Cyclopentane Prices, Demand, News, Chart and Forecast

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

- China: 1415 USD/MT

In China, the price of cyclopentane climbed to 1415 USD/MT by June 2023, marking an upward trend in prices throughout the second quarter of 2023.

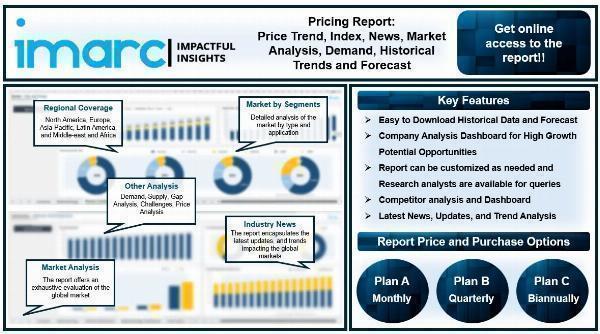

The latest report by IMARC Group, titled " Cyclopentane Pricing Report 2024: Price Trend, Chart, Market Analysis, News, Demand, Historical and Forecast Data," provides a thorough examination of the Cyclopentane Prices. This report delves into the price of Cyclopentane globally, presenting a detailed analysis, along with informative Price Chart. Through comprehensive keyword Price analysis, the report sheds light on the key factors influencing these trend. Additionally, it includes historical data to offer context and depth to the current pricing landscape. The report also explores the Demand, analyzing how it impacts Industry dynamics. To aid in strategic planning, the price forecast section provides insights into price forecast, making this report an invaluable resource for industry stakeholders.

Report Offering:

- Monthly Updates - Annual Subscription

- Quarterly Updates - Annual Subscription

- Biannually Updates - Annual Subscription

The study delves into the factors affecting cyclopentane price variations, including alterations in the cost of raw materials, the balance of supply and demand, geopolitical influences, and sector-specific developments.

The report also incorporates the most recent updates from the market, equipping stakeholders with the latest information on market fluctuations, regulatory modifications, and technological progress. It serves as an exhaustive resource for stakeholders, enhancing strategic planning and forecast capabilities.

Request for the sample copy of the report: https://www.imarcgroup.com/cyclopentane-pricing-report/requestsample

Cyclopentane Price Trend Last Quarter

The market for cyclopentane, a hydrocarbon used primarily as a blowing agent in the production of polyurethane foam, is experiencing significant growth driven by several key factors. Primarily, the shift away from hydrochlorofluorocarbons (HCFCs) and other ozone-depleting chemicals in foam production under international environmental agreements has prompted manufacturers to adopt cyclopentane due to its minimal environmental impact and excellent thermal insulation properties.

This transition is critical in industries such as refrigeration and construction, where energy efficiency is paramount. Additionally, the increasing demand for energy-efficient appliances and the global expansion of the construction sector further boost the demand for cyclopentane-based foams.

These foams are integral to enhancing insulation in buildings and appliances, contributing to global energy conservation efforts and compliance with stricter building codes. Technological advancements in foam production processes and formulations have also enhanced the performance and application range of cyclopentane, making it more attractive to manufacturers. Moreover, the growth of the automotive industry, where cyclopentane foams are used for lightweight and thermal insulation purposes, supports market expansion.

Government policies and subsidies promoting energy efficiency, along with the rising awareness of sustainable manufacturing practices, provide additional momentum to the cyclopentane market, aligning it with broader environmental objectives and market sustainability trends.

Cyclopentane Industry Analysis

The global cyclopentane market size reached US$ 294.6 Million in 2023. By 2032, IMARC Group expects the market to reach US$ 530.3 Million, at a projected CAGR of 6.80% during 2023-2032. In the last quarter of 2023, Cyclopentane prices were influenced by a variety of factors across different global markets, reflecting a complex interplay of supply chain disruptions, fluctuating raw material costs, and regional demand dynamics.

In North America, the initial positive market sentiment due to a supply shortage and heightened international demand, especially from the Indian market during the festive season, supported Cyclopentane prices.

However, this trend reversed as the quarter progressed. Key factors contributing to the decline in prices included a reduction in the cost of essential raw materials such as Benzene and crude oil, which decreased production expenses and energy costs. Additionally, a significant increase in Cyclopentane inventories in North America added downward pressure on prices.

The logistical challenges exacerbated by persistent drought conditions in the Panama Canal and strategic changes in shipping routes due to security concerns in the Red Sea further complicated the market dynamics. These logistical disruptions led to increased tonne-miles and a build-up of inventories at ports, reinforcing a bearish trend in the market.

Similarly, in the APAC region, Cyclopentane prices exhibited volatility, initially marked by subdued demand that later transitioned into a shortage-driven price increase. The shortage in China, combined with robust demand from the Indian refrigerant sector, triggered a rise in prices as the quarter progressed. Moreover, the heightened shipping rates from China, driven by ongoing attacks in the Red Sea and the consequent diversion of trade routes, significantly impacted transportation costs.

The rise in China's export container shipping price index by 2.3 percent month-on-month in December 2023 highlighted the direct impact of increased freight costs on commodity prices, including Cyclopentane. In Europe, the bearish trends were primarily driven by declining demand within the domestic and international refrigerant markets and the downturn in global crude oil prices.

The extended period of reduced demand, combined with geopolitical tensions affecting trade routes in the Red Sea, led to disruptions that impacted the supply chain and inventory levels across the region. These factors collectively influenced Cyclopentane prices, highlighting the dependency of the chemical industry on both macroeconomic indicators and geopolitical stability.

Regional Price Analysis:

- Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand

- Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece

- North America: United States and Canada

- Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru

- Middle East & Africa: Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco

Note: The current country list is selective, detailed insights into additional countries can be obtained for clients upon request.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.