Brazil ATM Market Size, Share, Growth, Trends, Report 2025-2033

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Brazil ATM Market Overview

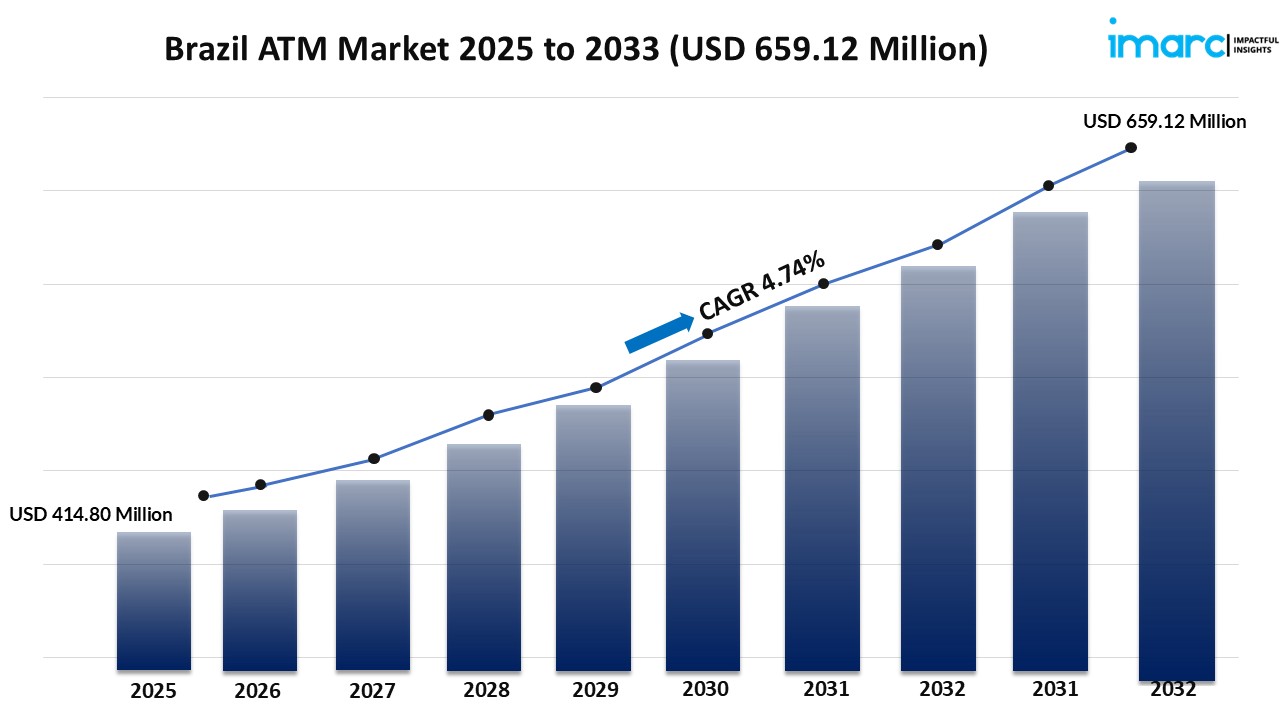

Market Size in 2024: USD 414.80 Million

Market Forecast in 2033: USD 659.12 Million

Market Growth Rate: 4.74% (2025-2033)

According to the latest report by IMARC Group, the Brazil agricultural biologicals market size was valued at USD 414.80 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 659.12 Million by 2033, exhibiting a CAGR of 4.74% from 2025-2033.

Brazil ATM Market Trends and Drivers:

The Brazil ATM market is currently experiencing sustained momentum as financial institutions, fintech providers, and government stakeholders are jointly prioritizing infrastructure expansion to meet growing consumer expectations. The rise of digital banking has not diminished the relevance of physical cash access points—instead, it is reinforcing demand for hybrid banking ecosystems that combine digital agility with physical accessibility.

Urban centers are witnessing the rapid deployment of multifunctional ATMs equipped with biometric authentication, contactless payments, and real-time account services, enhancing transactional convenience. Meanwhile, in semi-urban and rural regions, ATM installations are supporting financial inclusion initiatives by providing basic banking services in underserved areas. The shift toward self-service banking is gaining traction, driven by customer preferences for 24/7 accessibility and faster service delivery. In response, banks are upgrading legacy machines with intelligent terminals that integrate security enhancements and interactive interfaces. These developments are fortifying the Brazil ATM market as a key enabler of inclusive, efficient, and user-centric financial services delivery.

The integration of advanced technologies is emerging as a primary driver in the evolution of the Brazil ATM market, reflecting broader digital transformation across the banking sector. Institutions are increasingly adopting cloud-based remote monitoring systems and predictive maintenance algorithms to enhance ATM uptime and reduce operational costs. Simultaneously, real-time transaction analytics are being used to track usage trends and optimize cash replenishment cycles, improving service reliability and profitability.

Brazil ATM Market: Enabling Modernized Banking Experiences through Accessible Infrastructure

New-generation ATMs are being designed with customizable software that allows for bill payments, mobile top-ups, fund transfers, and card-less transactions, thereby expanding their utility beyond traditional withdrawals. These functionalities are aligning with Brazil’s broader digital payment ecosystem while ensuring continuity for consumers who continue to rely on cash. Strategic partnerships between financial institutions and retail chains are accelerating ATM deployment in high-footfall locations, improving accessibility for consumers and reinforcing brand presence. With rising demand for seamless, secure, and contact-free banking experiences, the Brazil ATM market share is expanding as a vital interface bridging digital banking innovation and physical service delivery.

Looking forward, the Brazil ATM market is advancing through a blend of innovation, inclusion, and efficiency—strengthening its relevance in the evolving financial landscape. The ongoing rollout of smart city initiatives is encouraging municipalities to adopt connected ATM infrastructure as part of urban digitization strategies. Moreover, the focus on financial literacy and consumer empowerment is boosting awareness about ATM functionalities, ensuring broader usage across age and income demographics. Financial institutions are collaborating with ATM manufacturers to introduce energy-efficient and solar-powered machines, aligning with environmental sustainability goals.

At the same time, government-sponsored banking programs are leveraging ATMs to expand outreach in remote territories, further deepening financial penetration. These efforts are being complemented by cybersecurity upgrades that address emerging digital threats, assuring customers of safe and reliable transactions. As consumers increasingly expect convenience without compromising security, the Brazil ATM market is solidifying its role as a critical distribution channel in the modern banking value chain. With its adaptive nature and continued investment in innovation, the market is poised to deliver on both operational excellence and equitable financial access.

Download a sample copy of the Report: https://www.imarcgroup.com/brazil-atm-market/requestsample

Brazil ATM Market Segmentation:

The report has segmented the market into the following categories:

Competitive Landscape:

The competitive landscape of the industry has also been examined, along with the profiles of the key players.

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current, and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you require specific information not currently within the scope of the report, we can provide it to you as part of the customization process.

Ask an analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=37655&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St., Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.