Construction Equipment Rental Market Performance: Size, Share, Growth, and Trends

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

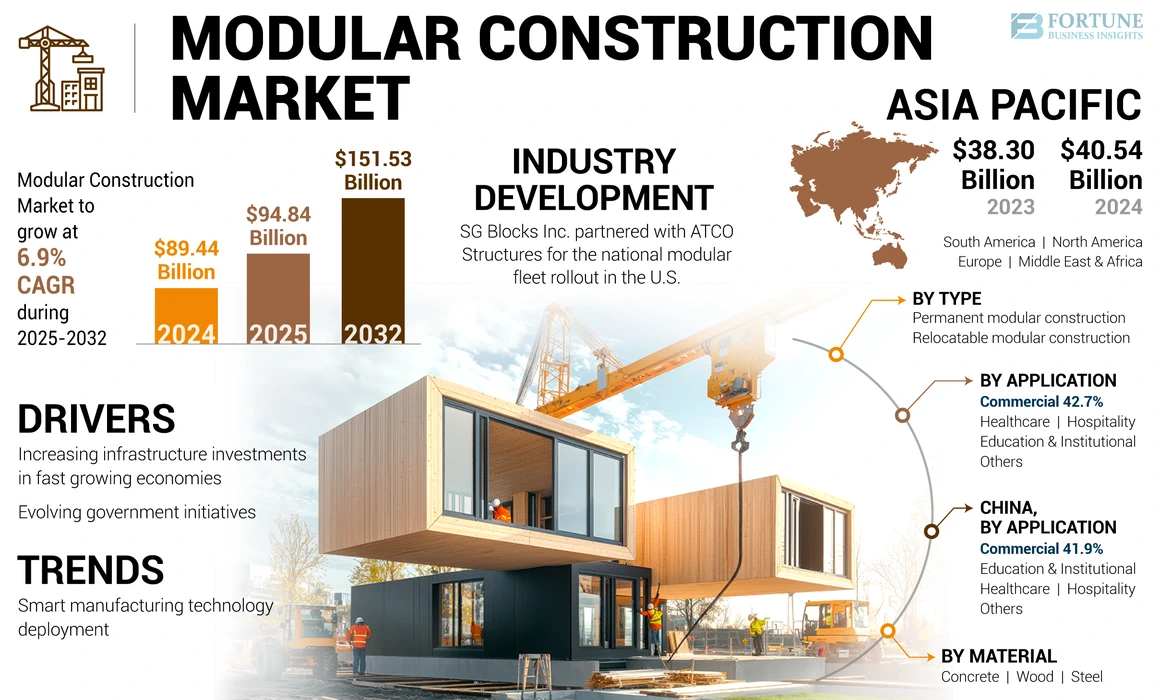

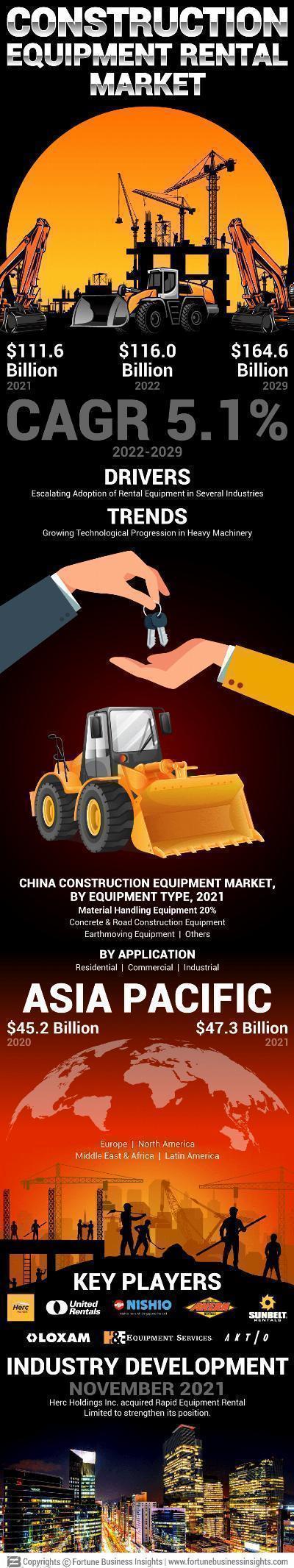

Fortune business insights recently published a detailed market research study focused on the “The construction equipment rental market share Report 2024” delivering key insights and providing a competitive advantage to clients through a detailed report. Construction Equipment Rental Market Size, Share & Industry Analysis, By Equipment Type (Earthmoving Equipment, Material Handling Equipment, Concrete & Road Building Equipment, and Others), By Application (Residential, Commercial, and Industrial), and Regional Forecast, 2022-2029

Get a free sample report pdf| https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/102247

The competitive landscape of the market for construction equipment rental market is determined by assessing the major industry participants, production capacity, production capacity utilization rate, construction equipment rental marketM’s production chain, pricing by each manufacturer and the revenue generated by each manufacturer in the construction equipment rental marketM globally.

