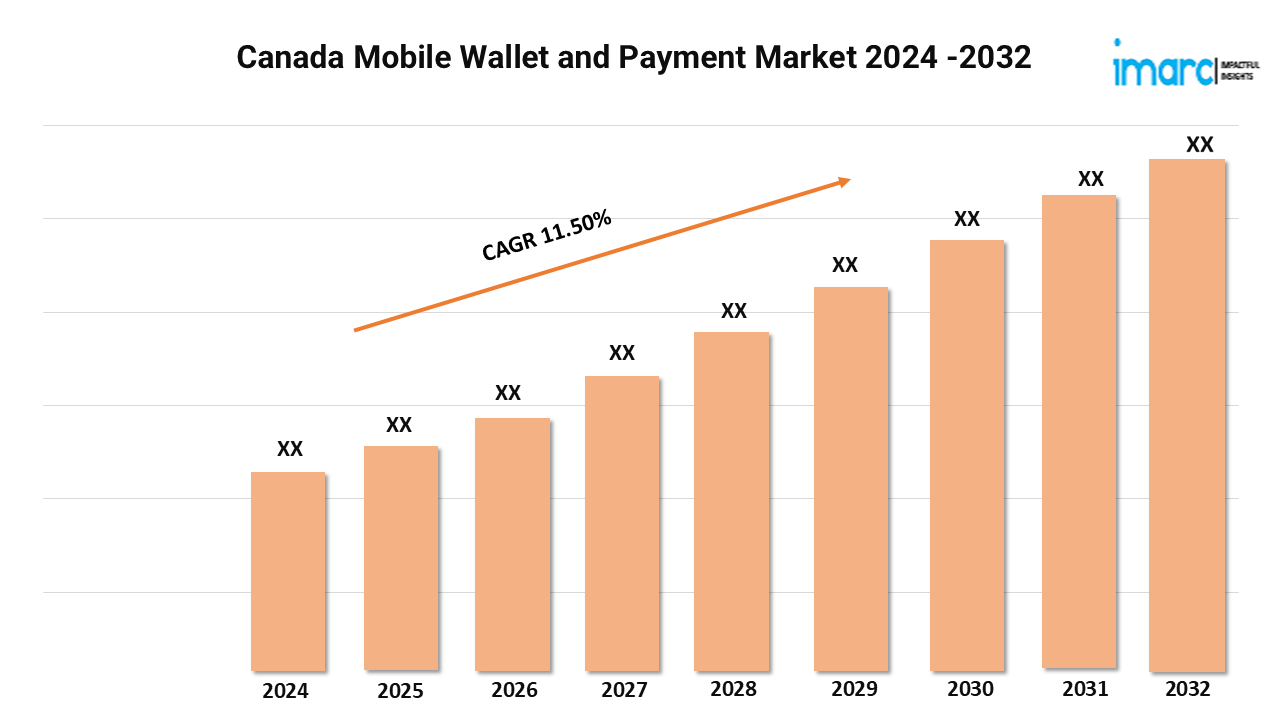

Canada Mobile Wallet and Payment Market Expected to Rise at 11.50% CAGR During 2024-2032

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Canada Mobile Wallet and Payment Market Overview

Base Year: 2023

Historical Years: 2018-2023

Forecast Years: 2024-2032

Market Growth Rate: 11.50% (2024-2032)

The market is experiencing rapid growth, driven by increasing smartphone penetration, a tech-savvy population, and a shift towards digital payments. Key players like Apple Pay, Google Pay, and PayPal dominate, with banks and fintech firms offering competitive solutions. The COVID-19 pandemic accelerated the adoption of contactless payments, supported by higher transaction limits and enhanced security features. E-commerce growth, real-time payment systems, and consumer demand for convenience further boost the market. However, challenges include cybersecurity concerns and regulatory compliance. The market is poised for innovation, with advancements in blockchain, AI, and mobile commerce shaping its future. According to the latest report by IMARC Group, the Canada mobile wallet and payment market size reached USD 183 Million in 2023. Looking forward, IMARC Group expects the market is projected to exhibit a growth rate (CAGR) of 11.50% during 2024-2032.

Canada Mobile Wallet and Payment Industry Trends and Drivers:

The mobile wallet and payment industry in Canada is undergoing a significant transformation, driven by the growing integration of technology into everyday transactions. As smartphones become ubiquitous and consumers increasingly seek convenience, the adoption of mobile payment solutions has surged across various sectors. The market is witnessing an evolution in the way Canadians manage their finances, moving away from traditional payment methods to embrace the efficiency and security offered by mobile wallets. This shift is supported by advancements in digital technologies, which enhance the user experience and provide seamless integration with other financial services.

One of the key factors propelling the growth of the mobile payment market in Canada is the widespread use of smartphones for purchasing goods and services. The proliferation of mobile devices, coupled with the increasing availability of high-speed internet, has made it easier for consumers to adopt digital payment methods. Businesses are also leveraging these trends, offering enhanced payment platforms that cater to the preferences of tech-savvy customers. Furthermore, innovations such as near-field communication (NFC), biometric authentication, and secure cloud-based solutions have bolstered the reliability and appeal of mobile wallets, fostering greater consumer trust in digital transactions.

The market is also benefiting from strong regulatory support aimed at modernizing the financial ecosystem. Policies that encourage innovation in payment technologies have paved the way for the development of robust and efficient systems. Various industries, including retail, hospitality, transportation, healthcare, and telecommunications, are adopting mobile payment solutions to enhance customer experiences and streamline operations. For instance, retailers are integrating mobile wallets into their checkout systems to reduce transaction times, while the healthcare sector is utilizing these technologies to facilitate cashless billing processes. These applications underscore the versatility of mobile payment solutions, making them indispensable across a range of use cases.

Looking ahead, the mobile wallet and payment market in Canada is poised for sustained growth as technology continues to evolve and consumer preferences shift. The increasing adoption of artificial intelligence and machine learning in payment applications is expected to unlock new opportunities, providing tailored experiences and improving operational efficiency. Additionally, collaboration between financial institutions and tech companies is likely to result in the creation of innovative solutions that address emerging consumer needs. This synergy, coupled with a focus on security and user convenience, positions the Canadian mobile payment market for a promising future.

Download sample copy of the Report: https://www.imarcgroup.com/canada-mobile-wallet-payment-market/requestsample

Canada Mobile Wallet and Payment Industry Segmentation:

The report has segmented the market into the following categories:

Type Insights:

- Proximity

- Remote

Application Insights:

- Retail

- Hospitality and Transportation

- Telecommunication

- Healthcare

- Others

Regional Insights:

- Ontario

- Quebec

- Alberta

- British Columbia

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Canada Mobile Wallet and Payment Market News:

May 2024: Visa unveiled new products and services that aim to revolutionize the card and address the upcoming needs of companies, merchants, and users along with the financial institutions serving them.

August 2023: BMO Commercial Bank launched mobile wallet for virtual cards with MasterCard and Extend four US and Canada users. The app presents new functionality that will provide cardholders the power to present and push virtual cards to their employees’ mobile wallets.

Key highlights of the Report:

- Market Performance (2018-2023)

- Market Outlook (2024-2032)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Ask analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=23981&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.