Europe Foreign Exchange Market Report 2025-2033, Industry Growth, Share, Size, Demand and Forecast

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

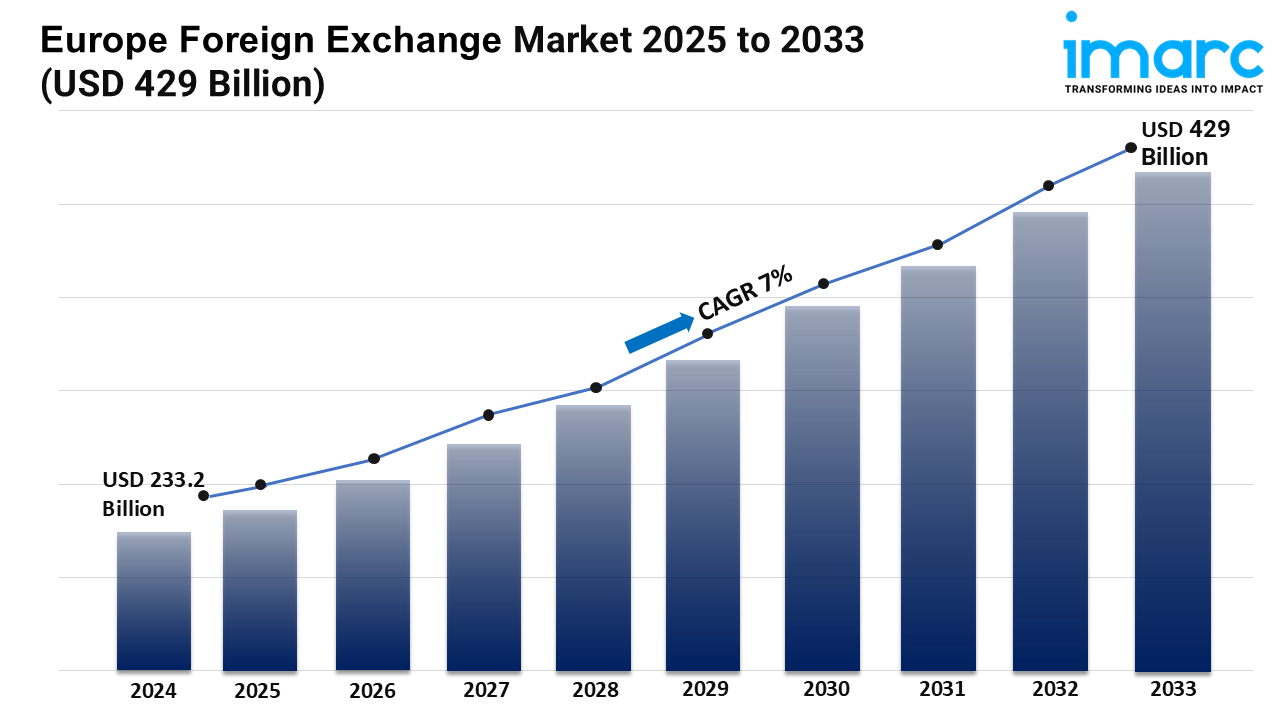

Europe Foreign Exchange Market Overview

Market Size in 2024: USD 233.2 Billion

Market Forecast in 2033: USD 429 Billion

Market Growth Rate: 7% (2025-2033)

According to the latest report by IMARC Group, the Europe foreign exchange market size was valued at USD 233.2 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 429 Billion by 2033, exhibiting a CAGR of 7% from 2025-2033.

Europe Foreign Exchange Industry Trends and Drivers:

Driven by a convergence of macroeconomic modernization, financial sector transformation, and increasing world commerce, the European foreign exchange market is growing at an accelerating pace. Financial institutions and corporate organizations are increasingly using FX products like currency swaps, FX options, and straightforward forward contracts to hedge risk and control currency exposure in response to increasing cross-border activity. While non-financial companies are using forex solutions to control transactional flows in turbulent economic circumstances, reporting dealers are instrumental in maintaining liquidity and enable real-time pricing. With algorithmic trading platforms and mobile-enabled services simplifying foreign currency transactions across corporate and retail sectors, digitization is changing market access and execution speed. Higher consumer incomes cross-currency and demand for foreign travel are fueling cross-currency consumer services at the same time, therefore indirectly driving retail foreign currency demand. Further bolstering investor confidence, transparency, and wider use of FX services among SMEs and fintech platforms is regulatory coordination inside the EU. Together, these changes are turning the FX industry into a more integrated and technically driven financial network.

Regional economies in Europe are showing different dynamics in the foreign currency market depending on institutional structure, worldwide exposure, and financial sophistication. With its strong financial institutions, varied portfolios, and deep-rooted trading culture, Western Europe especially the United Kingdom, Germany, and France is becoming a center of currency trading. These nations are creating electronic trading systems and using artificial intelligence to examine market patterns and carry out high-frequency transactions more precisely. By giving fintech integration and digital payment innovation top priority, Northern Europe is boosting real-time currency conversion speed and efficiency. With countries like Italy and Spain, Southern Europe's FX demand from tourism, remittances, and foreign commercial activity is growing, therefore spurring regional banks to enlarge their foreign exchange services. Eastern European economies are progressively improving their foreign currency systems, profiting from economic liberalization, foreign investment inflows, and growing trade with Western European partners. Together, these regional contributions are strengthening the momentum of Europe's FX market and placing it as a main engine of world financial connection and strategically managed currency risk.

Market players in the Europe foreign exchange landscape are strategically leveraging technical innovations, changing legislative frameworks, and cross-sectoral cooperation to offer adaptable and expandable solutions. To guarantee quicker settlements and real-time liquidity access, FX service providers are putting money in sophisticated analytics, API-driven systems, and blockchain connections. In the meantime, central banks and regulatory bodies are creating safe and clear trading environments that allow for greater institutional participation and lower settlement risk. With easy interfaces and customized portfolio tools, financial technology firms are improving user experience and so making forex trading more available to non-institutional customers. Furthermore speeding innovation in automated hedging, algorithmic execution, and multi-currency transaction management are strategic partnerships between traditional banks and fintech startups. Individual investors and SMEs are the focus of educational programs raising knowledge of hedging advantages and fueling demand for bespoke FX services. The Europe foreign exchange industry is becoming a forward-looking field defined by resilience, speed, and smart financial orchestration as these cooperative and technology-enabled changes keep altering the market.

Download sample copy of the Report: https://www.imarcgroup.com/europe-foreign-exchange-market/requestsample

Europe Foreign Exchange Industry Segmentation:

The report has segmented the market into the following categories:

Counterparty Insights:

- Reporting Dealers

- Other Financial Institutions

- Non-financial Customers

Type Insights:

- Currency Swap

- Outright Forward and FX Swaps

- FX Options

Country Insights:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Ask analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=9820&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.