Global Leasing Market Outlook to 2028: Redefining Access over Ownership

In an era where convenience, flexibility, and operational efficiency take center stage, the Global Leasing Market is witnessing a transformative boom. With evolving consumer behavior, digital innovation, and asset-light business models gaining popularity, leasing has emerged as a preferred route over traditional ownership—across equipment, real estate, automobiles, and even software.

According to the Global Leasing Market Report, the industry is poised for accelerated expansion by 2028, driven by rising demand from SMEs, growth in vehicle leasing, and the increasing shift toward flexible asset usage in emerging markets.

Key Drivers of Growth

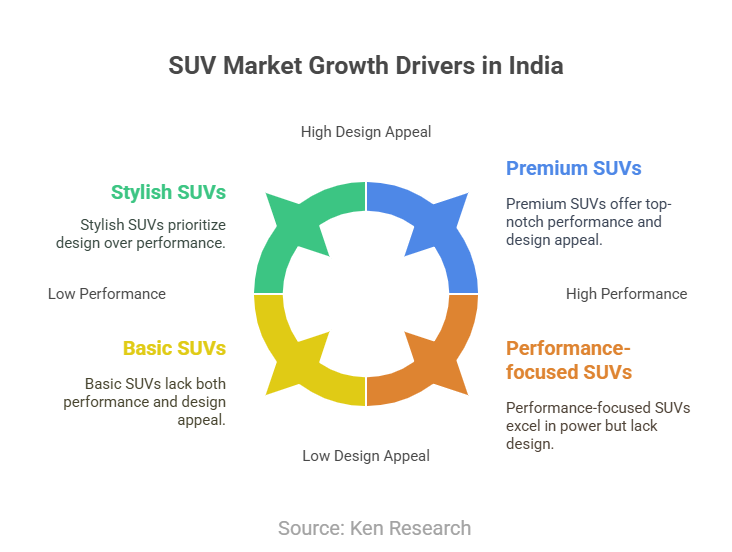

Vehicle Leasing Boom: Rising car prices and evolving mobility trends are prompting individuals and businesses to opt for leasing rather than ownership. Subscription-based leasing models are now preferred in urban areas where convenience and lower upfront costs matter.

- SME Adoption: Small and medium-sized enterprises are leveraging leasing to access high-end equipment without large capital outlays. This is especially relevant in sectors like construction, manufacturing, and IT services.

- Technology Integration: The infusion of AI, blockchain, and IoT into leasing platforms is streamlining risk assessment, asset tracking, and contract management—leading to enhanced transparency and operational efficiency.

- Sustainability and Circular Economy: Leasing promotes reuse and extended asset life, making it an eco-conscious model aligned with sustainability goals.

Regional and Segment Insights

- North America and Europe currently dominate the global market due to established leasing infrastructure, strong automotive and IT leasing penetration, and widespread B2B awareness.

- Asia-Pacific is the fastest-growing region, fueled by digital transformation, government initiatives supporting MSMEs, and expanding urban middle-class populations seeking affordable solutions.

- Vehicle and Equipment Leasing continue to hold major market share, with real estate and software licensing segments gaining traction rapidly.

Market Future Outlook

The Global Leasing Market is expected to evolve significantly by 2028 with:

- A strong focus on mobility-as-a-service (MaaS) and electric vehicle leasing.

- More subscription-based business models, offering high flexibility for consumers.

- A surge in cloud leasing and SaaS leasing platforms for software delivery.

- Decentralized leasing ecosystems enabled by blockchain for higher security and automation.

As leasing shifts from a traditional financial service to an integrated, tech-driven business model, it will reshape the global economic landscape, especially in industries prioritizing agility over asset accumulation.

Conclusion

The future of leasing is being reshaped by three core imperatives—innovation, customization and value-added services—that together elevate it from a mere financing tool to a full strategic offering. Rather than simply providing assets on a term basis, tomorrow’s leasing companies will embed smart technologies (IoT sensors, AI-driven analytics, blockchain-enabled contracts) into their portfolios. This allows them to offer predictive maintenance alerts, real-time utilization dashboards and flexible, usage-based billing—turning each lease into an adaptive, data-powered service rather than a static contract.

Customization is the next frontier. As customers in industries from manufacturing to mobility increasingly demand “leasing on demand,” providers must craft granular packages: modular insurance add-ons, tailored training programs, integrated financing + maintenance bundles, or even turnkey “as-a-service” solutions that include installation, upgrades and end-of-life recycling. By partnering with software developers, sustainability consultants and aftermarket specialists, lessors can deliver end-to-end experiences that go well beyond the underlying asset.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.