Buy Now Pay Later Market Segmentation and Revenue Forecast 2030

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

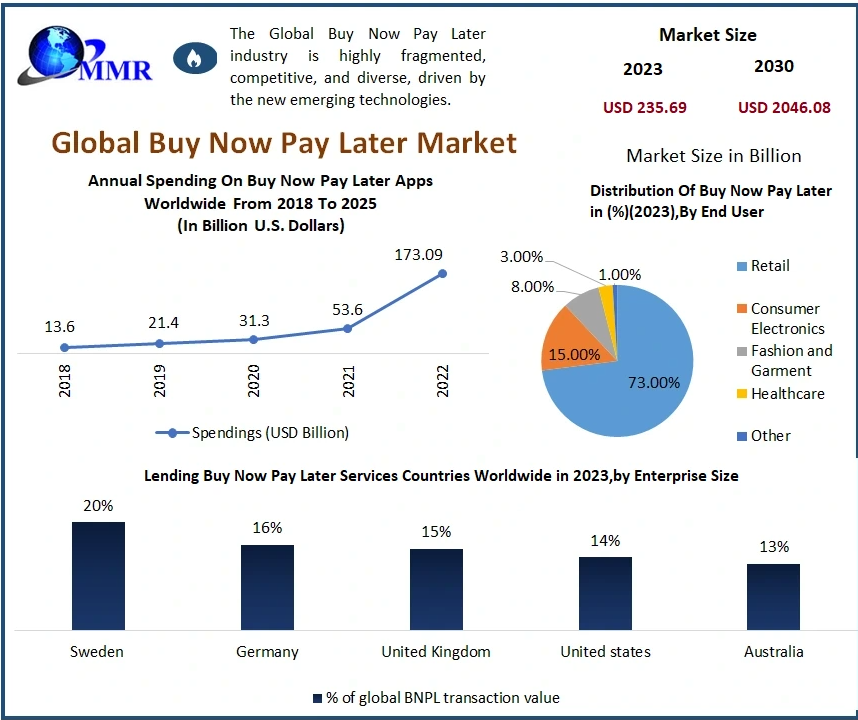

Buy Now, Pay Later Market Set to Surpass USD 2 Trillion by 2030 Amid Explosive Growth in Digital Payments

The global Buy Now, Pay Later (BNPL) Market is experiencing unprecedented growth, driven by evolving consumer behavior, the rise of e-commerce, and increasing demand for flexible payment solutions. Valued at approximately USD 235.36 billion in 2023, the BNPL market is forecasted to reach nearly USD 2,046.08 billion by 2030, expanding at a CAGR of over 36% during the forecast period.

Unlock key market insights by accessing the sample report through the link .@https://www.maximizemarketresearch.com/request-sample/118477/

Market Estimation & Definition

Buy Now, Pay Later (BNPL) refers to a short-term financing option that allows consumers to purchase goods or services and pay for them over time, typically in fixed installments with no interest if payments are made on time. Unlike traditional credit cards, BNPL services often require only soft credit checks, making them accessible to a wider audience.

The market’s exponential growth is fueled by its ease of use, consumer-centric features, and widespread adoption across online and offline retail environments. BNPL has evolved from a niche offering to a mainstream financial tool that is reshaping the global consumer finance ecosystem.

Market Growth Drivers & Opportunities

Consumer-Centric Payment Model

One of the primary drivers of BNPL adoption is its appeal to consumers seeking financial flexibility without the complexities of traditional credit systems. With interest-free installment options and transparent repayment terms, BNPL has gained traction, especially among younger demographics.

E-Commerce Expansion

The rise of online shopping has significantly propelled BNPL usage. Major e-commerce platforms are increasingly integrating BNPL options at checkout, enabling seamless and instant financing. This has led to increased order values and reduced cart abandonment rates.

Digital and Mobile Payment Adoption

With the proliferation of smartphones and mobile wallets, digital payment ecosystems are rapidly expanding. BNPL services embedded within mobile apps and digital wallets provide users with an integrated shopping and financing experience, enhancing convenience and driving user engagement.

B2B BNPL Growth

While traditionally focused on consumers, BNPL is now making inroads into the B2B sector. Small and medium-sized enterprises are utilizing BNPL solutions to manage cash flow, procure inventory, and finance operations, opening a new revenue stream for providers.

Retail Partnerships and Merchant Integration

Merchants are increasingly adopting BNPL solutions to attract more customers, boost sales, and differentiate themselves in a competitive retail environment. By offering BNPL at point-of-sale, businesses improve the overall shopping experience and increase customer loyalty.

Rising Financial Inclusion

BNPL platforms are playing a critical role in enhancing financial inclusion by providing access to credit for underserved populations. The minimal barriers to entry allow consumers with limited credit history to make purchases and build repayment track records.

