EPFO Login, UAN, Passbook & Online Claim

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

The Employees’ Provident Fund Organisation (EPFO) is a statutory body under the Ministry of Labour and Employment, Government of India, established to administer the Employees’ Provident Fund (EPF), Pension Scheme, and Insurance Scheme for employees in the organized sector. The EPFO login portal is a crucial digital interface that allows employees, employers, and pensioners to access various services related to their provident fund accounts, check balances, download passbooks, file claims, and manage other related activities. This article provides a comprehensive overview of the EPFO login process, its features, and its significance in ensuring financial security for Indian workers.

What is the EPFO Login Portal?

The EPFO login portal, accessible through the official website (www.epfindia.gov.in) or the Unified Member Portal (unifiedportal-mem.epfindia.gov.in), is a user-friendly platform designed to streamline access to provident fund services. It caters to three primary user groups: employees, employers, and pensioners. Employees can track their PF contributions, check balances, and initiate withdrawals, while employers use the portal to manage employee PF accounts, remit contributions, and generate reports. Pensioners can access pension-related information and submit life certificates.

Importance of EPFO Login

The EPFO login portal is pivotal in promoting transparency and accessibility in the management of provident fund accounts. It eliminates the need for physical visits to EPFO offices, enabling users to access services anytime, anywhere. With over 6 crore active members and 7 lakh employers registered, the portal handles millions of transactions monthly, making it a cornerstone of India’s social security framework. The digitization of services through the portal aligns with the government’s Digital India initiative, ensuring efficiency and convenience.

How to Access the EPFO Login Portal

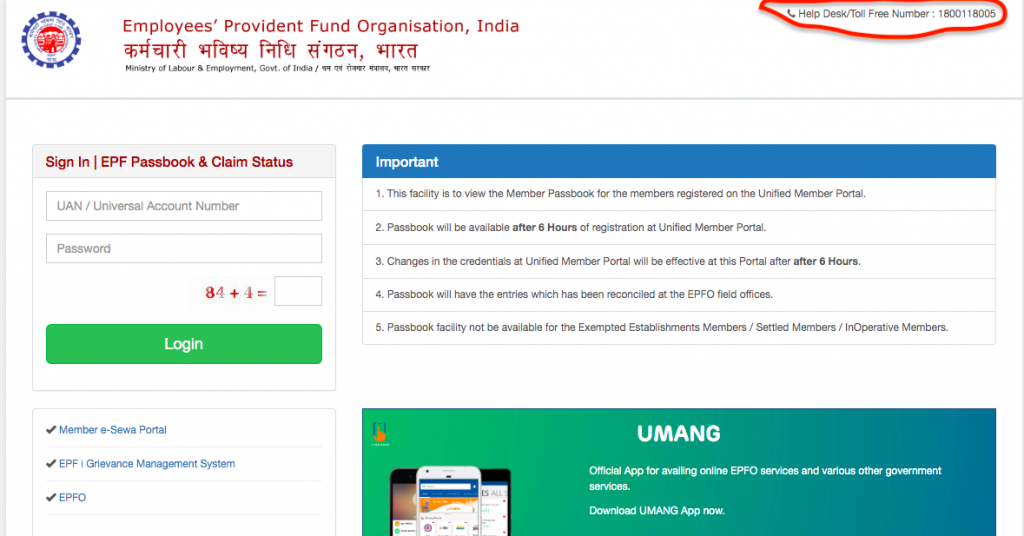

To log in to the EPFO portal, users need a Universal Account Number (UAN), a 12-digit unique identifier assigned to each employee by the EPFO. Here’s a step-by-step guide to accessing the portal:

- Visit the Official Portal: Open a web browser and navigate to the Unified Member Portal (unifiedportal-mem.epfindia.gov.in) or the EPFO homepage (www.epfindia.gov.in).

- Locate the Login Section: On the homepage, find the “For Employees” section and click on “Member UAN/Online Service.”

- Enter Credentials: Input your UAN, password, and the CAPTCHA code displayed on the screen.

- Authenticate with OTP: If Aadhaar-linked authentication is enabled, an OTP will be sent to your registered mobile number for verification.

- Access Dashboard**: Once authenticated, you’ll be directed to the member dashboard, where you can access various services.

Prerequisites for EPFO Login

Before logging in, ensure the following:

- - Activated UAN: The UAN must be activated by the employee through the portal or the UMANG app using their Aadhaar, PAN, or bank details.

- - Linked Aadhaar: Your Aadhaar must be linked to your UAN and verified by your employer.

- - Registered Mobile Number: The mobile number linked to your Aadhaar must be active to receive OTPs.

- - Password: If you’ve forgotten your password, use the “Forgot Password” option to reset it via OTP.

Key Features of the EPFO Login Portal

The EPFO login portal offers a range of services, including:

- - View Passbook: Employees can download their PF passbook, which details contributions, interest earned, and account balance.

- - Online Claims: Users can file claims for PF withdrawal, pension, or insurance benefits directly through the portal.

- - Track Claim Status: Real-time updates on the status of submitted claims are available.

- - Update KYC: Employees can update their Know Your Customer (KYC) details, such as Aadhaar, PAN, and bank account information.

- - Transfer PF Account: The portal allows seamless transfer of PF accounts when switching jobs.

- - e-Nomination: Employees can file e-nominations to designate beneficiaries for their PF and pension accounts.

- - Grievance Redressal: Users can lodge complaints or queries through the EPFiGMS (EPF Grievance Management System) integrated into the portal.

Common Issues and Troubleshooting

While the EPFO login portal is robust, users may encounter issues such as:

- -Invalid UAN/Password: Ensure the correct UAN and password are entered. Use the “Forgot Password” option if needed.

- - OTP Not Received: Verify that the registered mobile number is active and linked to Aadhaar.

- - KYC Mismatch: Ensure KYC details (Aadhaar, PAN, bank account) are updated and verified by the employer.

- - Portal Downtime: During maintenance, the portal may be temporarily unavailable. Try again later.

For persistent issues, users can contact the EPFO helpline at 1800-118-005 or email [email protected].

Security and Best Practices

To ensure a secure login experience:

- - Never share your UAN, password, or OTP with anyone.

- - Log out after each session, especially on shared devices.

- - Regularly update your password and KYC details.

- - Beware of phishing websites mimicking the EPFO portal; always use the official website.

Conclusion

The EPFO login portal is a vital tool for millions of Indian workers, employers, and pensioners, offering seamless access to provident fund services. By enabling users to manage their PF accounts, file claims, and track contributions online, it enhances convenience and transparency. Employees are encouraged to activate their UAN, link their Aadhaar, and familiarize themselves with the portal’s features to maximize its benefits. As the EPFO continues to digitize its services, the login portal remains a cornerstone of India’s social security ecosystem, ensuring financial stability for the workforce.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.