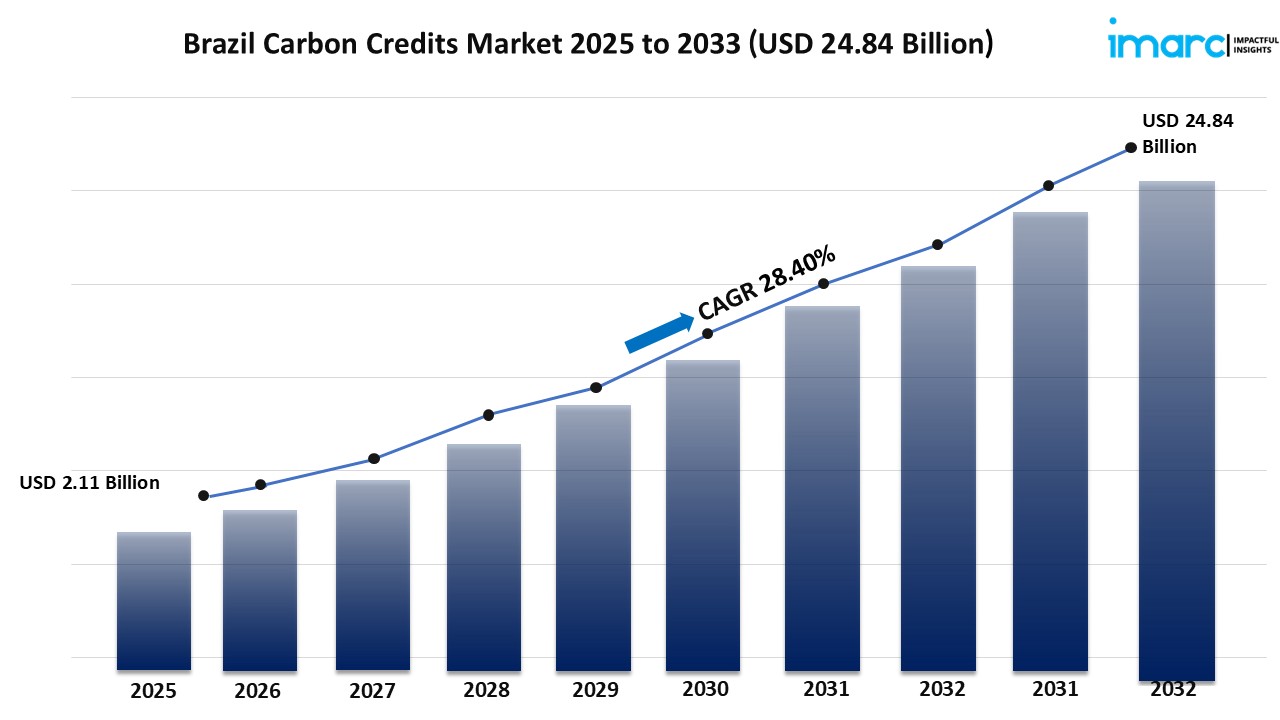

Brazil Carbon Credits Market – Trends, Growth & Policy Outlook

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

The Brazil Carbon Credits Market is gaining momentum as the country intensifies efforts to combat climate change and preserve the Amazon. Supportive regulations and global demand for offsetting emissions are driving market expansion.

The Brazil carbon credits market size reached USD 2.11 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 24.84 Billion by 2033, exhibiting a growth rate (CAGR) of 28.40% during 2025-2033.

Brazil Carbon Credits Industry Trends and Drivers:

The Brazil carbon credits market is expanding rapidly. This growth is driven by a mix of environmental goals and economic chances, boosting the Brazil Carbon Credits Market Size. Many organizations are turning to carbon credits to reduce their carbon footprints. This helps as the world strives for carbon neutrality and lower emissions. Brazil’s rich natural resources, including vast rainforests and wetlands, provide a strong base for carbon sequestration projects. This enhances Brazil’s role in global carbon markets.

The demand for sustainable solutions is rising. Brazilian businesses are getting involved in carbon offset initiatives as part of their ESG commitments. This trend is strengthening Brazil’s reputation as a reliable source of high-quality carbon credits. It also increases the Brazil Carbon Credits Market Share in the global sustainability economy.

Policy frameworks and regulations are key drivers of Brazil Carbon Credits Market Growth. The government has launched progressive measures like a national carbon pricing system. This encourages companies to invest in greener technologies and join regulated carbon markets. These policies offer incentives for cleaner operations and direct investments into ecosystem preservation. Clear rules and government support build confidence for local and foreign investors.

This encouragement helps them engage in Brazil’s carbon credits sector. Brazil is updating its rules to improve transparency, accountability, and innovation in carbon credit trading. This move aligns national goals with global climate agreements. This positions the country for ongoing market growth.

Brazil's rich biodiversity offers lasting chances for the Brazil Carbon Credits Market. Its diverse ecosystems are important carbon sinks. They support offset projects that offer environmental benefits and economic gains. Projects to protect and restore these areas are becoming popular. This growth is helped by better monitoring and strict certification standards. Brazilian companies are grabbing these chances.

They create new revenue streams and help global climate efforts. Caring for the environment, backing policies, and boosting tech growth are building a solid base for Brazil's carbon credits market to expand. It helps the sector meet the growing need for sustainable carbon offset solutions. This also boosts Brazil's role as a leader in the carbon credits market.

Download a sample copy of the Report: https://www.imarcgroup.com/brazil-carbon-credits-market/requestsample

Brazil Carbon Credits Industry Segmentation:

The report has segmented the market into the following categories:

Type Insights:

- Compliance

- Voluntary

Project Type Insights:

- Avoidance/Reduction Projects

- Removal/Sequestration Projects

- Nature-based

- Technology-based

End-Use Industry Insights:

- Power

- Energy

- Aviation

- Transportation

- Buildings

- Industrial

- Others

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

Competitive Landscape:

The competitive landscape of the industry has also been examined, along with the profiles of the key players.

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current, and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you require specific information not currently within the scope of the report, we can provide it to you as part of the customization.

Ask an analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=32567&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St., Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.