How GPSSA Benefits UAE Nationals in the Private and Public Sectors

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

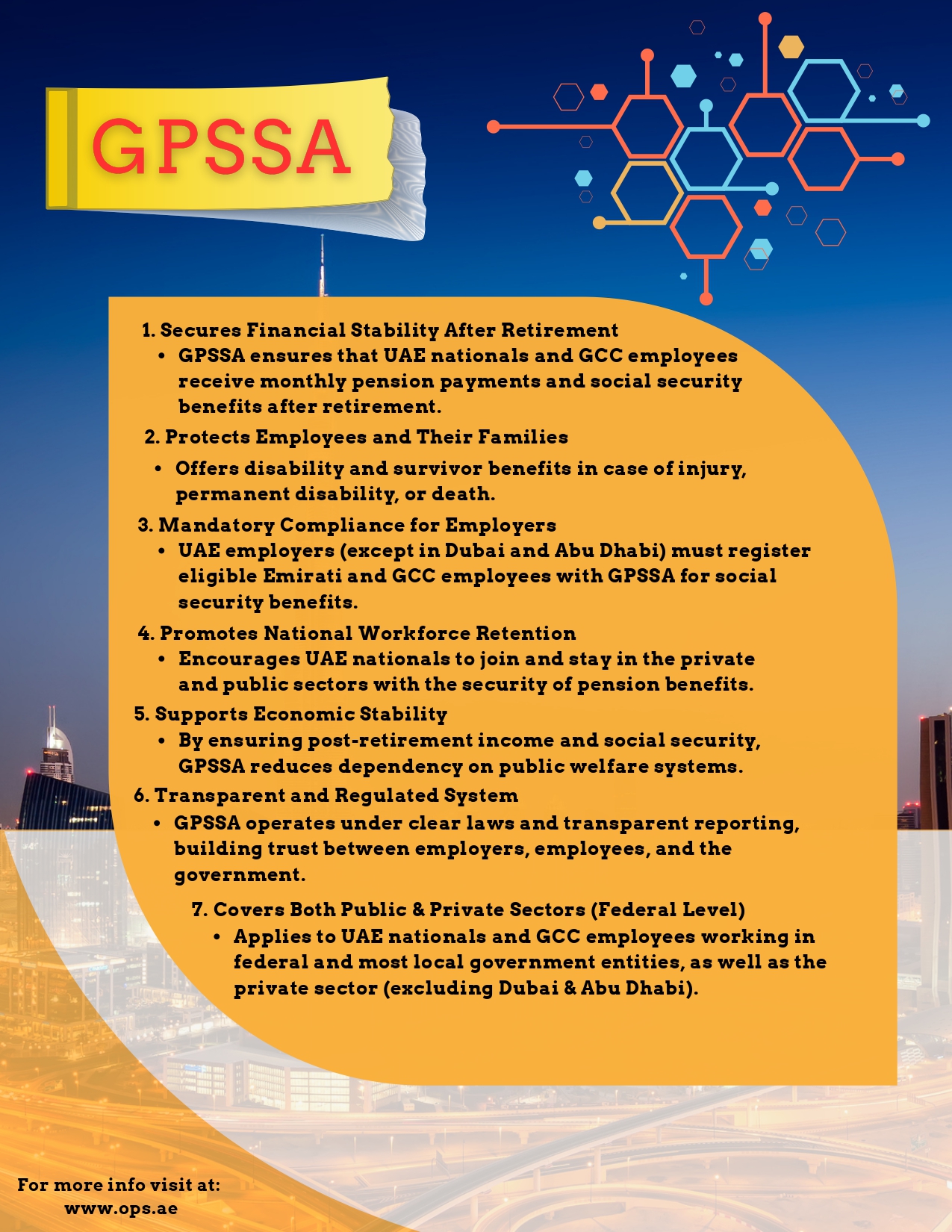

In the United Arab Emirates, social security is more than a safety net—it's a foundation of economic and social empowerment for Emirati citizens. One key organization responsible for this is the General Pension and Social Security Authority (GPSSA). For UAE Nationals employed in both public and private sectors, understanding how GPSSA works can help ensure better retirement planning, job security, and financial stability.

This blog explores how GPSSA supports UAE Nationals, how it integrates with systems like the Wage Protection System (WPS UAE), and its implications for businesses using HR solutions Dubai, Treasury Services, or seeking help from the best outsourcing companies in UAE.

What is GPSSA?

The General Pension and Social Security Authority (GPSSA) is a federal body established under UAE Federal Law No. 7 of 1999. It is responsible for managing and distributing pensions and social security benefits to UAE Nationals working in both public and private sectors. The authority ensures long-term income security and welfare for Emirati citizens through organized pension contributions, end-of-service benefits, and retirement planning services.

GPSSA in the Public Sector

For UAE Nationals in government or semi-government organizations, the GPSSA plays a pivotal role in securing their future:

1. Structured Pension Scheme

Employees contribute 5% of their salary, and the employer contributes 15%. These contributions are pooled into a pension fund, which is then used to provide monthly income post-retirement.

2. Early Retirement Support

Under certain conditions, GPSSA allows early retirement, providing flexibility and control over work-life balance.

3. Family Protection

In the unfortunate event of an employee’s death or disability, GPSSA ensures continued financial support for dependents.

4. Transparent Service Tracking

Government employees can access transparent digital portals to track contributions, request retirement certificates, and review their status.

GPSSA in the Private Sector

With the UAE government's push to increase Emirati participation in the private sector (Emiratization), GPSSA offers identical pension benefits for UAE Nationals working in private companies. This ensures:

Equal Social Protection: Emiratis receive the same pension rights regardless of their employer.

