How to Apply for Loans on eLoan Warehouse: A Step-by-Step Guide

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

In today’s fast-paced world, financial emergencies can hit at any time. Whether it's an unexpected medical bill, car repair, or urgent utility payment, having access to fast cash can be a lifesaver. That’s where payday loans come in—and platforms like payday loans eLoan Warehouse make the application process simple, fast, and accessible. If you’re looking to apply for a payday loan online, this guide will walk you through the entire process of using eLoan Warehouse effectively and responsibly.

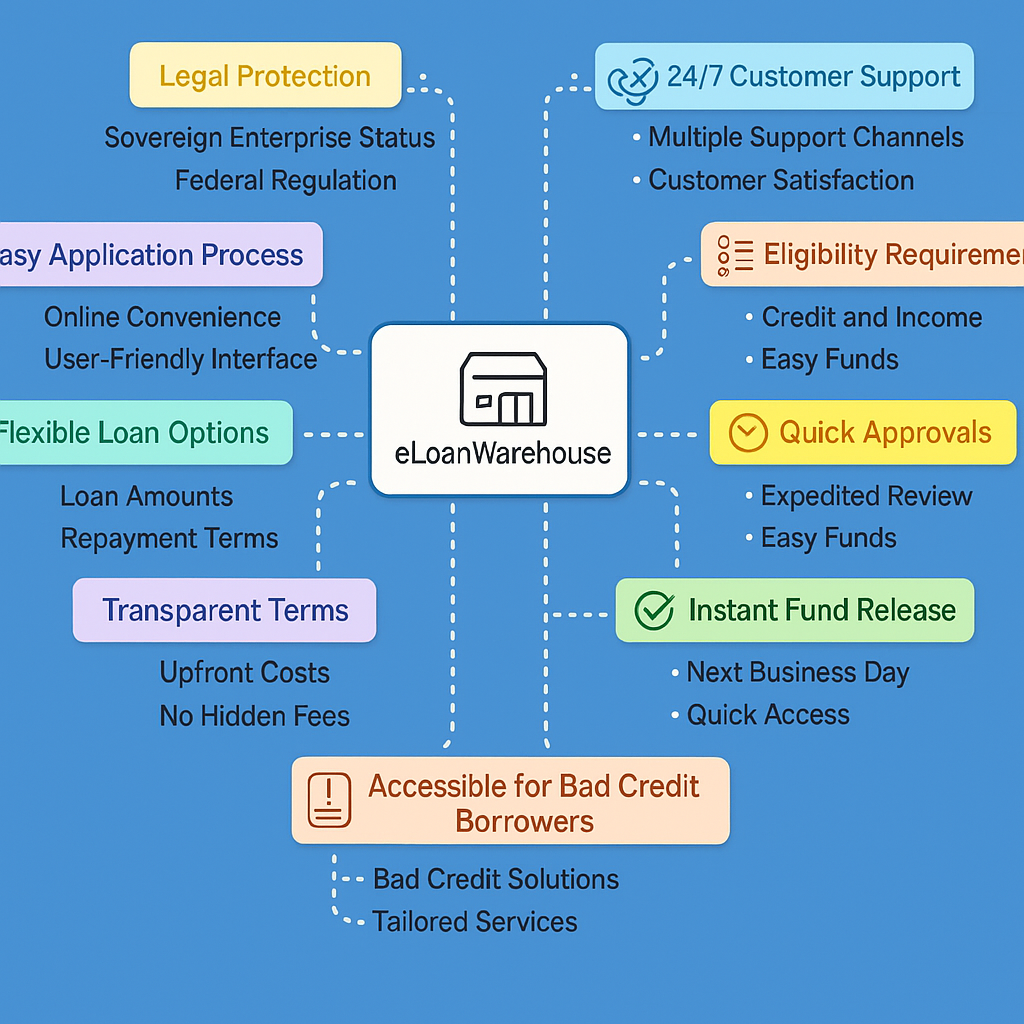

What is eLoan Warehouse?

eLoan Warehouse is a trusted online lender that offers short-term financial solutions, including payday loans and installment loans. The platform focuses on speed, convenience, and customer satisfaction, making it ideal for borrowers who need funds quickly and prefer an entirely digital process. With minimal paperwork and no need to visit a physical office, you can apply and receive funds directly to your bank account without leaving your home.

What is a Payday Loan?

A payday loan is a short-term loan designed to help you cover immediate expenses until your next paycheck arrives. These loans are typically smaller in amount—ranging from $100 to $1,000—and are meant for temporary financial relief. Borrowers are expected to repay the loan, including fees and interest, by their next payday. Because of their short-term nature, payday loans often come with higher interest rates than traditional loans, so they should be used with caution.

Who is Eligible to Apply?

Before applying on eLoan Warehouse, make sure you meet these basic eligibility requirements:

Be at least 18 years old

Be a U.S. citizen or permanent resident

Have an active checking account

Provide proof of steady income

Not be in active bankruptcy proceedings

Meeting these criteria helps ensure a smoother application process and increases your chances of approval.

Step-by-Step: How to Apply for a Payday Loan on eLoan Warehouse

Step 1: Visit the Official Website

Start by visiting the official eLoan Warehouse website at eloanwarehouse.com. Ensure you're on the secure site to protect your personal information.

Step 2: Choose Your Loan Type

eLoan Warehouse offers multiple loan options, so select “Payday Loan” from the menu. If you're unsure, the site also provides information to help you compare payday vs. installment loans.

Step 3: Complete the Online Application

Click on “Apply Now” to begin the application. You’ll be asked to provide:

Personal Information: Name, address, Social Security number, etc.

Employment Details: Employer, job title, monthly income, and pay schedule

Banking Info: Checking account and routing numbers for direct deposit

Make sure to double-check everything for accuracy. Inaccurate info could delay or disqualify your application.

Step 4: Submit and Wait for Approval

Once submitted, the platform typically reviews your application within minutes during business hours. If additional verification is needed, you may be contacted via phone or email.

Step 5: Review and Accept the Loan Offer

If approved, you'll receive a loan offer detailing:

The loan amount

Repayment terms

Interest rate and fees

Due date

Read this thoroughly before signing. Once you’re comfortable with the terms, e-sign the agreement to finalize your loan.

Step 6: Receive Your Funds

After the agreement is signed, funds are usually deposited into your checking account by the next business day, though sometimes even sooner.

Repayment Process

Repayment typically occurs automatically on your next payday, via a scheduled bank draft. Make sure you have enough funds in your account to avoid overdraft fees or late penalties. If you're unable to repay on time, contact eLoan Warehouse immediately—some flexibility may be offered depending on your situation.

Final Tips for Borrowers

✅ Only borrow what you truly need

✅ Read the loan agreement carefully

✅ Have a repayment plan in place

❌ Avoid rolling over loans repeatedly—this leads to more fees

Conclusion

Applying for a payday loan on eLoan Warehouse is a quick and straightforward process that can provide immediate relief in financial emergencies. As long as you borrow responsibly and understand the repayment terms, payday loans can be a helpful tool for short-term cash needs. Always treat these loans as temporary solutions and explore alternatives for long-term financial stability.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.