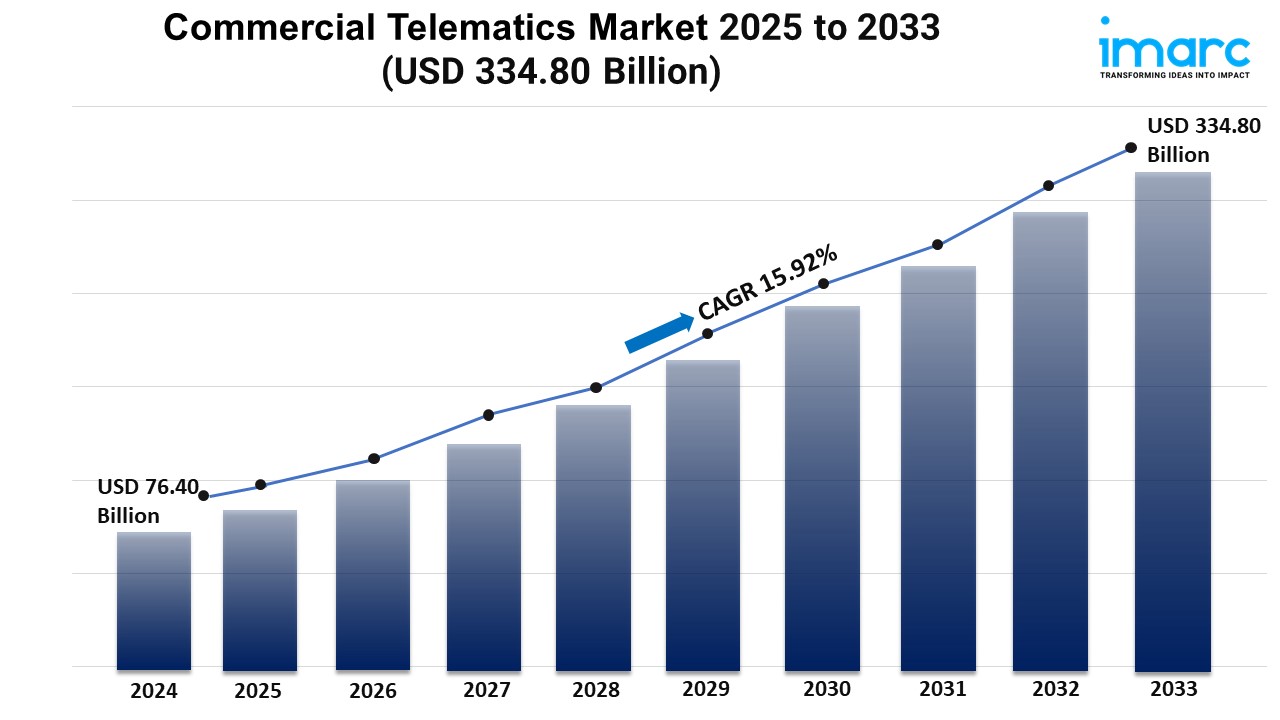

Commercial Telematics Market Trends, Growth, and Demand 2025-2033

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Global Commercial Telematics Industry: Key Statistics and Insights in 2025-2033

Summary:

- The global commercial telematics market size reached USD 76.40 Billion in 2024.

- The market is expected to reach USD 334.80 Billion by 2033, exhibiting a growth rate (CAGR) of 15.92% during 2025-2033.

- North America leads the market, accounting for the largest commercial telematics market share.

- Solution (fleet tracking and monitoring, driver management, insurance telematics, safety and compliance, V2X solutions, and others) accounts for the majority of the market share in the type segment.

- Embedded holds the largest share in the commercial telematics industry.

- Aftermarket remain a dominant segment in the market, driven by the flexible and cost-effective telematics solutions that can be retrofitted into existing vehicles.

- Transportation and logistics represent the leading end use industry segment.

- The increasing focus on fleet management is a primary driver of the commercial telematics market.

- Advancements in connectivity technology and the growing demand for driver safety solutions are reshaping the commercial telematics market.

