Do Healthcare Providers Benefit from Remote CFO Services?

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

The healthcare industry is complex, highly regulated, and constantly evolving. From navigating insurance reimbursements to managing rising operational costs, healthcare providers face intense financial pressure. For clinics, hospitals, dental practices, and private physicians, maintaining strong financial performance while focusing on patient care is no small task.

One increasingly popular solution is remote CFO services. These services offer expert financial oversight and strategic planning without the cost of a full-time, in-house CFO. But the big question remains—do healthcare providers really benefit from remote CFO services? The answer is a resounding yes. Let’s explore why.

What Are Remote CFO Services?

Remote CFO services involve outsourcing the financial leadership of a business to an experienced Chief Financial Officer who works virtually. These professionals manage everything from budgeting and forecasting to cash flow, compliance, and strategic growth planning.

Unlike hiring a full-time CFO, remote CFOs provide flexible, scalable financial expertise tailored to the business’s size, industry, and goals. In healthcare, this means expert financial guidance from someone who understands both the numbers and the unique regulatory landscape of medical practices.

Why Healthcare Providers Need Financial Leadership

Healthcare organizations often operate on tight margins and deal with delayed reimbursements, unpredictable patient volumes, and rising costs. Many providers depend on internal accountants or practice managers to “handle the books,” but this is rarely enough to drive long-term financial success.

Here’s where a remote CFO adds value:

- They go beyond day-to-day bookkeeping to offer financial strategy.

- They provide accurate forecasting and performance tracking.

- They ensure compliance with HIPAA, tax regulations, and healthcare billing standards.

- They help healthcare providers make informed decisions about expansion, hiring, and equipment investments.

Key Benefits of Remote CFO Services for Healthcare Providers

1. Improved Financial Visibility

Remote CFOs provide healthcare providers with dashboards and regular reports that give real-time visibility into revenues, expenses, and profit margins. This level of transparency helps providers understand where their money is going—and how to make it work harder.

They can track:

- Revenue by service line

- Collection rates

- Profitability per provider

- Operating expenses over time

With better visibility, practices can make data-driven decisions rather than relying on guesswork.

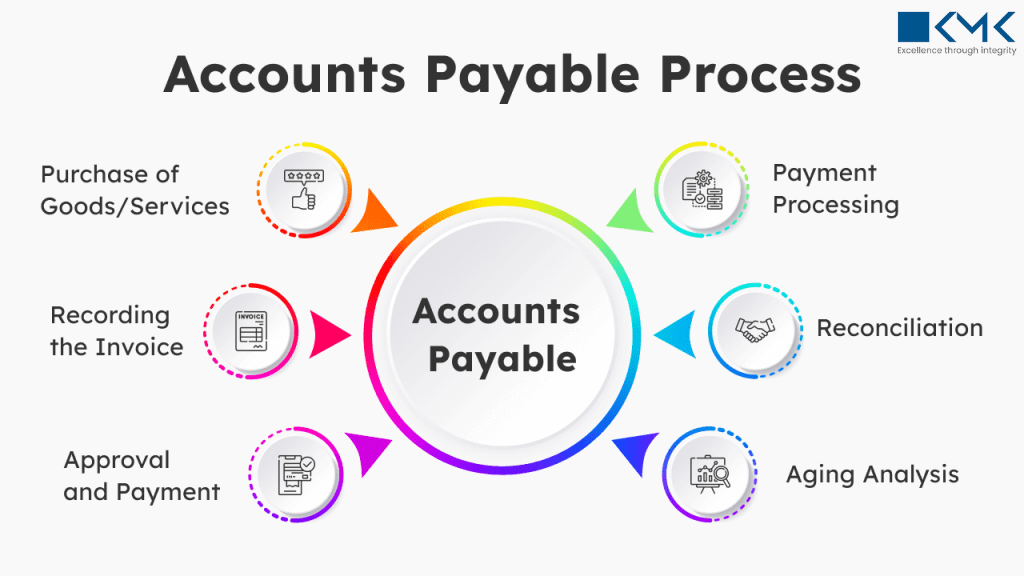

2. Cash Flow Management

Unpredictable cash flow is a common challenge in healthcare, especially with delayed insurance reimbursements and fluctuating patient volumes. A remote CFO helps manage inflows and outflows to ensure the organization always has enough cash on hand to operate smoothly.

This includes:

- Cash flow forecasting

- Billing process optimization

- Accounts receivable analysis

- Expense management strategies

By tightening up collections and monitoring cash closely, remote CFOs help avoid shortfalls and keep the practice financially healthy.

3. Regulatory Compliance and Audit Readiness

Healthcare providers must comply with numerous financial and privacy regulations, including HIPAA, IRS standards, and local tax laws. A remote CFO ensures that the financial side of the practice meets these standards.

They assist with:

- Financial reporting accuracy

- Tax planning and filings

- Internal controls to prevent fraud

- Preparation for audits or inspections

This proactive approach helps avoid costly penalties and builds trust with stakeholders, including patients, staff, and investors.

4. Strategic Growth Planning

Whether you’re planning to open a second location, invest in new medical equipment, or hire additional staff, a remote CFO can guide you through the financial aspects of growth.

They help assess:

- Whether expansion is financially viable

- ROI on major investments

- Staffing cost implications

- Lease vs buy decisions for equipment

Remote CFOs act as strategic advisors, helping you grow responsibly without putting your practice at financial risk.

5. Cost Control and Profitability Optimization

Rising labor costs, technology upgrades, and equipment maintenance can erode a practice’s profitability. A remote CFO reviews every line of spending to find opportunities to reduce costs and improve margins.

They may:

- Negotiate vendor contracts

- Identify inefficient spending

- Recommend automation tools

- Benchmark costs against industry norms

This focus on cost control helps ensure every dollar spent contributes to long-term sustainability.

6. Scalable and Affordable Expertise

Hiring a full-time CFO can cost upwards of $150,000 per year—something many healthcare practices simply can’t afford. Remote CFO services offer the same level of expertise at a fraction of the cost.

You get:

- Executive-level insight without executive-level salary

- Flexible pricing models (hourly, monthly, or project-based)

- The ability to scale services up or down as needed

This affordability makes strategic financial leadership accessible to solo practitioners and multi-location practices alike.

7. Integration with Practice Management Tools

Today’s remote CFOs are tech-savvy. They work with your EHR (Electronic Health Record) and practice management software to streamline reporting, reconcile data, and ensure financial metrics align with patient operations.

Whether you use Kareo, AdvancedMD, Athenahealth, or a custom platform, a remote CFO can help extract meaningful financial insights from your systems.

Final Thoughts

So, do healthcare providers benefit from remote CFO services? Absolutely. From improved cash flow and financial clarity to long-term strategic planning and compliance, remote CFOs help providers run stronger, smarter, and more sustainable practices.

In 2025 and beyond, healthcare organizations can no longer afford to operate without strategic financial leadership. But that doesn’t mean hiring a full-time CFO is the only option. Remote CFO services offer the flexibility, affordability, and expertise today’s providers need to thrive in an ever-changing healthcare environment.

If your medical practice is growing—or facing financial challenges—it may be time to explore how remote CFO services can help you manage money more effectively, stay compliant, and focus on what matters most: delivering excellent patient care.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.