Encouragement for Private Employment: It boosts confidence among UAE Nationals to explore career opportunities in the private sector.

End-of-Service Replacements: Instead of traditional gratuity, pension contributions offer more secure long-term returns.

This equality is crucial in bridging the gap between public and private employment, further supported by platforms like the Wage Protection System UAE.

Role of GPSSA in the Wage Protection System UAE

The Wage Protection System (WPS UAE) is a Ministry of Human Resources and Emiratisation (MOHRE) initiative aimed at ensuring salary transparency and timely payments for employees across all sectors.

For UAE Nationals, WPS helps:

Confirm regular salary payments that match GPSSA contributions

Eliminate discrepancies in pension calculations

Reduce payroll fraud or manipulation

Businesses that utilize Treasury Services or HR solutions Dubai can better automate compliance with WPS, including the required GPSSA deductions and reporting.

GPSSA and Treasury Services: Enhancing Financial Planning

Forward-thinking organizations increasingly rely on Treasury Services to manage cash flows, optimize working capital, and ensure financial compliance—particularly when managing large-scale payrolls and social security contributions like those required by GPSSA.

How Treasury Services Support GPSSA Compliance:

Accurate Payment Scheduling: Treasury teams can forecast upcoming GPSSA payments and allocate funds accordingly.

Automated Reporting: Integrated treasury systems help prepare timely financial reports for MOHRE and GPSSA.

Risk Reduction: Treasury strategies mitigate the risks of missed or incorrect payments, which can lead to legal penalties.

Outsourcing GPSSA Functions: A Smart Move?

Managing compliance, documentation, and contributions for social security can be time-consuming and error-prone. This is why many companies are turning to the best outsourcing companies in UAE to streamline payroll, HR, and treasury functions.

Key Benefits of Outsourcing GPSSA Responsibilities:

Error-Free Deductions: Experts ensure the correct GPSSA contribution rates are applied.

Faster Onboarding: New Emirati hires are registered promptly with GPSSA.

Up-to-Date Compliance: Outsourcing firms stay current with regulatory changes in pension law and WPS.

Focus on Core Business: Employers save time and resources.

For SMEs and growing businesses in the UAE, outsourcing ensures both compliance and cost-efficiency without compromising employee satisfaction or legal obligations.

HR Solutions Dubai: Simplifying GPSSA and Payroll Integration

HR software and HR solutions in Dubai are increasingly designed with GPSSA integration. Modern platforms now allow businesses to:

Automate Employee Registration with GPSSA

Calculate Contributions with Each Payroll Cycle

Generate Real-Time Reports for Audits

Track Employment Status and Service Years

This not only ensures accuracy but builds trust with Emirati employees by showcasing a commitment to their long-term financial security.

Latest Trends Supporting GPSSA Operations

With the UAE’s digital transformation journey accelerating, several trends are shaping the future of GPSSA operations:

1. Digital GPSSA Portals

Self-service portals for employees and employers offer transparency in contributions and benefit calculations.

2. AI-Driven HR Systems

Smart systems help predict retirement eligibility, automate GPSSA registration, and analyze contribution histories.

3. Blockchain for Payroll and Social Security

Several pilot programs in the region are exploring blockchain to record pension transactions, increasing security and transparency.

4. Unified Government HR Systems

Efforts are underway to create a connected platform between MOHRE, WPS, GPSSA, and other authorities to enable seamless data flow.

How UAE Nationals Can Make the Most of GPSSA

For UAE Nationals, it’s important to be proactive with your pension and benefits. Here's how:

Regularly Monitor Your GPSSA Status

Keep Your Employment History Updated

Plan for Retirement Early

Communicate With HR on Contribution Changes

Know Your Rights for Disability, Retirement, and Family Support

The GPSSA is not just a post-retirement benefit—it’s a financial wellness framework that begins with your first paycheck.

Conclusion

The General Pension and Social Security Authority (GPSSA) plays a critical role in protecting the financial future of UAE Nationals across both public and private sectors. Whether you're an employee planning your retirement or an employer ensuring compliance, understanding how GPSSA works—and integrating it with tools like Wage Protection System UAE, Treasury Services, and HR solutions Dubai—is essential.

For businesses, the most effective way to navigate the complexities of GPSSA and payroll compliance is to partner with the best outsourcing companies in UAE. These firms ensure your operations remain efficient, compliant, and future-ready.

📞 Need Help With GPSSA, Payroll, or Treasury Compliance?

Explore expert-led HR and payroll outsourcing with OPS – one of the best outsourcing companies in UAE. Empower your team with worry-free, fully compliant payroll and social security support.

FAQs

❓ What is GPSSA in the UAE?

GPSSA stands for the General Pension and Social Security Authority, which manages pensions and social benefits for UAE Nationals working in the public and private sectors.

❓ How does GPSSA apply to private sector employees?

UAE Nationals in private companies contribute to GPSSA just like government employees, ensuring equal access to pensions and benefits.

❓ Can outsourcing help with GPSSA compliance?

Yes, the best outsourcing companies in UAE can handle employee registration, contributions, and reporting, ensuring full compliance with GPSSA and WPS requirements.

❓ How does WPS affect GPSSA contributions?

The Wage Protection System ensures that salary data is properly logged and matched with required GPSSA contributions, reducing fraud and errors.

❓ Are there HR solutions in Dubai that integrate with GPSSA?

Absolutely. Many HR software platforms in Dubai now offer direct integration with GPSSA, making contributions and reporting more efficient.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.