Industry Trends and Drivers:

- Advancements in connectivity technology:

The development of 4G and 5G networks is ensuring that there are high speed and reliable data transfer rates that enable vehicles to communicate freely with the central systems. Real time data collection and analysis is possible with high speed networks and this in turn enhances the decision making processes in the area of fleet management, asset management and vehicle performance. This is particularly by 5G allowing the use of telematics applications such as predictive maintenance, remote diagnostics and advanced driver assistance systems which need high bandwidth and low latency. The development of connectivity infrastructure is enabling businesses to adopt telematics solutions in order to enhance their operations and make them more data driven, which in the long run leads to cost reduction and improved customer service.

- Increasing focus on fleet management:

Higher fuel prices, pressure to gain competitive advantage and need for automated means to enhance operational efficiency are forcing companies to incorporate telematics solutions in managing their fleets. These systems facilitate measurement of performance characteristics of the vehicles, consumption of fuel as well as understanding of drivers’ behaviors. Telematics allow the fleet managers to time their maintenance more effectively and greatly decrease the chance of costly failures and downtime. Moreover, there is tracking the position of the automobiles in real-time to enable the companies to plan the best routes, minimal or no misuse of the automobiles, and delivery of products in the quickest time possible. The efficiency in gathering data on the location and performance of vehicles also makes it easier for the company to minimize risks of an accident, meet required legal standards and stay safe.

- Growing demand for driver safety solutions:

This paper has identified that organizations are waking up to the fact that their drivers need to be safeguarded and that accidents have to be prevented on the roads. Telematics include solutions such as real-time driver monitoring, identification of fatigue, and other effective in-cab reminder. From speeding, harsh braking and excessive acceleration, risk prone driving behavior can thus be predicted by fleet managers and appropriate modification made. Besides, most telematics programs incorporate facets like collision notifications and lane change indicators that increases driver security. Many companies are reporting increased concern with road safety and the related costs of damage and are seeking to use telematics as an active tool to encourage safer driving and thus reduce the risks of accidents and related costs.

Request PDF Sample for more detailed market insights: https://www.imarcgroup.com/commercial-telematics-market/requestsample

Commercial Telematics Market Report Segmentation:

Breakup By Type:

- Solution

- Fleet Tracking and Monitoring

- Driver Management

- Insurance Telematics

- Safety and Compliance

- V2X Solutions

- Others

- Services

- Professional services

- Managed services

Solution (fleet tracking and monitoring, driver management, insurance telematics, safety and compliance, V2X solutions, and others) exhibits a clear dominance in the market due to the increasing demand for comprehensive telematics systems that integrate data analytics, real-time tracking, and fleet management services.

Breakup By System Type:

- Embedded

- Tethered

- Smartphone Integrated

Embedded represents the largest segment, as it offers enhanced integration, reliability, and security.

Breakup By Provider Type:

- OEM

- Aftermarket

Aftermarket holds the biggest market share owing to the flexible and cost-effective telematics solutions that can be retrofitted into existing vehicles.

Breakup By End Use Industry:

- Transport and Logistics

- Media & Entertainment

- Government and Utilities

- Travel and Tourism

- Construction

- Healthcare

- Others

Transportation and logistics account for the majority of the market share attributed to the high reliance on telematics for optimizing route planning, improving fuel efficiency, and ensuring timely deliveries.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America dominates the market, driven by the early adoption of telematics technology, well-developed infrastructure, and stringent regulatory requirements for fleet management and safety.

Top Commercial Telematics Market Leaders:

The commercial telematics market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies. Some of the key players in the market are:

- AirIQ Inc.

- Bridgestone Corporation

- General Motors Co. (GM)

- Geotab Inc.

- Michelin Group

- MiX Telematics International (Pty) Ltd

- Octo Telematics SpA

- Omnitracs LLC

- Trimble Inc.

- Bell Atlantic Corporation

- Continental AG

Note: If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most changemakers to create a lasting ambitious impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.