Automated Blog-to-Social Sharing – Publish Once. Appear Everywhere!

Automated Blog-to-Social Sharing – Publish Once. Appear Everywhere!

GCC Real Estate Market Growth, Trends, Share, Analysis, Size, Outlook 2024-2032

Written by Rahul Singh » Updated on: June 17th, 2025

Real Estate Market in GCC 2024:

How Big is the GCC Real Estate Industry?

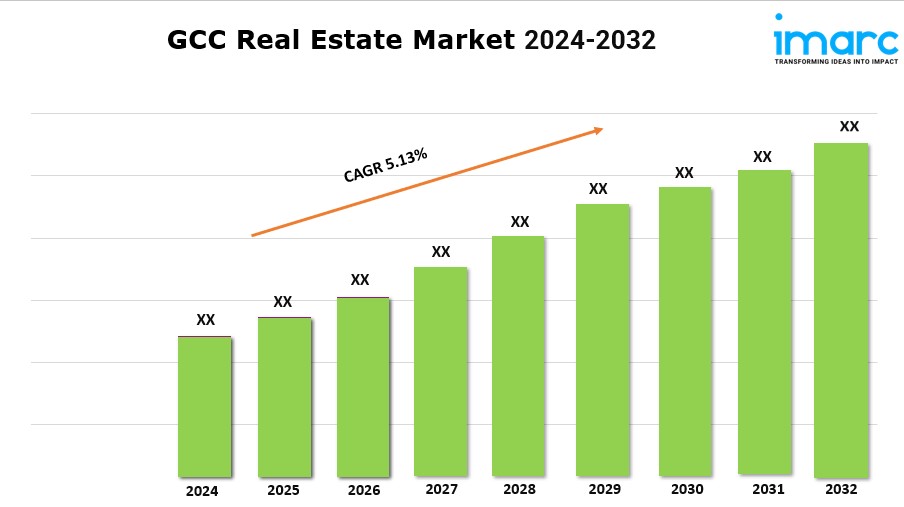

The GCC real estate market size is projected to exhibit a growth rate (CAGR) of 5.13% during 2024-2032. The market is growing, driven by infrastructure projects, economic diversification, government initiatives, and increasing demand for quality properties.

Base Year: 2023

Historical Years: 2018-2023

Forecast Years: 2024-2032

Market Growth Rate: 5.13% (2024-2032)

GCC Real Estate Market Trends and Drivers:

A combination of factors such as economic diversification, population expansion, as well as large-scale infrastructure developments across the region are responsible for the growth of the GCC real estate market. Additionally, initiatives by government authorities like Saudi Vision 2030 and the UAE Centennial 2071 are fueling investments in residential, commercial, and mixed-use projects, transforming the urban landscape. The increasing influx of expatriates and international businesses has amplified the demand for housing, office spaces, and retail outlets, further bolstering the market. Moreover, rising disposable incomes and changing lifestyle preferences are also driving the need for luxury properties, integrated communities, and smart home technologies.

The adoption of digital technologies and a growing emphasis on sustainability is augmenting the GCC real estate market. In addition to this, developers are leveraging advanced tools like virtual reality, AI-driven analytics, and blockchain to enhance property management, sales, and transparency. Smart city initiatives are gaining traction, incorporating IoT-enabled infrastructure to offer modern, tech-friendly living, and working environments. Sustainability has become a cornerstone of development strategies, with an increasing focus on green building certifications, energy-efficient designs, and renewable energy integration. The shift toward affordable housing projects to cater to middle-income residents is another notable trend, addressing diverse market needs. Furthermore, the rise of real estate investment trusts (REITs) is providing investors with opportunities to diversify their portfolios, boosting market liquidity. The ongoing reforms to improve transparency and foreign investment opportunities are expected to drive sustained growth in the GCC real estate market in the coming years, making it a cornerstone of the economic evolution.

GCC Real Estate Industry Segmentation:

The report has segmented the market into the following categories:

Breakup by Property:

- Residential

- Commercial

- Industrial

- Land

Breakup by Business:

- Sales

- Rental

Breakup by Mode:

- Online

- Offline

Breakup by Country:

- Saudi Arabia

- UAE

- Qatar

- Bahrain

- Kuwait

- Oman

Competitive Landscape:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

Key highlights of the Report:

- Market Performance (2018-2023)

- Market Outlook (2024-2032)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.

Copyright © 2019-2025 IndiBlogHub.com. All rights reserved. Hosted on DigitalOcean for fast, reliable performance.