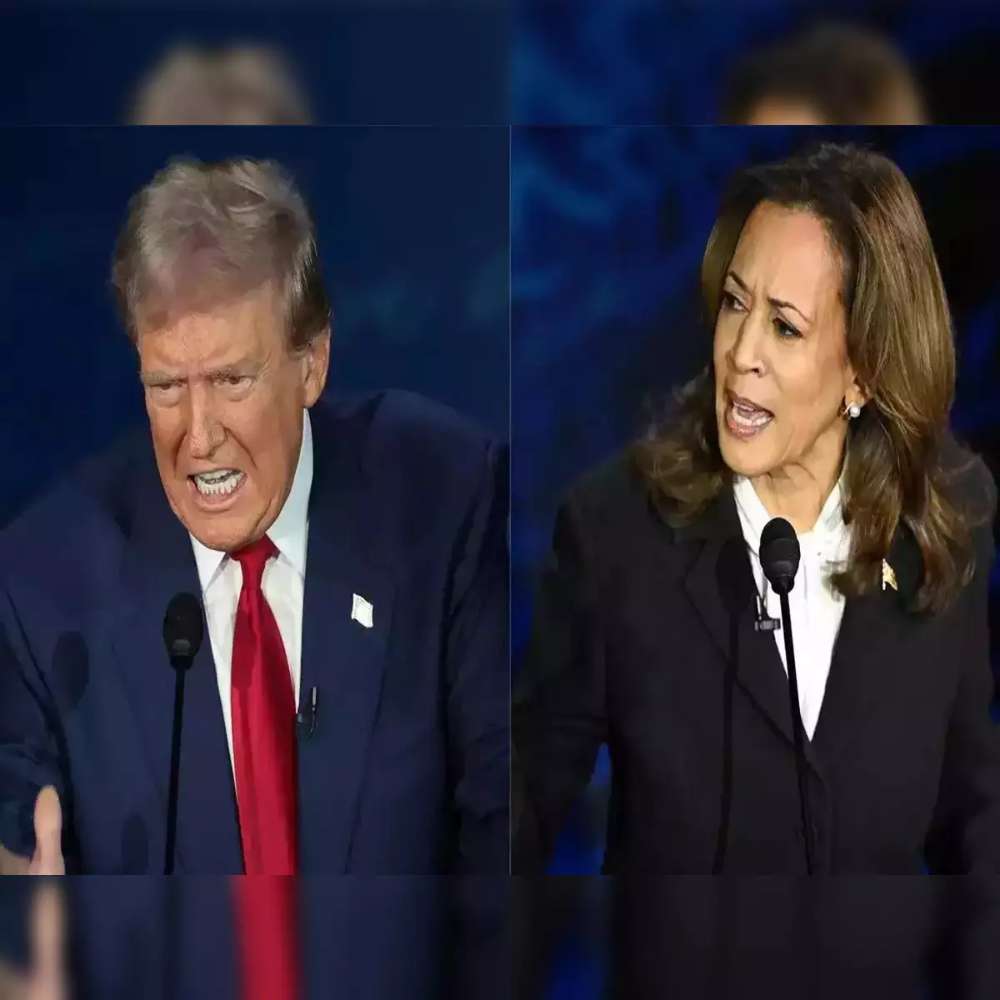

How a Trump or Harris Election Win Could Shape the Stock Market?

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Category: News

Source: economictimes.indiatimes.com

Investors on Edge as Election Approaches

With Election Day just hours away, the financial world is watching closely, though no one can say with certainty what the outcome will be. For stock market investors, however, experts are offering a calming message: there’s no need to panic. While some fluctuations are expected as election results start to unfold, the overall market performance is predicted to remain strong through the end of this year.

Historically, U.S. stocks and the stock market have averaged an annual return of 9.1% during election years, according to data spanning more than 70 years. This pattern has held steady through the terms of more than a dozen presidents and 36 Congresses, suggesting that, in general, the market endures and even thrives during election cycles. So far this year, key indices reflect this resilience: the Dow Jones Industrial Average is up by over 11%, the S&P 500 has risen 21%, and the Nasdaq has surged by 31%. Analysts suggest that years with significant returns through October often see further gains as the year draws to a close, a trend that also holds during election years.

What a Trump Victory Could Mean for Stocks

Each candidate brings distinct policy agendas with implications for specific sectors. A victory for former President Donald Trump would likely lead to a series of economic changes. His tax and tariff policies, if implemented, could impact foreign companies and increase taxes on many Americans, although corporations might see a slight tax cut. This focus on corporate tax breaks may signal potential price hikes, as companies could shift costs onto consumers. Sectors that may benefit from a Trump win include oil and gas, along with cryptocurrency and banking. These industries could find a supportive environment under Republican-led policies.

Moreover, private prison operators, such as those involved in detention facilities, could see an increase in stock market value if Trump moves forward with plans for stricter immigration enforcement. Some companies are already anticipating that his policies may lead to substantial shifts across various markets, particularly those reliant on labor-intensive industries and international trade.

The Potential Impact of a Harris Win

A win for Vice President Kamala Harris could produce a different set of impacts on the market, primarily focused on renewable energy, housing, and technology. Harris has pledged to address the affordable housing crisis and combat climate change, both of which signal growth for companies in housing development and renewable energy. She has outlined plans to invest heavily in areas like artificial intelligence, semiconductor manufacturing, and electric vehicles—industries she views as critical to the future of the economy.

However, Harris’s approach also includes a proposed corporate tax increase from 21% to 28%. While this would support funding for initiatives like healthcare and climate action, it could create pressure on corporate profit margins, particularly in industries like pharmaceuticals and grocery, where profit ratios are tightly managed. Her stance on healthcare, including potential legislation to curb high drug prices, could impact pharmaceutical firms, and measures to prevent price-gouging at grocery stores might squeeze profits in the retail sector.

Will Policy Proposals Face Obstacles?

Both Trump or Harris would likely face challenges implementing their most ambitious plans unless their party gains a majority in Congress. Without unified control, significant policies could become watered down through negotiation or even stall in legislative gridlock. Experts highlight that the markets often react more strongly to unified government action, as it signals a greater likelihood of significant policy changes. In contrast, a divided government can delay policy implementation or limit proposals to compromises that have minimal impact.

The passage of President Joe Biden’s Inflation Reduction Act provides an example of this dynamic. Despite clearing the Senate and delivering substantial support for clean energy, certain tax measures were altered to secure centrist votes. In the end, it took a tie-breaking vote from Harris to pass the bill, underscoring the challenges that narrow Senate margins can pose for ambitious policy agendas.

Balancing Market Strategy and Political Uncertainty

Analysts warn that betting too heavily on a candidate’s proposals can be risky. In reality, few elected officials can fully deliver on campaign promises once in office. Investors should remember that other forces, like earnings reports and broader economic trends, often play a more significant role in shaping market conditions. Inflation, interest rates, and consumer spending can outweigh policy changes in determining market movements. Additionally, several major corporations have yet to report earnings for their latest quarters, and these results will likely provide insights that will shape investor expectations moving into the next year.

In summary, while the election will undoubtedly influence markets, other factors—including economic performance, corporate earnings, and the government’s response to inflation—remain central to the market’s trajectory. Investors would be wise to approach the coming months with a balanced outlook, acknowledging both political developments and broader economic indicators that ultimately shape market performance.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.