Fractional Tokens Explained: Unlocking Real-World Assets on Blockchain

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

In the rapidly evolving world of blockchain, one of the most practical and disruptive innovations emerging is the concept of fractional tokens. As more industries begin to understand the underlying value of tokenization, there’s growing interest in how blockchain can make large, illiquid real-world assets more accessible. That’s where fractional tokens step in—offering a bridge between traditional markets and decentralized digital platforms.

✍️ If you’ve ever wondered how blockchain ensures trust and security in digital transactions, check out our in-depth resource on blockchain security and learn why decentralization matters for businesses and consumers.

The concept isn’t new, but its application is beginning to gain serious traction. Simply put, fractional tokens allow an asset to be split into smaller units, enabling more people to invest in something that would otherwise be out of reach. Whether it’s a luxury apartment, a Picasso painting, or a rare bottle of vintage wine, tokenizing these assets and dividing ownership via the blockchain opens up enormous possibilities for global accessibility and liquidity.

What Are Fractional Tokens?

Fractional tokens are digital representations of a portion of ownership in a real-world or digital asset. Instead of buying a whole property or an entire high-value collectible, investors can purchase a fraction of it using blockchain-based tokens. Each token represents a share of the asset and can be traded, transferred, or stored, just like any other digital asset.

Let’s say a $1 million property is tokenized into 1,000,000 tokens. Each token represents $1 worth of ownership. If someone buys 10,000 tokens, they now own 1% of the property. Ownership is secured and tracked using smart contracts on a blockchain, ensuring transparency and trust in the process.

This process involves crypto token development, smart contract engineering, legal structuring, and platform integration. Many organizations turn to a token development company to handle the technical and legal complexities of launching fractional tokens, especially when real-world compliance is involved.

The Need for Fractional Ownership

Traditionally, investing in high-value assets has been the domain of the wealthy. Real estate, fine art, and exotic cars require large upfront capital, limiting access to a narrow slice of the population. This exclusivity has long created a barrier to entry for regular investors. Even crowdfunding models have their limitations due to centralized management, lack of liquidity, and limited transparency.

Fractional tokens change the equation. By enabling divisible ownership and decentralized control, blockchain allows these assets to be split into affordable units, lowering the cost of entry for new investors. People from different parts of the world can now collectively invest in a single asset, creating an inclusive model that was not previously feasible.

Additionally, fractional ownership improves liquidity in traditionally illiquid markets. For example, selling a portion of a building via tokens is significantly easier and faster than waiting to sell the entire property. Investors can enter and exit positions with more flexibility, which makes assets like commercial real estate or fine art far more dynamic from an investment perspective.

