Does a High Claim Settlement Ratio Guarantee a Smooth Claim Process?

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

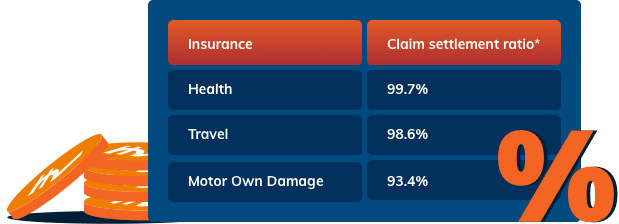

When evaluating health insurance options, the claim settlement ratio in health insurance often emerges as a pivotal metric. Representing the percentage of claims an insurer settles annually, it is widely regarded as a barometer of reliability. For those considering a health insurance policy for family or personal accident insurance, a high ratio, for example above 90%, can inspire confidence. However, does this figure alone ensure a seamless claim process?

In this article, we’ll examine the relationship between a high claim settlement ratio in health insurance and the actual experience of filing a claim, exploring whether it truly guarantees efficiency and ease for policyholders seeking health insurance.

Defining the Claim Settlement Ratio

The claim settlement ratio in health insurance quantifies an insurer’s performance in settling claims. It is calculated as follows:

CSR = (Number of Claims Settled ÷ Total Claims Received) × 100

For example, an insurer receiving 1,000 claims and settling 980 achieves a claim settlement ratio in health insurance of 98%. The Insurance Regulatory and Development Authority of India (IRDAI) mandates annual disclosure of this data, providing transparency for those assessing options such as personal accident insurance or a health insurance policy for family.

The Appeal of a High Claim Settlement Ratio

A high claim settlement ratio in health insurance naturally attracts attention, suggesting dependability. Here are a few of the benefits of a high CSR:

Perceived Reliability

A ratio exceeding 90%, indicates that an insurer honours most of the claims. This is particularly reassuring for a health insurance policy for family, where multiple members depend on coverage, or even personal accident insurance, where swift payouts are critical post-incident.

Market Confidence

Insurers with elevated ratios often leverage this in marketing, fostering trust. Policyholders assume that a high claim settlement ratio in health insurance translates to fewer rejections, an appealing prospect for families or individuals seeking personal accident insurance.

Benchmarking Tool

Comparing ratios across providers aids decision-making. A strong figure suggests an insurer’s capacity to manage claims, a key consideration when securing a health insurance policy for family.

Limitations of Relying Solely on CSR

Despite its prominence, a high claim settlement ratio in health insurance does not fully assure a smooth claim process. Several underlying factors reveal its limitations:

Processing Speed

A 95% ratio reflects settled claims but not the time taken. An insurer might approve most claims yet delay cashless authorisations by weeks, disrupting urgent care. Conversely, a slightly lower ratio with rapid processing can be better for accident insurance needs.

Claim Complexity

High ratios may stem from straightforward claims, for example minor treatments, rather than complex cases like critical illnesses. If complex claims face delays or denials, the ratio masks these challenges.

Volume Variability

A 98% claim settlement ratio in health insurance from 200 claims differs significantly from one based on 20,000. Smaller volumes may inflate ratios without proving scalability, a critical factor for personal accident insurance during widespread incidents.

Factors Influencing the Claim Process Beyond CSR

A smooth claim experience is often influenced by factors beyond the claim settlement ratio, such as:

Policy Terms and Conditions

Exclusions, such as pre-existing conditions or experimental treatments, can lead to rejections despite a stellar claim settlement ratio in health insurance. Understanding these terms is vital for both personal accident insurance and family plans.

Network Hospital Coordination

Cashless claims depend on hospital-insurer synergy. A robust ratio means little if network hospitals, essential for a health insurance policy for family, face payment disputes or slow pre-authorisations, delaying treatment.

Customer Support Quality

Efficient support can expedite claims, yet a high claim settlement ratio in health insurance doesn’t guarantee responsive helplines or clear guidance, impacting personal accident insurance claims during emergencies.

How to Assess Beyond the Ratio?

To ensure a seamless claim process for a health insurance policy, consider these steps alongside the claim settlement ratio in health insurance:

Review Processing Times

Investigate average claim approval durations, some insurers target under 30 minutes for pre-authorisations, per their claims process.

Examine Network Strength

A broad, reliable hospital network enhances claim efficiency, crucial for both personal accident insurance and family plans.

Study Customer Feedback

IRDAI data (2023-24 report) provides ratios, but social media platforms reveal policyholder experiences such as delays, rejections, or support quality and offer a broader picture.

Look Beyond the Numbers

A high claim settlement ratio in health insurance offers a reassuring glimpse of an insurer’s reliability, yet it falls short of guaranteeing a smooth claim process. Factors such as speed, network efficiency, and support quality shape the real-world experience for a health insurance policy. Niva Bupa exemplifies this balance, pairing an impressive 90.02% ratio (IRDAI 2023-24) with a streamlined claims process. With over 10,000 network hospitals and plans such as the Heartbeat Family Floater, Niva Bupa ensures efficiency and trust.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.