Fluid Loss Additives Market Size, Share, Growth and Forecast 2025-2033

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Summary:

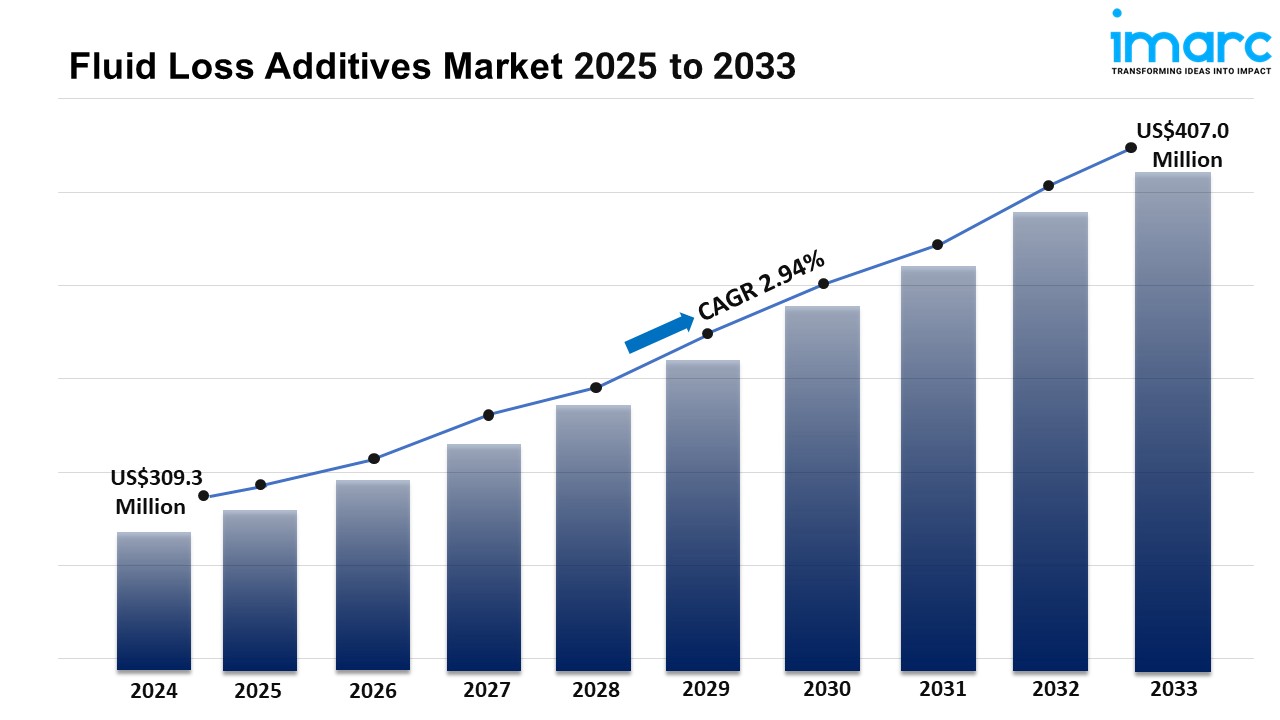

• The global fluid loss additives market size reached USD 309.3 Million in 2024.

• The market is expected to reach USD 407.0 Million by 2033, exhibiting a growth rate (CAGR) of 2.94% during 2025-2033.

• North America leads the market, accounting for the largest fluid loss additives market share.

• Synthetically modified accounts for the majority of the market share as it offers various features like stability and fluid loss prevention.

• Drilling fluids dominate the market segment owing to their ability to lubricate drill bits and maintain wellbore stability.

• The growing instances of exploration activities for oil and gas is a primary driver of the fluid loss additives market.

• The fluid loss additives market growth and forecast highlight a significant rise due to various innovations in drilling technologies.

Industry Trends and Drivers:

Increasing Demand for Oil and Gas Exploration:

One of the primary factors driving the fluid loss additives market share is the expanding demand for oil and gas exploration activities, particularly in regions with challenging geological formations. In drilling operations, fluid loss additives play a crucial role in controlling the loss of drilling fluid to the surrounding formations, preventing damage to the wellbore, and improving overall drilling efficiency. As the global demand for energy continues to rise, exploration activities are shifting to more complex and deeper reservoirs, such as offshore fields, shale gas, and tight oil formations. These reservoirs often require specialized drilling fluids, including fluid loss additives, to maintain well integrity and optimize drilling performance. The growing number of drilling rigs and exploration projects is also directly contributing to the demand for fluid loss additives.

Advances in Drilling Technologies:

The continuous advancement in drilling technologies is a significant factor shaping the fluid loss additives market trends. Technological innovations in drilling methods, such as horizontal and directional drilling, have enabled oil and gas companies to access reserves that were previously difficult or uneconomical to exploit. These advanced drilling techniques often encounter complex and unstable formations that require high-performance drilling fluids, including fluid loss additives, to prevent fluid loss and wellbore instability. The development of new-generation fluid loss additives that offer improved performance, such as higher temperature resistance, better dispersion properties, and compatibility with various types of drilling fluids, is a growing trend in the market. Additionally, the increased use of environment-friendly and non-toxic fluid loss additives is gaining traction as the industry adopts more sustainable practices. As drilling operations become more sophisticated and environmentally conscious, the fluid loss additives demand is expected to rise further. Moreover, with the growing need for faster and efficient drilling, fluid loss additives that improve the rate of penetration (ROP) and reduce operational downtime are in high demand.

Expanding Applications in Construction and Geothermal Energy

The expanding applications of fluid loss additives in industries, such as construction and geothermal energy, are contributing significantly to the fluid loss additives market size. In the construction industry, fluid loss additives are used in the preparation of cement slurries for wellbore stability during grouting and piling operations. The ability to control fluid loss is essential in ensuring the stability of structures like foundation piles and deep shafts, where the risk of losing fluid into porous formations is high. Similarly, in geothermal energy projects, where drilling into hot, high-pressure reservoirs is common, fluid loss additives are crucial for maintaining wellbore integrity and improving drilling efficiency. Apart from this, the increased focus on renewable energy sources, particularly geothermal energy, is driving the demand for fluid loss additives in this sector.

Request Sample For PDF Report: https://www.imarcgroup.com/fluid-loss-additives-market/requestsample

Report Segmentation:

The report has segmented the market into the following categories:

Breakup by Type:

Synthetically Modified

Natural Additives

Synthetic Additives

Synthetically modified accounts for the majority of market share, as it maintains stability and prevents fluid loss, while also reducing non-productive time and minimizing the need for costly remedial measures.

Breakup by Application:

Drilling Fluids

Cement Slurries

Drilling fluids hold the largest segment as they help control well pressure, lubricate the drill bit, remove cuttings from the wellbore, and maintain wellbore stability.

Market Breakup by Region:

North America (United States, Canada)

Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

Latin America (Brazil, Mexico, Others)

Middle East and Africa

North America leads the market due to the presence of vast shale reserves and the rising unconventional drilling activities such as hydraulic fracturing in the region.

Competitive Landscape with Key Player:

BASF SE

Clariant AG

Global Drilling Fluids and Chemicals Limited

Halliburton Company

Kemira OYJ

Newpark Resources Inc.

Nouryon

Schlumberger Limited

Sepcor Inc.

Solvay S.A

Tytan Organics Pvt. Ltd

Note: If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.