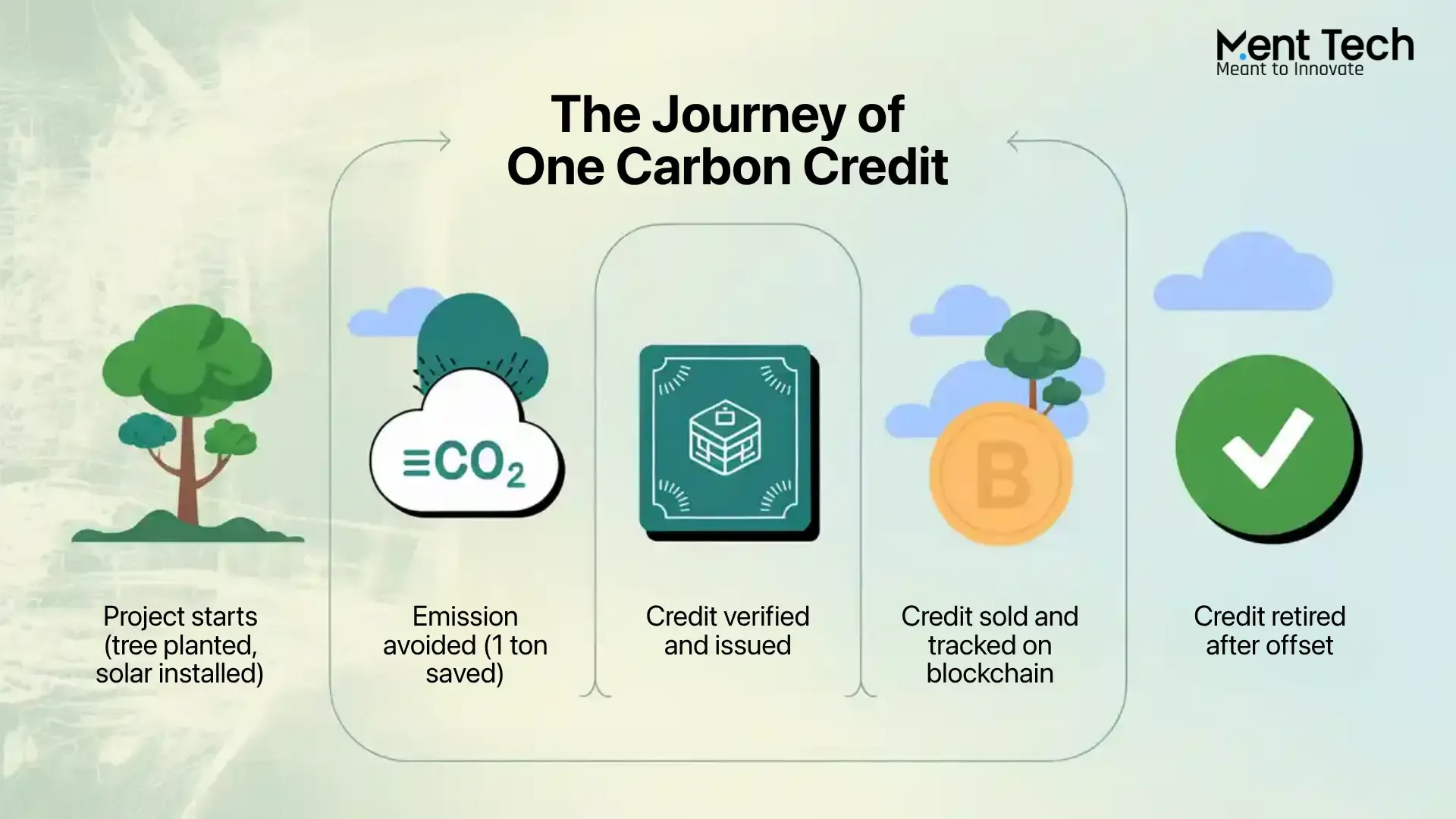

How It Works: The Tokenization Process

The tokenization of real-world assets involves several steps. It typically starts with asset evaluation and legal compliance. The owner or issuer needs to assess the value of the asset and determine the legal framework for splitting ownership.

Next comes the crypto token development phase. Here, a smart contract is created to define the rules of the token: how many will be issued, how they can be transferred, what rights token holders have, and how revenue (like rental income or sale proceeds) will be distributed. The token can be built on popular standards like ERC-20 (Ethereum), BEP-20 (Binance Smart Chain), or newer alternatives depending on network efficiency, cost, and scalability requirements.

Once the token is ready, it’s issued to investors through a secure platform—either via a decentralized application (dApp) or a regulated platform. Smart contracts handle ownership records, distributions, and compliance checks. This eliminates the need for intermediaries and reduces the risks of human error or fraud.

A reliable token development company ensures the technical infrastructure is secure, user-friendly, and compliant with relevant jurisdictional laws. Smart contracts are typically audited, and the platform may integrate features like KYC/AML, wallet support, and liquidity management tools.

Use Cases in the Real World

The most compelling use case for fractional tokens is in real estate. Properties are high-value assets with consistent demand, but they’re notoriously illiquid. Tokenization allows landlords to sell equity in their property to multiple investors, offering them proportional returns from rent and property appreciation.

