and resilience in an increasingly digital financial landscape.

Get Sample Copy of Report at – https://www.imarcgroup.com/blockchain-in-bfsi-market/requestsample

Blockchain in BFSI Market Trends:

The global market is majorly driven by the increasing demand for security. Security is a paramount concern, and blockchain addresses this by providing an immutable and decentralized ledger, reducing the risk of fraud and ensuring the integrity of financial transactions. Transparency is another driving factor; blockchain's transparent and auditable nature enables all relevant parties to access and verify transaction data in real-time, promoting trust and accountability. Furthermore, efficiency gains are significant drivers as well. Blockchain streamlines complex and time-consuming processes such as settlements, reducing the need for intermediaries and minimizing transactional costs.

Cross-border payments benefit from blockchain's ability to facilitate faster and cost-effective transactions, overcoming traditional challenges associated with legacy systems. Moreover, smart contracts, self-executing agreements with coded terms, automate and enforce contractual obligations, reducing the need for manual intervention and minimizing errors. This automation contributes to operational efficiency and cost savings in the BFSI sector. Besides, blockchain's role in financial inclusion is a compelling driver, especially in regions with underbanked populations. The technology enables more accessible and affordable financial services, fostering inclusion and reducing barriers to entry. Additionally, regulatory compliance and adherence to industry standards also contribute to the growth of the blockchain market in BFSI.

Competitive Landscape with Key Players:

- Accenture plc

- AlphaPoint

- Amazon Web Services Inc.

- Auxesis Services & Technologies (P) Ltd.

- Infosys Limited

- International Business Machines Corporation

- Oracle Corporation

Key Market Segmentation:

Type Insights:

- Private

- Public

- Consortium

- Hybrid

Component Insights:

- Platform

- Services

Application Insights:

- Digital Currency

- Record Keeping

- Payments and Settlement

- Smart Contracts

- Compliance Management

- Others

End User Insights:

- Banking

- Insurance

- Non-Banking Financial Companies (NBFCs)

Breakup by Region:

- North America (United States, Canada)

- Pacific (China, Japan, India, Australia, Indonesia, Korea, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa (United Arab Emirates, Saudi Arabia, Qatar, Iraq, Other)

Key Highlights of the Report:

- Market Performance

- Market Outlook

- Porter’s Five Forces Analysis

- Market Drivers and Success Factors

- SWOT Analysis

- Value Chain

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Who we are:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact us:

IMARC Group134 N 4th St. Brooklyn, NY 11249, USAEmail: [email protected]Tel No:(D) +91 120 433 0800United States: +1-631-791-1145 | United Kingdom: +44-753-713-2163

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.