Segmentation Analysis

The BNPL market is segmented by channel, payment type, enterprise size, end-use sector, and user age group.

By Channel

Online: Dominates the market due to the strong presence of e-commerce platforms and the rapid shift in consumer behavior toward digital transactions. Online BNPL accounted for the largest share in 2023 and is expected to continue its dominance.

Point-of-Sale (POS): Gaining momentum in physical retail environments. Brick-and-mortar stores are increasingly offering BNPL options to provide consumers with instant credit at checkout, enhancing the in-store shopping experience.

By Payment Type

Interest-Free Installments: These plans are the most popular, especially for low-to-mid-ticket purchases. They are favored for their simplicity and transparency.

Interest-Based Plans: Typically used for higher-value purchases, such as travel bookings or electronics, where longer repayment periods are required.

By Enterprise Size

Large Enterprises: Have been early adopters, integrating BNPL into their digital ecosystems to offer customers more payment options.

Small and Medium Enterprises (SMEs): An emerging segment embracing BNPL to increase conversions, manage receivables, and compete with larger brands.

By End-Use Sector

Retail and E-Commerce: The largest segment, accounting for a significant portion of BNPL transactions. Product categories include fashion, electronics, personal care, and home appliances.

Healthcare: A growing use case where patients can split medical bills into installments.

Travel and Leisure: Increasingly popular for booking trips and vacation packages.

Education: Used for financing tuition fees and learning materials.

Automotive and Electronics: Used for high-value items requiring structured repayment options.

By Age Group

18–27 Years (Gen Z): Digital-native and budget-conscious consumers who prefer BNPL over traditional credit cards.

28–43 Years (Millennials): A substantial user base leveraging BNPL for convenience, control, and lifestyle purchases.

44+ Years: Adoption is growing as BNPL providers expand offerings to more segments of the population.

Unlock Exclusive Market Insights with a Single Click @https://www.maximizemarketresearch.com/request-sample/118477/

Country-Level Analysis

United States

The U.S. is one of the largest and most mature BNPL markets. Consumer awareness and adoption have surged, with major retailers, banks, and fintechs offering embedded BNPL solutions across various industries. Regulatory oversight is increasing, promoting responsible lending and ensuring consumer protection. In 2023, the U.S. market saw a remarkable rise in BNPL transactions across electronics, apparel, and everyday essentials.

Germany

Germany is a key market in the European BNPL landscape. High internet penetration and a strong e-commerce sector have accelerated the use of BNPL, especially among tech-savvy consumers. Financial institutions and fintechs are actively collaborating with retailers to introduce tailored BNPL services. The country's emphasis on data privacy and consumer rights has shaped a secure and trustworthy environment for BNPL expansion.

Commutator (Competitor) Analysis

The BNPL market is highly competitive, with a mix of fintech startups, established financial institutions, and e-commerce giants driving innovation.

Key Players Include

Pure-Play BNPL Providers: Companies offering BNPL as a core service, known for their agile technology stacks and seamless user experiences.

Fintech Giants: Leveraging existing digital infrastructure to expand BNPL offerings, often through mobile apps and digital wallets.

Traditional Banks: Collaborating with retailers or launching in-house BNPL solutions to compete with fintech challengers.

Retailers & E-Commerce Platforms: Integrating BNPL at checkout to enhance customer satisfaction and increase conversion rates.

Competitive Strategies

AI and Risk Management: Leading players are investing in AI-driven credit assessments to minimize default risks and improve approval rates.

Partnership Ecosystems: Strategic collaborations with retailers, banks, and payment processors are enabling broader reach and stronger market positioning.

Geographic Expansion: Companies are entering emerging markets where digital adoption is rising, tailoring offerings to local payment preferences and regulations.

Product Diversification: In addition to standard BNPL services, many players are launching complementary financial products, including virtual cards, budgeting tools, and loyalty programs.

Conclusion

The global Buy Now, Pay Later market is undergoing a major transformation, disrupting traditional credit systems and redefining how consumers approach spending. With a projected value of over USD 2 trillion by 2030, BNPL has evolved from a convenience-based option to a vital financial solution for millions.

Key growth drivers—including digital transformation, changing consumer habits, and increased merchant adoption—are shaping the future of this dynamic industry. As technology advances and regulatory frameworks evolve, the market is expected to become more mature, transparent, and inclusive.

For businesses, BNPL presents a powerful opportunity to boost sales, improve customer satisfaction, and tap into new markets. For consumers, it offers a smart, flexible alternative to traditional payment methods—one that aligns with modern lifestyles and financial priorities.

The BNPL market is not just a trend—it's a lasting shift in how the world shops, spends, and saves.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.