Art and collectibles are another popular domain. Rare items like sculptures, historical documents, or even music royalties can be tokenized. This creates a secondary market where cultural and artistic items gain new financial life through increased investor engagement.

Infrastructure projects are also starting to explore fractional tokens. Instead of governments or large firms handling funding, tokenized ownership can allow global citizens to invest in public projects like solar farms, highways, or water treatment plants—earning returns based on project performance.

Beyond that, fractional tokens are being tested for commodities (like gold or oil), venture capital funds, and even sports teams. This kind of democratization can fundamentally change how people invest and diversify their portfolios.

Legal and Technical Considerations

While the benefits are compelling, there are real challenges—especially around regulation and legal ownership. Tokenizing an asset doesn’t automatically grant legal title to the buyer unless the jurisdiction recognizes blockchain-based ownership. For example, holding 10,000 tokens representing a property doesn’t mean you’re on the legal deed unless the legal system integrates with the blockchain platform.

Most projects work around this by setting up a legal entity (such as an LLC) that owns the asset. Token holders then own shares in the entity. This indirect model helps align blockchain tokens with legal frameworks, but it also adds complexity and requires clear legal contracts.

From a technical standpoint, smart contracts must be robust, secure, and upgradable. Bugs or vulnerabilities in contract code can have serious consequences, especially when dealing with high-value assets. That’s why partnering with a professional token development company is essential. These teams typically conduct security audits, optimize gas costs, and ensure that smart contracts interact smoothly with wallets, oracles, and compliance layers.

Challenges and Limitations

One of the biggest challenges facing fractional token adoption is regulatory uncertainty. Many governments are still figuring out how to classify and regulate tokenized assets. Are they securities? Commodities? Something new altogether? Until there is more clarity, some projects operate in legal gray areas, which may deter institutional investors or large-scale adoption.

Interoperability is another issue. Assets tokenized on one blockchain may not be easily traded or used on another. While cross-chain solutions are improving, fragmentation still creates friction for users.

Additionally, investor education is critical. Many people are not familiar with how smart contracts or tokenized ownership works. Without understanding the risks, people may overinvest or misunderstand the nature of their ownership. Education, transparent communication, and platform usability are key to long-term success.

Finally, liquidity may not always be guaranteed. While fractional tokens increase the potential for liquidity, the actual ability to sell tokens depends on the presence of an active market. Without buyers, token holders may still face challenges in exiting their positions.

The Future of Fractional Tokenization

Despite these challenges, the future looks promising. As blockchain infrastructure becomes more mature and regulatory environments stabilize, fractional tokens could become a standard way of owning and trading assets.

For developers, entrepreneurs, and startups exploring this space, crypto token development offers a powerful toolkit to build new financial models. For investors, fractional ownership expands access and diversification. And for asset owners, tokenization presents a novel way to unlock capital and engage a global investor base.

Already, new tools and platforms are emerging that streamline the tokenization process. Self-service tokenization kits, compliance layers, and integration APIs are making it easier for companies to create and manage fractional tokens without needing to build from scratch.

The most successful projects will likely be those that combine blockchain innovation with legal compliance, intuitive user experience, and strong community support. By partnering with a competent token development company, asset owners can turn complex tokenization processes into practical, scalable solutions.

Final Thoughts

Fractional tokens represent one of the most tangible applications of blockchain in the real world. They enable wider participation, increase liquidity, and introduce transparency to markets that have traditionally been opaque and exclusive. Whether it’s real estate, collectibles, or infrastructure, fractional ownership opens the door to a more democratic financial system.

While there are still legal, technical, and market hurdles to overcome, the foundation is already in place. As token standards improve and regulatory frameworks evolve, fractional tokens may very well become the future of asset ownership.

For anyone considering entering this space—whether as an investor, startup founder, or asset owner—the key is to stay grounded, understand the fundamentals, and work with experienced partners. A trusted token development company can help turn complex ideas into live, functioning ecosystems.

This isn’t just a technological upgrade. It’s a shift in how value is created, shared, and owned.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.