India's MSME sector is the growth engine for the economy, representing nearly 30% contribution to GDP and generating substantial employment. Yet availability of credit on time and at affordable rates has always been a challenge for MSMEs. Traditional loans usually require a lot of paperwork and red tape and a very long acceptance process that some can’t wait until they receive the funds. Modern Loan Origination Systems (LOS) are changing the face of MSME lending in India today for the better, making funding faster, easier, and more democratic than ever before.

What Is a Loan Origination System (LOS)?

A Loan Origination System (LOS) is a digital gateway that automates and simplifies the whole process of lending, right from the application and documentation to underwriting, approval, and dispersal of the loan amount. These technologies drastically decrease processing time, minimize manual error, and benefit the overall customer experience.

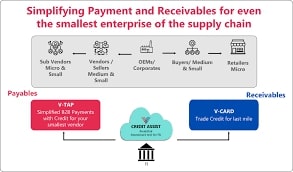

Fintech pioneers such as Vayana have played a crucial role in the implementation of state-of-the-art LOS solutions designed specifically for MSMEs. Vayana’s solution removes these traditional barriers, giving small businesses access to capital when they truly need it the most.

How Modern LOS Are Reshaping MSME Lending

1. Speeding Up Loan Processing

Online loan applications on contemporary LOS platforms can be easily filled out by MSMEs, in most cases in a few minutes. Automated checks of GST returns, bank statements, and Aadhaar details help in quicker underwriting. For example, borrowers using Vayana’s technology can shorten loan processing time from weeks to a few days, which generates critical liquidity when businesses need it most.

2. Enabling Data-Driven Lending

Emerging LOS platforms use alternative and online sources of information like GST filings, e-invoices, and digital payments for judging the quality of credit. This is good news for MSMEs that do not have a formal credit history but a healthy digital business. Vayana is driving this change by bringing about convenient convergence of trade and tax data to enhance ease of financing for MSMEs.

3. Reducing Operational Costs

The automation of different points in the lending cycle can cut costs dramatically for financial institutions. This, in effect, enables lenders to extend loans at lower interest rates to MSMEs. Vayana’s scalable LOS systems enable lenders to support a larger houseload while staying away from expensive overheads.

4. Improving Transparency and Compliance

It records everything and ensures adherence to the law with updated records as per RBI guidelines and GST laws and more. Enjoying the robust base in GST Suvidha Provider (GSP)-based services, namely Vayana being one such leading company in this case, provides a distinct advantage by integrating compliance throughout the entire loan origination experience.

5. Supporting Financial Inclusion

The intuitive, digital-first nature of contemporary LOS platforms is clearing the path for micro and small businesses in Tier 2 and 3 cities to get formal credit. Vayana is at the forefront of financial inclusion, offering access to finance to even the smallest of businesses.

Conclusion

The revolution of MSME lending in India via advanced Loan Origination Systems is not a trend—it’s a shift that is long overdue. Through technology adoption, lenders can open up the credit ecosystem to be more inclusive, faster, and affordable. Revolutionary organizations like Vayana are at the vanguard of this revolution, fueling millions of MSMEs to fulfill their potential.

As India inches toward a $5 trillion economy, these new LOS platforms and innovative players such as Vayana will further bloom in the ecosystem to feed into the growth and success of the MSME sector.