Consumer Preferences and the Evolution of US Healthcare Insurance Third-Party Administrator Market

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

United States of America– [13-03-2025]- The Insight Partners is proud to announce its newest market report, "Consumer Preferences and the Evolution of US Healthcare Insurance Third-Party Administrator Market: An In-depth Analysis of the market". The report provides a holistic view of the market and describes the current scenario as well as growth estimates of during the forecast period.

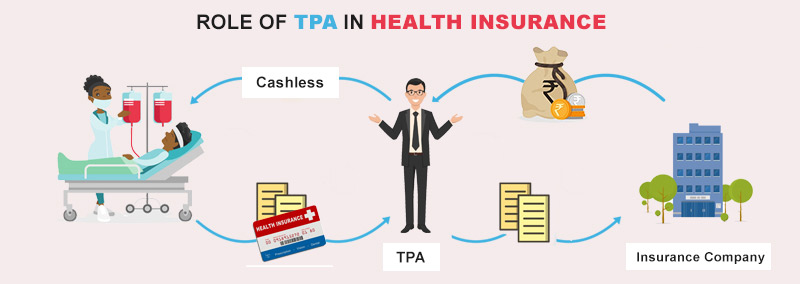

Overview of US Healthcare Insurance Third-Party Administrator Market

There has been some development in the US Healthcare Insurance Third-Party Administrator market, such as growth and decline, shifting dynamics, etc. This report provides insight into the driving forces behind this change: technological advancements, regulatory changes, and changes in consumer preference.

Key findings and insights

Market Size and Growth

• Historical Data: The US Healthcare Insurance Third-Party Administrator market size was valued at US$ 64.92 billion in 2024 and is expected to reach US$ 144.86 billion by 2031. The market is estimated to record a CAGR of 12.1% from 2024 to 2031. The adoption of AI-driven tools and automation is likely to be a key trend in the market.

• Key factors:

1. Cost Containment Pressures: US healthcare costs are notoriously high. TPAs facilitate claims management, provider rate negotiation, and cost-control efforts, making them vital to insurers and self-funded employers.

2. Growing Complexity of Healthcare Regulations: The US healthcare industry is highly regulated. TPAs assist in navigating this regulatory thicket by guaranteeing compliance with regulations such as HIPAA, and dealing with the complexities of claims administration and benefit administration.

US Healthcare Insurance Third-Party Administrator Market Segmentation: -

By Type

• Health Insurance

• Disability Insurance

• Workers Compensation Insurance

By Enterprise Size

• Large Enterprises

• SMEs

Identification of Emerging Trends

• Technological Developments:

1. Artificial Intelligence (AI) and Automation: AI is increasingly being utilized to automate claim processing, detection of fraud, and customer service requests, ensuring greater efficiency and less error.

2. Cloud-Based Platforms: TPAs are more and more using cloud-based platforms to ensure better accessibility of data, strengthen security, and facilitate smooth integration into other healthcare systems.

3. Data Analytics and Business Intelligence: Sophisticated analytics software is being utilized to examine claims data, recognize trends, and deliver insights for cost control and risk evaluation.

• Shifting Consumer Preferences

1. Demand for Digital and Mobile Access: Consumers anticipate easy digital experiences, such as mobile apps and online portals for obtaining claims information, benefit information, and provider directories.

2. Focus on Cost Transparency and Clarity: Consumers desire transparent and easy-to-understand information regarding their healthcare expenditures, such as explanations of benefits, claims administration, and out-of-pocket costs.

3. Desire for Tailored Customer Support: Consumers demand responsive and customized customer service with access to knowledgeable agents who can respond to their individual needs and issues.

• Regulatory Changes

1. HIPAA (Health Insurance Portability and Accountability Act): Constant updates and enforcement of HIPAA rules necessitate TPAs to have robust data privacy and security controls, especially for electronic protected health information (ePHI).

2. ACA (Affordable Care Act) Compliance: Although the future of the ACA is uncertain, TPAs must still deal with its complexities, such as reporting rules, essential health benefits, and market reforms compliance.

Growth Opportunities

1. Growth of Self-Funded Plans: Ongoing growth of self-funded health plans by employers, particularly small to mid-sized enterprises, is one of the main areas of expansion for TPAs.

2. Growing Need for Specialized Solutions: TPAs can leverage clients' demand for specialized solutions such as disease management, wellness initiatives, and analytics, providing higher value to them.

3. Technology innovation and digital change: Spending money on and implementing sophisticated technologies such as AI, telehealth, and cloud systems can increase effectiveness, add to services, and gain new clients.

4. Emphasize cost-reduction solutions: With growing health expenses, TPAs providing impactful cost-reducing approaches like network negotiations and claims processing will be the in-demand entities.

Conclusion

The US Healthcare Insurance Third-Party Administrator Market: Global Industry Trends, Share, Size, Growth, Opportunity, and Forecast 2024-2031 report provides much-needed insight for a company willing to set up its operations in the XXX market. Since an in-depth analysis of competitive dynamics, the environment, and probable growth path are given in the report, a stakeholder can move ahead with fact-based decision-making in favor of market achievements and enhancement of business opportunities.

About The Insight Partners

The Insight Partners is among the leading market research and consulting firms in the world. We take pride in delivering exclusive reports along with sophisticated strategic and tactical insights into the industry. Reports are generated through a combination of primary and secondary research, solely aimed at giving our clientele a knowledge-based insight into the market and domain. This is done to assist clients in making wiser business decisions. A holistic perspective in every study undertaken forms an integral part of our research methodology and makes the report unique and reliable.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.