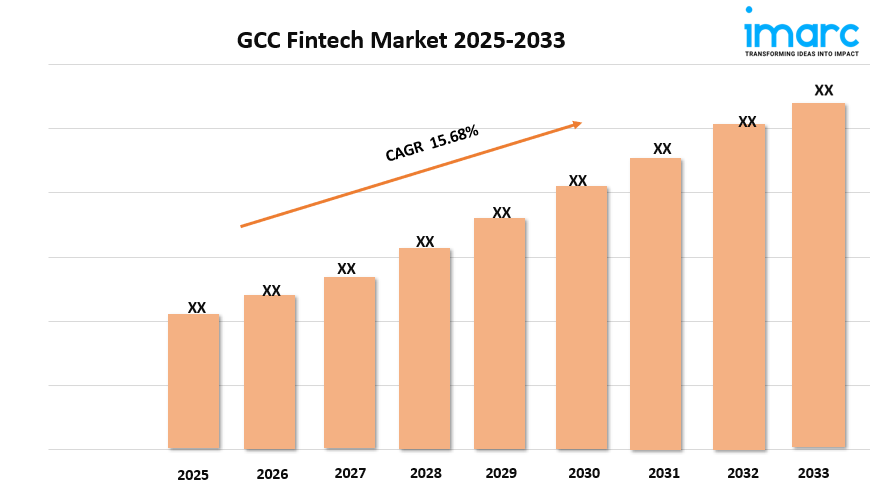

GCC Fintech Market Trends, Growth, and Demand Forecast 2025-2033

Strong8k brings an ultra-HD IPTV experience to your living room and your pocket.

GCC Fintech Market Overview

Market Growth Rate 2025-2033: 15.68%

According to IMARC Group's latest research publication, "GCC Fintech Market Report by Deployment Mode (On-premises, Cloud-based), Technology (Application Programming Interface, Artificial Intelligence, Blockchain, Robotic Process Automation, Data Analytics, and Others), Application (Payment and Fund Transfer, Loans, Insurance and Personal Finance, Wealth Management, and Others), End User (Banking, Insurance, Securities, and Others), and Country 2025-2033", the GCC fintech market size is projected to exhibit a growth rate (CAGR) of 15.68% during 2025-2033.

Download a sample PDF of this report: https://www.imarcgroup.com/gcc-fintech-market/requestsample

Growth Factors in the GCC Fintech Market

- Supportive Regulatory Frameworks

The GCC region's fintech market is booming. This growth comes from supportive regulations that encourage innovation. Governments, like those in the UAE and Saudi Arabia, are pushing fintech with new policies. These efforts align with their goals for economic diversification. The UAE's Dubai International Financial Centre (DIFC) created a regulatory sandbox. This allows startups like Sarwa to test robo-advisory services in a safe environment. This framework helps fintech firms try new ideas while protecting consumers. It also attracts global companies like Binance to grow in the region. These initiatives lower entry barriers, boost investor confidence, and foster fintech innovation. As a result, the market is expanding rapidly across the GCC.

- Digital Transformation and Smartphone Penetration

Digital change in the GCC, along with many people using smartphones, is a key driver of growth. The young, tech-savvy people in the region want more digital financial services. Saudi Arabia’s STC Pay is a mobile wallet that's becoming popular. It allows easy peer-to-peer payments. This shows the move toward cashless economies. Affordable smartphones and basic internet access allow people to use mobile banking and digital wallets. This connectivity helps fintech firms reach underserved people. It boosts financial inclusion and encourages new solutions for today’s consumers.

- Increasing Investment and Funding Opportunities

The GCC fintech market is booming. It's seeing a rise in investment from both local and international venture capital. This is helping startups grow. Bahrain-based Rain, a cryptocurrency exchange, got major funding. This will help it grow its digital asset offerings. The company aims to take advantage of the region's rising interest in blockchain. The UAE’s fintech sector has drawn significant investments. For example, Tabby raised funds to improve its buy-now-pay-later (BNPL) services. This capital boost helps develop new technologies. It helps fintech companies grow. They can meet rising consumer demand and compete with traditional banks. All this drives market growth.

Key Trends in the GCC Fintech Market

- Rise of Digital Payments and Mobile Wallets

Digital payments and mobile wallets are changing how people transact in the GCC. Consumer demand for convenience and security drives this shift. Companies like Telr in the UAE and Geidea in Saudi Arabia lead the way. They offer smooth payment solutions for e-commerce and in-store buying. The post-COVID move to contactless payments has sped up this trend. Platforms like Apple Pay and Google Pay are becoming more popular. Tabby bought Tweeq in Saudi Arabia to enhance its digital wallet features. This helps users manage their spending accounts better. This trend shows that the region wants cashless societies and improved user experiences.

- Adoption of Blockchain and Digital Assets

Blockchain tech and digital assets are on the rise in the GCC, especially in the UAE and Bahrain. Here, supportive regulations encourage innovation. Local exchanges such as Rain and global firms like eToro are tapping into the rising interest in cryptocurrencies. For instance, Bahrain’s Central Bank has set up rules to regulate digital assets, creating a safer trading environment. The transparency and security of blockchain support smart contracts and digital identity verification. This shift is changing investment strategies. It also opens new opportunities for consumers and businesses in the GCC's financial landscape.

- Emergence of Neobanks

Neobanks are changing the banking scene in the GCC. They provide fully digital services focused on customers. Platforms like Emirates NBD’s Liv. and YAP in the UAE provide online-only banking, appealing to digitally savvy consumers. For instance, Liv. provides tailored financial management tools for young users who like mobile banking instead of traditional branches. These neobanks use AI and data analytics. They offer personalized services like budgeting tools and instant transactions. Plus, they do this at lower costs. This trend matches the region's move towards better, easier financial solutions. It cuts down on reliance on traditional banks and boosts fintech innovation.

We explore the factors driving the growth of the market, including technological advancements, consumer behaviors, and regulatory changes, along with emerging GCC fintech market trends.

GCC Fintech Industry Segmentation:

The report has segmented the market into the following categories:

Deployment Mode Insights:

- On-premises

- Cloud-based

Technology Insights:

- Application Programming Interface

- Artificial Intelligence

- Blockchain

- Robotic Process Automation

- Data Analytics

- Others

Application Insights:

- Payment and Fund Transfer

- Loans

- Insurance and Personal Finance

- Wealth Management

- Others

End User Insights:

- Banking

- Insurance

- Securities

- Others

Country Insights:

- Saudi Arabia

- UAE

- Qatar

- Bahrain

- Kuwait

- Oman

Competitive Landscape:

The competitive landscape of the industry has also been examined, along with the profiles of the key players.

Future Outlook

The GCC fintech market is set for major growth. This is due to new technology, helpful regulations, and changing consumer needs. Fintech firms will play a crucial role as governments push for financial inclusion and economic diversity. They will help shape the region’s financial ecosystem. Open banking innovations, like those from Thimsa in the UAE, will boost teamwork. Fintechs will work with traditional banks to offer personalized services. AI, blockchain, and IoT will boost efficiency and security. Also, investing in sustainable financial products, like carbon-conscious tools, will match global trends. The young, tech-savvy people in the GCC are making it a global fintech hub. This region will provide new solutions that change financial services.

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St., Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.