How Lawyers Handle Insurance Coverage Investigations

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Insurance coverage investigations are a fundamental aspect of legal practice in personal injury, business, construction, and commercial litigation. When a dispute arises, one of the first questions lawyers ask is: “Is there insurance coverage, and what does it include?”

Whether representing plaintiffs, defendants, or insurers, attorneys must conduct a thorough insurance coverage investigation to evaluate potential liability, the scope of coverage, and the insurer’s duty to defend or indemnify.

This article outlines how lawyers handle these investigations, the tools they use, and why this process is critical to legal strategy and client outcomes.

What Is an Insurance Coverage Investigation?

An insurance coverage investigation is the process of determining whether and to what extent an insurance policy applies to a particular loss or claim. This involves examining the insurance policy language, understanding the facts of the case, analyzing relevant legal precedent, and applying statutory and regulatory rules that affect insurance obligations.

The goal is to answer key questions such as:

Is there an applicable insurance policy?

Does the policy cover the claim or loss?

Are there exclusions or limitations?

Has the insured complied with all conditions of coverage?

Is the insurer obligated to defend the insured in litigation?

What are the policy limits?

When Do Lawyers Conduct Coverage Investigations?

Lawyers may conduct coverage investigations in a variety of contexts, including:

Personal Injury Litigation (e.g., car accidents, premises liability)

Commercial Litigation (e.g., breach of contract, business torts)

Construction Defect Claims

Employment Practices Liability

Product Liability

Environmental Claims

Insurance Bad Faith Litigation

They may represent insureds, insurers, or third-party claimants, and the investigation approach may vary based on the party they represent.

Step-by-Step Process of an Insurance Coverage Investigation

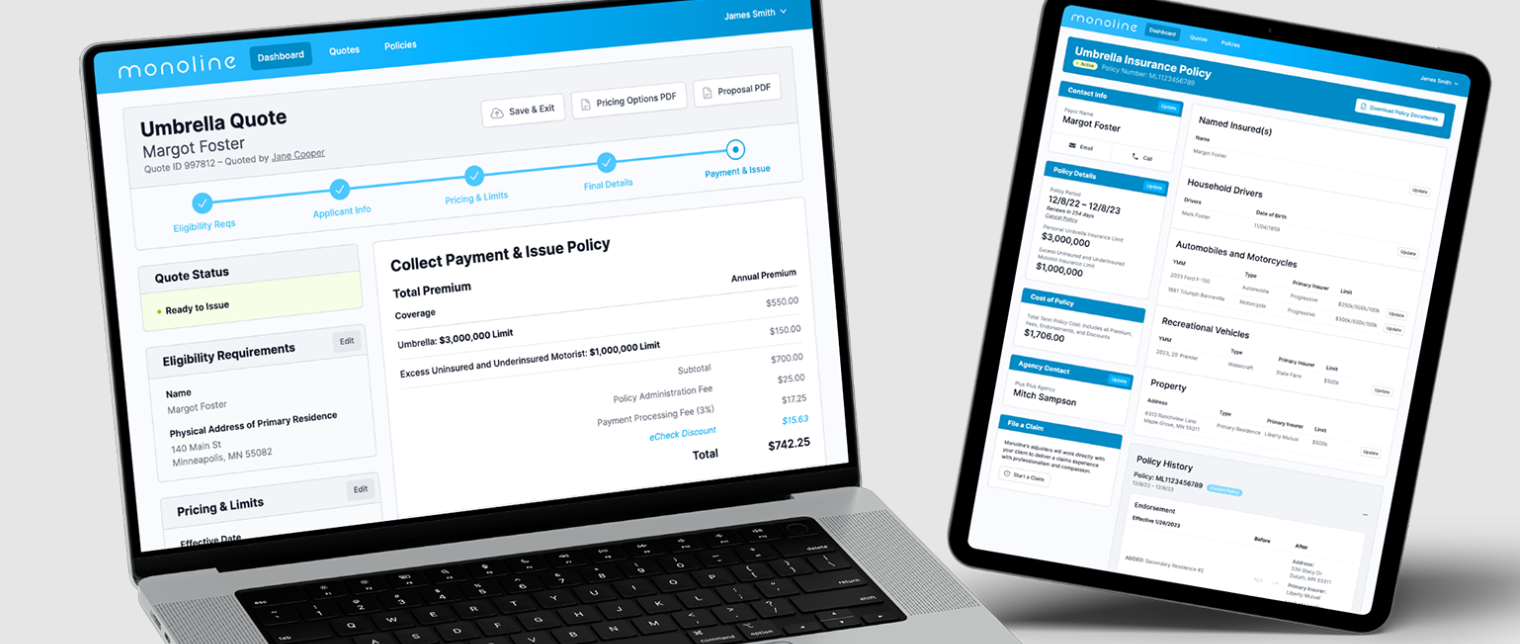

1. Identify All Potential Policies

The first step is identifying all insurance policies that could provide coverage. Lawyers ask clients to disclose:

