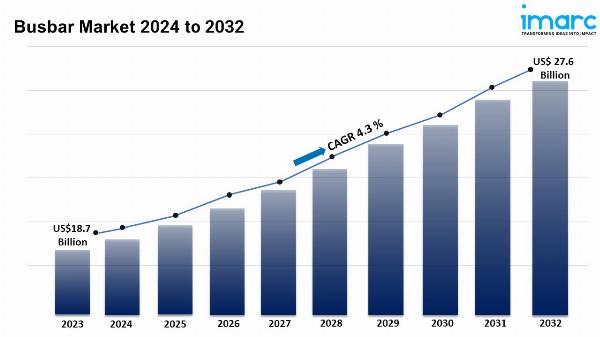

Busbar Market is Expected to Reach USD 27.6 Billion by 2032: IMARC Group

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Summary:

The global busbar market size reached USD 18.7 Billion in 2023.

The market is expected to reach USD 27.6 Billion by 2032, exhibiting a growth rate (CAGR) of 4.3% during 2024-2032.

Asia Pacific leads the market, accounting for the largest busbar market share.

Low accounts for the majority of the market share in the power rating segment due to its safety, ease of installation, and cost-effectiveness.

Copper holds the largest share in the busbar industry.

Utilities remain a dominant segment in the market due to the ability of busbars to handle high voltages and ensure efficient, reliable power flow.

Chemicals and petroleum represent the leading industry segment.

The rising requirement for energy efficiency globally is a primary driver of the busbar market.

The increasing use of sustainable energy resources and expanding infrastructure development are reshaping the busbar market.

Industry Trends and Drivers:

Increasing demand for energy efficiency in power distribution:

Energy efficiency is a major concern for utility companies and end-users, and busbars play a significant role in achieving this. A busbar is a conductor that efficiently distributes power across electrical systems with minimal energy losses compared to traditional wiring methods. As industries and large-scale operations seek ways to optimize their energy consumption, busbars provide a more efficient and reliable solution for power distribution. Their ability to handle higher current densities and distribute power more evenly makes them essential in modern power systems. Furthermore, the shift toward smart grids and advanced power management solutions, where efficient and reliable power distribution is vital, is also increasing the demand for busbars.

Rising adoption of renewable energy sources:

The global transition toward renewable energy sources, such as wind and solar power, is contributing substantially to the growth of the busbar market. Renewable energy installations require efficient power distribution systems to handle the intermittent and variable nature of these energy sources. As a result, busbars are increasingly being used in power stations, substations, and solar and wind farms to connect various components of renewable energy systems. Their flexibility, reliability, and capability to manage high voltages make them ideal for these applications. As governments and private entities invest in expanding renewable energy infrastructure to meet environmental targets, the demand for busbars is rising, particularly in regions with large-scale renewable energy projects.

Growing infrastructure development across sectors:

The rapid growth in infrastructure development in residential, commercial, and industrial sectors is significantly influencing the busbar market. As urbanization increases, there is a rising demand for reliable power distribution systems to support residential complexes, commercial buildings, data centers, and industrial facilities. Busbars are widely used in these infrastructures due to their space-saving design, ease of installation, and enhanced safety features. They are particularly popular in modern high-rise buildings and data centers, where efficient and compact power distribution systems are essential. As countries invest in expanding and upgrading their power infrastructure to support economic growth, busbars are becoming a preferred choice for new installations and retrofit projects.

Request Sample For PDF Report: https://www.imarcgroup.com/busbar-market/requestsample

Busbar Market Report Segmentation:

Breakup by Power Rating:

High

Medium

Low

Low accounts for the majority of shares due to its extensive use in residential, commercial, and industrial applications, where it efficiently distributes power in buildings and small-scale operations.

Breakup by Conductor:

Copper

Aluminium

Copper dominates the market due to its excellent electrical conductivity and low resistivity.

Breakup by End-User:

Industrial

Commercial

Residential

Utilities

Utilities represent the majority of shares due to the essential role busbars play in power generation, transmission, and distribution systems.

Breakup by Industry:

Chemicals and Petroleum

Metals and Mining

Manufacturing

Others

Chemicals and petroleum hold the majority of shares due to their need for robust, reliable power distribution systems that can handle high energy demands in harsh industrial environments.

Regional Insights:

North America (United States, Canada)

Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

Latin America (Brazil, Mexico, Others)

Middle East and Africa

Asia Pacific holds the leading position owing to a large market for busbars driven by rapid industrialization, urbanization, and significant infrastructure development in countries such as China and India, propelling demand for efficient power distribution solutions.

Top Busbar Market Leaders:

Siemens AG

ABB Group

Schneider Electric SE

Eaton Corporation, Inc.

Legrand Pvt Ltd.

General Electric Company

Mersen Corporate Services SAS

Rittal GmbH & Co. KG

CHINT Group Corporation

Power Products Unlimited, LLC

C&S Electric Ltd.

Promet AG

ElvalHalcor SA

Littelfuse, Inc.

Southwire Company, LLC

Oriental Copper Co. Ltd.

Note: If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.