FD Rate Cut and Loan Rate Link: What SBI's Move Means for Your EMIs

India's largest public sector bank, the State Bank of India (SBI), recently announced a cut in Fixed Deposit (FD) interest rates. While this move directly affects savers, it also holds deeper implications for borrowers - especially those with loans linked to floating interest rates. Here's a breakdown of what the FD rate cut means and how it links to loan interest rates, ultimately influencing your EMIs.

Why SBI Slashed FD Rates

SBI recently reduced its Fixed Deposit (FD) rates by up to 25 basis points across various tenures, marking the first rate cut in several months. The move reflects the bank’s response to easing inflation and a surplus liquidity environment. Banks generally reduce deposit rates when they already have sufficient funds and don’t need to aggressively attract more deposits. Lower cost of funds allows them to recalibrate lending rates as well.

Key FD Rate Changes:

The rate for 1-year FDs was cut by 25 basis points.

Senior citizen FD rates also saw a marginal decrease.

Though this may disappoint depositors, it's part of a broader economic signal that interest rates are either stabilizing or poised to fall.

The Link Between FD Rates and Loan Rates

Bank lending is primarily funded through deposits. When banks pay less on FDs, their cost of funds reduces. This gives them the flexibility to lower lending rates — especially for loans linked to external benchmarks like the RBI Repo Rate or SBI’s own Marginal Cost of Funds Based Lending Rate (MCLR).

In simple terms:

Lower FD Rates → Lower Cost of Funds for Banks → Potential Drop in Lending Rates

This is particularly true in a floating rate regime, where lending rates are frequently reset based on cost-of-fund metrics or repo rate movements.

How It Affects Your EMIs

SBI’s move may not immediately cut your EMIs, but it creates a pathway for lower interest rates, especially if you have:

Home Loans or Auto Loans linked to EBLR (External Benchmark Lending Rate)

These loans are often tied to the RBI’s repo rate, and if banks start reducing their spreads or the repo rate gets cut in the future, your EMI could drop.

Loans Linked to MCLR

If the bank’s cost of funds continues to decline, it may lead to a lower MCLR, which will benefit borrowers on MCLR-linked loans during the next reset cycle.

Example Impact:

Suppose you have a ₹30 lakh home loan with a 9% interest rate. If SBI cuts lending rates by even 25 basis points (0.25%), your monthly EMI could reduce by around ₹500–₹600, and you may save over ₹1.5 lakh in total interest over a 20-year term.

What Borrowers Should Watch For

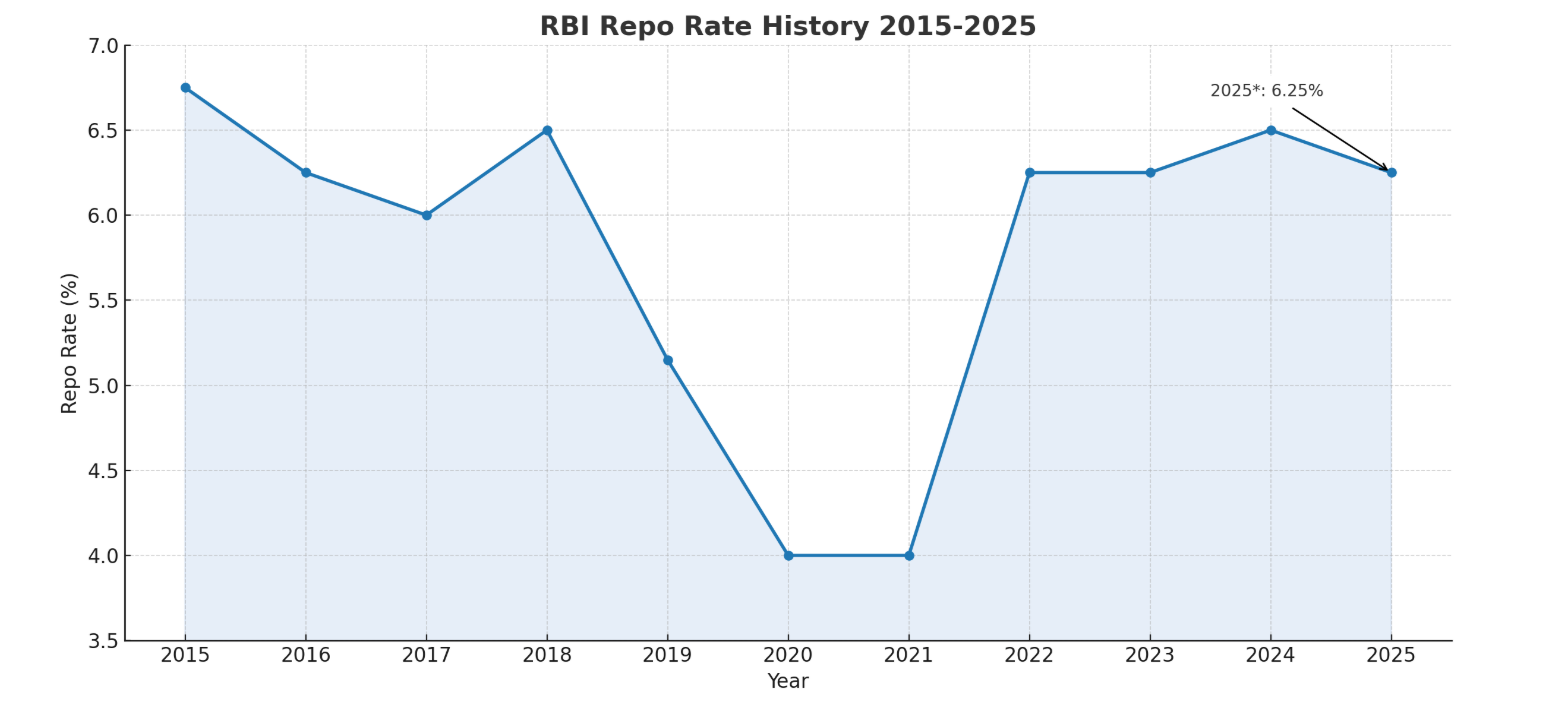

Upcoming RBI Policy Announcements:

If the central bank cuts the repo rate due to softening inflation, SBI and other banks may follow suit in reducing lending rates.

Your Loan Type:

Check whether your loan is linked to EBLR, MCLR, or RLLR (Repo Linked Lending Rate). The faster the transmission of rate cuts in your loan type, the sooner your EMIs could reduce.

Reset Frequency:

Loans linked to external benchmarks adjust rates more frequently than MCLR-linked loans, which typically reset every 6 or 12 months.

What Should Savers Do?

While borrowers may find relief, savers now face lower returns on their fixed deposits. If you depend heavily on FD interest for income, consider diversifying:

Short-term debt mutual funds

Tax-free bonds (for longer-term investors)

Recurring deposits with better rates in smaller banks

Conclusion

SBI’s FD rate cut is not just a signal for depositors — it’s a precursor to potential lending rate adjustments. While the direct impact on your EMI may not be immediate, the domino effect through cost of funds and benchmark-linked rates could soon work in borrowers’ favor. Stay updated with your loan reset cycle and keep an eye on RBI’s monetary policy to make informed financial decisions.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.