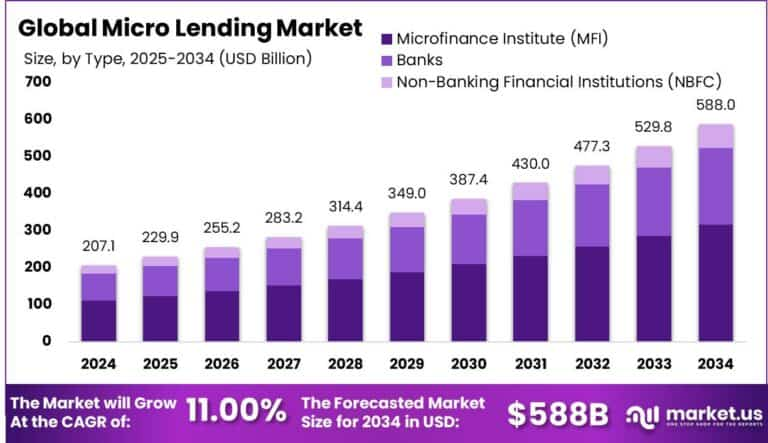

Global Micro Lending Market size is at a CAGR of 11.00%

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

The Global Micro Lending Market size is expected to be worth around USD 588 Billion By 2034, from USD 207.1 Billion in 2024, growing at a CAGR of 11.00% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific led the global micro-lending market with over 45% share and USD 93.1 billion in revenue. China alone contributed USD 30.5 billion, growing at a CAGR of 8.2%, fueled by demand from small businesses and individuals.

Micro lending is the practice of providing small loans to individuals or small businesses that lack access to traditional banking services. These loans are typically offered by microfinance institutions (MFIs), non-banking financial companies (NBFCs), and digital platforms, aiming to promote financial inclusion and support entrepreneurship among underserved populations.

Read more - https://market.us/report/micro-lending-market/

The Micro Lending Market refers to a segment of the financial industry that provides small loans, typically to low-income individuals, entrepreneurs, and small businesses who lack access to traditional banking services. These loans, often called microloans, are designed to support people in developing regions or underserved communities by offering a stepping stone toward financial independence. The market has grown substantially, driven by the need to bridge the credit gap and support grassroots economic development.

Top driving factors fueling this growth include increasing financial inclusion efforts, rising entrepreneurial ventures in emerging markets, and the expansion of digital financial services. Demand analysis reveals a sharp rise in loan applications across regions like Southeast Asia, Sub-Saharan Africa, and parts of Latin America, where traditional banking infrastructure is weak or absent. The increasing use of mobile technology and digital wallets has significantly simplified the loan disbursal process, making it quicker and more accessible than ever before.

New technologies are playing a crucial role in transforming the micro lending landscape. Innovations such as AI-based credit scoring, blockchain for transaction transparency, and mobile banking platforms are increasing both the efficiency and trustworthiness of microfinance operations. These technologies not only reduce operational costs but also improve borrower assessment and repayment tracking, making the model more sustainable. Key reasons for adopting such technologies include the need for speed, accuracy in risk evaluation, better customer experience, and lower overheads.

From an investment standpoint, the Micro Lending Market offers strong opportunities, especially for fintech startups and social impact investors. Venture capital interest in micro lending platforms has surged over the past five years, with notable funding rounds exceeding USD 500 million globally in the last year alone. The scalability and social impact potential of these platforms make them attractive to both financial and ethical investors.

The business benefits of entering this space include access to a growing, underserved customer base, high customer retention due to personalized service, and alignment with global development goals. Many businesses have successfully built loyal communities around their lending platforms, establishing long-term revenue streams with manageable risk.

Technological advancements have also improved the loan recovery process, reducing default rates through real-time monitoring, automated reminders, and behavioral analytics. This has increased the profitability of micro lending institutions while simultaneously building trust among borrowers.

Top impacting factors in the market include digital literacy, smartphone penetration, government regulations, investor confidence, and repayment behavior. The resilience of micro lenders during economic downturns has proven that the model can survive and even thrive in tough times, reinforcing its importance in the global financial ecosystem.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.