Declarations pages (showing policy numbers, limits, and effective dates)

Policy forms and endorsements

Umbrella or excess policies

Prior year or expired policies (which may have a role in long-tail claims)

In corporate or construction litigation, lawyers often request Certificates of Insurance (COIs) and review contractual obligations for “additional insured” provisions.

2. Analyze the Policy Language

Once the policies are gathered, lawyers carefully analyze the language. Key provisions reviewed include:

Insuring Agreement – What is covered?

Definitions – How does the policy define terms like "occurrence," "property damage," or "bodily injury"?

Exclusions – Are any specific types of losses excluded?

Conditions – Has the insured met conditions like prompt notice or cooperation?

Endorsements – These can alter or override standard policy terms.

Policy Limits – Both per-occurrence and aggregate limits.

Lawyers also examine “duty to defend” clauses, which in many jurisdictions are broader than the duty to indemnify.

3. Investigate the Facts of the Claim

Insurance coverage cannot be assessed in a vacuum. Lawyers must compare the actual facts of the incident or claim with the policy language. This involves:

Reviewing police reports, medical records, and incident reports

Interviewing clients or witnesses

Evaluating timelines of events

Assessing damages and types of loss

This factual alignment helps determine whether the insurer must defend or cover the loss.

4. Legal Research and Case Law Application

Coverage often hinges on nuanced interpretations of policy terms. Lawyers research:

Judicial interpretations of similar policy language

Precedent within the jurisdiction (state or federal)

Statutory requirements affecting coverage

Public policy exceptions (e.g., illegality, moral hazard)

Courts may interpret ambiguous language in favor of the insured, so legal research helps determine the likelihood of prevailing in a coverage dispute.

5. Communicate with the Insurer

If a claim is pending, lawyers typically:

Notify the insurer promptly and submit the claim

Request a defense, where applicable

Ask for a coverage position letter stating whether the insurer will defend or indemnify

If coverage is denied or reserved (under a reservation of rights), lawyers scrutinize the denial letter and may push back with legal arguments, additional documentation, or a request for reconsideration.

6. Prepare for Declaratory Judgment Actions or Coverage Litigation

If the insurer denies coverage or refuses to defend, the attorney may recommend initiating a declaratory judgment action to resolve the issue in court. This often arises in:

Coverage denials

Disputes over exclusions or endorsements

Disagreements between primary and excess insurers

In some cases, insureds or third-party claimants may assert bad faith claims against the insurer for wrongful denial of coverage or failure to settle within policy limits.

Special Considerations Based on Representation

For Plaintiffs’ Attorneys

Plaintiffs’ attorneys investigate coverage to:

Determine whether a judgment will be collectible

Identify all possible sources of recovery (e.g., multiple defendants, umbrella policies)

Leverage settlement negotiations

Preserve bad faith claims by making timely, policy-limit demands

For Defense Attorneys (Representing Insureds)

Defense counsel evaluates whether the insurer must defend and, if applicable:

Ensures the insurer is paying for legal fees and costs

Monitors for conflicts of interest

Advises clients about excess exposure

Coordinates with personal counsel if needed

For Insurer Counsel

Lawyers representing insurers conduct investigations to:

Evaluate risk and exposure

Assess whether exclusions apply

Advise on issuing reservation of rights or denial letters

Manage litigation strategy, including tendering defense or initiating declaratory actions

Tools and Resources Used by Lawyers

Lawyers rely on several resources during insurance coverage investigations:

Policy databases for standard ISO forms and historical versions

Insurance experts or consultants for complex commercial policies

Claims handling guidelines from insurers

Regulatory bulletins from state insurance departments

Litigation tools such as subpoenas or discovery requests for uncovering additional policies

Conclusion

Insurance coverage investigations are a critical part of legal strategy across a wide array of practice areas. Whether representing policyholders seeking defense and indemnity or insurers evaluating their exposure, lawyers must understand the interplay between policy language, legal precedent, and the facts of the case.

By thoroughly investigating coverage, attorneys can clarify rights and responsibilities early, influence settlement dynamics, and avoid costly litigation missteps. For many cases, uncovering the nuances of insurance coverage can be the difference between full compensation and no recovery at all.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.