Top key players of construction equipment rental market:

- United Rentals, Inc. (U.S.)

- Loxam (France)

- Sunbelt (U.S.)

- Taiyokenki Rental Co., Ltd. (Japan)

- AKTIO Corporation (Japan)

- Herc Rentals Inc. (U.S.)

- Ahern Rentals. (U.S.)

- H&E Equipment Services, Inc. (U.S.)

- Nikken Corporation (Japan)

- Nishio Rent All Co. Ltd. (Japan)

Market atributes:

Report Componant Aspects Forecast Period 2021-2029 Projected market valuve 2021 USD 111.6 billion Forecasted market valuve 2029 USD 164.6 billion Compound Annual Growth Rate 5.1 Get a quote -https://www.fortunebusinessinsights.com/enquiry/get-a-quote/102247

Drivers and restraints:

- Drivers:

- Cost Savings: Renting construction equipment reduces upfront capital expenditures and ongoing maintenance costs for businesses, providing financial flexibility.

- Increased Demand for Infrastructure Projects: The rise in infrastructure and construction projects drives the need for flexible and accessible equipment rental solutions.

- Technological Advancements: Modern rental fleets offer advanced and efficient equipment, including GPS and telematics, enhancing productivity and safety on job sites.

- Short-Term Project Needs: The growing trend of short-term and project-based construction work boosts the demand for rental equipment instead of long-term ownership.

- Maintenance and Support Services: Rental companies often provide comprehensive maintenance and support, ensuring well-maintained equipment and reducing downtime for renters.

- Restraints:

- High Rental Costs: The cumulative cost of renting equipment over time can become significant, potentially impacting the overall project budget.

- Availability and Logistics: Equipment availability and logistical challenges can sometimes cause delays and affect project timelines.

- Maintenance Responsibilities: Renters are often responsible for routine maintenance and ensuring equipment is returned in good condition, which can be burdensome.

- Economic Fluctuations: Economic downturns can lead to reduced construction activity and lower demand for rental equipment, affecting rental companies' revenue.

- Competition and Pricing Pressure: Intense competition among rental companies can lead to pricing pressures and reduced profit margins for equipment rental businesses.

Regional analysis:

- North America (By Equipment Type, By Application, By Country)

- U.S. (By Equipment Type)

- Canada (By Equipment Type)

- Europe (By Equipment Type, By Application, By Country)

- U.K. (By Equipment Type)

- Germany (By Equipment Type)

- France (By Equipment Type)

- Italy (By Equipment Type)

- Rest of Europe

- Asia Pacific (By Equipment Type, By Application, By Country)

- China (By Equipment Type)

- Japan (By Equipment Type)

- India (By Equipment Type)

- Southeast Asia (By Equipment Type)

- Rest of Asia Pacific

- Middle East & Africa (By Equipment Type, By Application, By Country)

- GCC Countries (By Equipment Type)

- South Africa (By Equipment Type)

- Rest of Middle East and Africa

- Latin America (By Equipment Type, By Application, By Country)

- Brazil (By Equipment Type)

- Mexico (By Equipment Type)

- Rest of Latin America

Table of Content :

- Introduction

- Research Scope

- Market Segmentation

- Research Methodology

- Definitions and Assumptions

- Executive Summary

- Market Dynamics

- Market Drivers

- Market Restraints

- Market Opportunities

- Key Insights

- Key Industry Developments – Merger, Acquisitions, and Partnerships

- Porter’s Five Forces Analysis

- SWOT Analysis

- Technological Developments

- Value Chain Analysis

TOC Continued…!

Ask for customizatin|https://www.fortunebusinessinsights.com/enquiry/ask-for-customization/102247

Key industry developments:

About Us:

- November 2021 - Herc Holdings Inc. acquired Rapid Equipment Rental Limited, a Toronto-based rental company.

- June 2020 - H&E Equipment Services Inc., announced the relocation of its Georgetown branch to a Texas-based expanded unit.

- April 2021 - General Finance Corp. and United Rentals inked a definitive agreement for the former’s acquisition by United Rentals. The deal involved a transaction value of USD 996 million.

- February 2020 - Boels took over Cramo PLC to increase its customer base. The move was aimed at becoming one of the major players in the rental market in Europe.

- June 2022 - Sunbelt Rentals announced its partnership with Britishvolt, to support the development of Britishvolt’s first full-scale Cambois-based battery Gigaplant. This long-term deal will also see the companies work closely together to favor the development of battery solutions for power plants and heavy equipment to help decarbonize the construction and equipment rental sector.

Fortune Business Insights is committed to offering a distinctive mix of qualitative and quantitative market research reports to clients around the world. We assist both international and local businesses in enhancing their operations by delivering detailed market insights and the most dependable future trends. Our reports encompass all key market aspects, providing essential insights and forecasts to clients globally.

Email|[email protected]

Key questions are answer in this report:

- What is the market size of construction equipment rental market 2024?

- Who are top key players in this report?

- what are drivers in the construction equipment rental industry?

- what is the future projection of construction equipment rental industry?

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.