From Letters of Credit to Blockchain: The Evolution of Trade Finance

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Trade Finance Market: The Engine Powering Global Trade

✍️ From cryptocurrency transactions to smart contracts and real estate tokenization, the applications are endless. Explore our comprehensive guide to blockchain use cases and see how industries are adopting this technology for better efficiency.

In the vast world of international business, where goods and services flow seamlessly across continents, trade finance plays the silent yet critical role of enabler. Often working behind the scenes, this financial ecosystem empowers exporters, importers, banks, and financial institutions to reduce risk, maintain liquidity, and ensure smooth commercial transactions.

What is Trade Finance?

Trade finance Analysis refers to the broad array of financial products and instruments used to facilitate international trade. It bridges the gap between exporters and importers, ensuring that payments and deliveries are made on time and in accordance with contracts. From letters of credit and bank guarantees to trade credit and factoring, these instruments mitigate risk and improve cash flow for both parties.

The fundamental objective of trade finance is to remove uncertainty in global trade. It assures the seller that they will be paid and assures the buyer that they will receive their goods. This level of trust is crucial in cross-border transactions, where unfamiliar business practices, legal systems, and currency risks are often involved.

Key Components and Instruments

Trade finance isn't a single product but a system of interconnected solutions designed to support the entire lifecycle of a trade transaction. Some of the most commonly used instruments include:

Letters of Credit (LCs): Guarantees payment from the buyer’s bank to the seller upon fulfillment of agreed terms.

Bank Guarantees: Assure compensation if the counterparty fails to meet their obligations.

Export Credit: Provides exporters with funds to cover pre-shipment or post-shipment costs.

Factoring and Forfaiting: Enable businesses to convert accounts receivable into instant cash.

Supply Chain Finance: Optimizes working capital by extending payment terms for buyers while enabling early payments for suppliers.

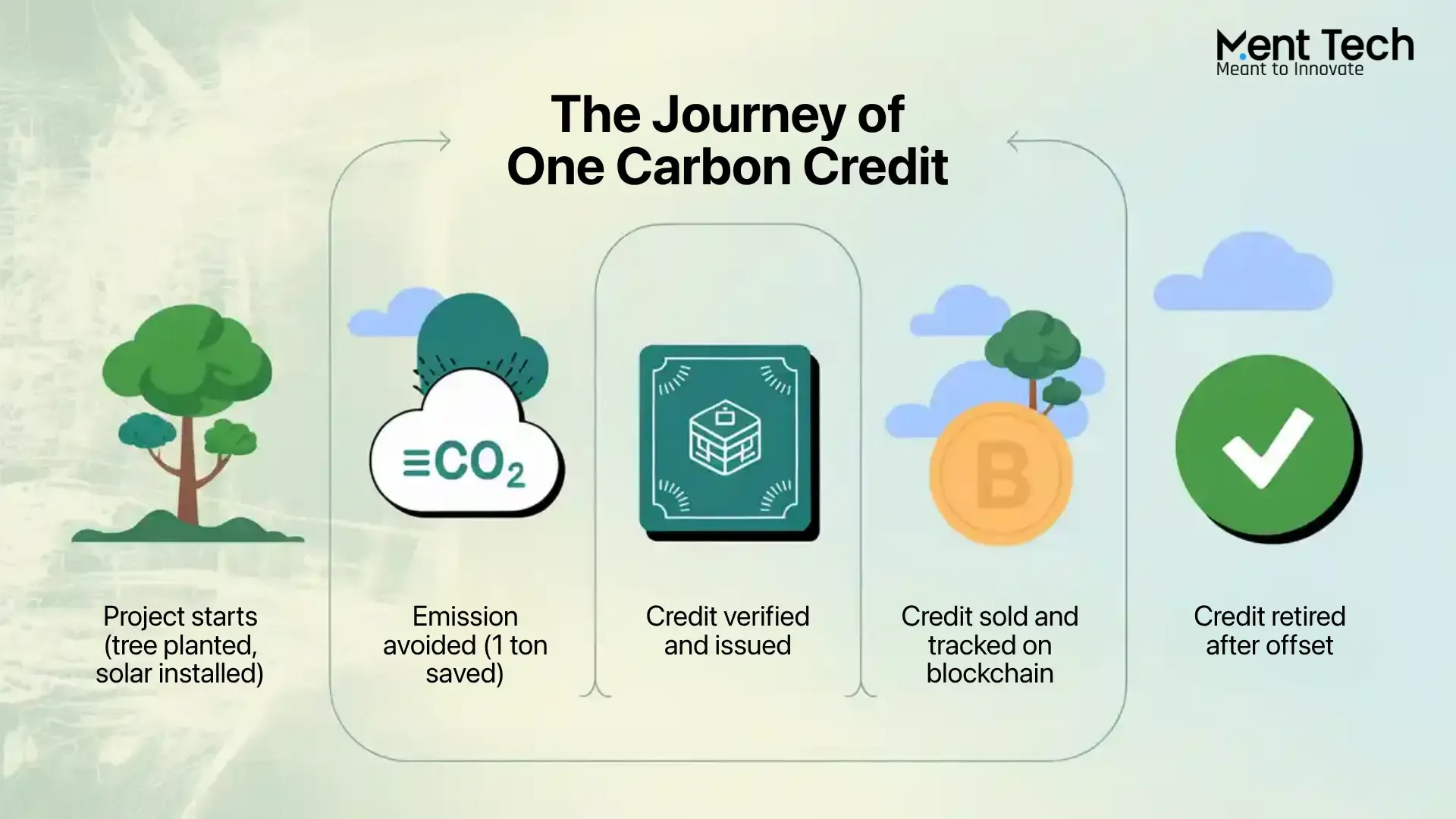

Digital Transformation in Trade Finance

The trade finance market, long dominated by traditional paper-heavy processes, is now undergoing a digital revolution. Technologies like blockchain, electronic bills of lading, and digital signatures are streamlining the exchange of documentation, improving transparency, and enhancing fraud detection.

Fintech companies are also disrupting the landscape by offering cloud-based platforms that connect buyers, sellers, and financiers. These platforms automate risk assessment, credit scoring, and document verification—making the process faster and more inclusive, especially for small and medium enterprises (SMEs) that were previously underserved.

Why Trade Finance Matters Today

The relevance of trade finance has only grown in a post-pandemic, increasingly connected world. Supply chain disruptions, geopolitical tensions, and inflation have made liquidity and risk management more critical than ever. Trade finance provides the tools to weather these storms by:

Supporting global supply chains

Providing access to working capital

Mitigating credit and performance risks

Improving balance sheet health

Moreover, as ESG (Environmental, Social, and Governance) criteria become more prominent in business decisions, sustainable trade finance is gaining momentum. Financial institutions are beginning to offer preferential terms for transactions that align with sustainability goals.

Challenges in the Market

Despite its importance, the trade finance sector is not without hurdles:

Regulatory complexities across jurisdictions

High documentation burden

Limited SME access to trade finance facilities

Cybersecurity risks in digital platforms

Geopolitical uncertainties affecting risk profiles

To stay relevant, banks and institutions must continuously innovate and collaborate with regulatory bodies and fintech providers.

The Road Ahead: Innovation & Inclusion

The future of trade finance lies in digital inclusivity, smarter credit assessment tools, and a stronger push toward sustainable trade practices. With regulators, financial institutions, and technology providers working hand in hand, trade finance can become more accessible, efficient, and resilient.

Global trade will continue to evolve, but the mechanisms that power it—trade finance foremost among them—must evolve even faster.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.