Breaking Down Low Credit Home Loans: A Real Path to Homeownership

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

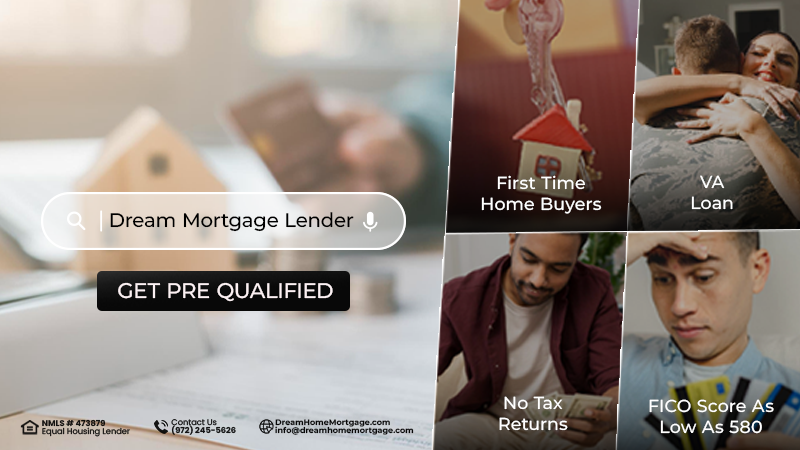

For many Americans, the biggest hurdle to buying a home is a low credit score. But the good news is that low credit home loans make owning a home possible, even if your score isn’t perfect. These loans are designed to help buyers with past credit challenges take that important step toward homeownership.

What Are Low Credit Home Loans?

Low credit home loans are mortgages available to people with credit scores below the conventional threshold of 620. Instead of focusing solely on credit, lenders also consider income, employment, and financial stability. These loans often include options like FHA, VA, USDA, and special lender programs.

FHA loans, for example, are government-backed and require lower credit scores. They are ideal for first-time homebuyers and those who have experienced past financial issues. VA loans, offered to veterans and active service members, come with benefits like no down payment and no private mortgage insurance. USDA loans focus on rural and suburban buyers and may accept lower scores if other criteria are strong.

Who Qualifies for a Low Credit Home Loan?

If your score is below 620, you still have options. FHA loans allow scores as low as 580 with a 3.5% down payment. With a score between 500-579, you may still qualify if you can make a 10% down payment. VA and USDA loans also accept lower scores, especially with strong financial profiles. Subprime lenders may consider scores below 580 with higher interest rates, but it is crucial to review all terms and ensure long-term affordability.

Why Prequalification Is Key

Wondering how to get prequalified for a home mortgage? Prequalification helps you understand what you can afford and how lenders view your finances. It only takes a few steps:

- Check your credit report.

- Use a home loan calculator to estimate payments.

- Submit financial info to a trusted lender.

- This process doesn’t impact your credit and gives you a clear path forward.

Getting home loan prequalification does not impact your credit score. It provides a realistic picture of your purchasing power and identifies potential issues early in the process.

Budgeting with Tools That Work

A monthly mortgage calculator is essential when planning your budget. It helps estimate your total monthly payment, including principal, interest, taxes, and insurance. Smart buyers use this to stay within budget and avoid financial surprises.

Using tools like a home loan calculator allows you to compare different loan scenarios, plan for various down payment options, and make informed decisions about the affordability of different properties.

What Is an Escrow Advance?

If you get approved, the lender may collect an escrow advance to cover initial costs like property taxes and homeowners insurance. It’s a smart way to protect both you and the lender, ensuring bills are paid on time from the start.

Escrow accounts simplify budgeting by including taxes and insurance in your monthly payment. Understanding this process helps buyers avoid surprises and plan effectively.

Tips for Getting Approved

To boost your chances of approval:

- Pay down existing debt

- Don’t open new credit accounts

- Save for a down payment

- Use a home loan calculator to plan

- Get home loan prequalification to understand your options

Improving financial habits, such as making timely payments and reducing credit card balances, can gradually raise your score even before applying.

Trusted Help Makes a Difference

Choosing the right lender can make all the difference. Dream Home Mortgage, powered by Brazos National Bank, offers trusted support and comprehensive services tailored for low credit home loans. Their team helps buyers navigate every step with confidence.

They take the time to understand each borrower’s unique situation and offer personalized guidance, from document preparation to loan approval.

Final Thoughts

Don’t let your credit score hold you back. With flexible options, smart budgeting tools, and expert guidance, low credit home loans offer a real way forward. Start today with prequalification, use a monthly mortgage calculator, and connect with a trusted mortgage partner to make your dream home a reality.

The path to homeownership may take planning and patience, but it's possible. With the right tools, knowledge, and lender by your side, owning a home with low credit is no longer just a dream—it's a goal within reach.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.