How to Invest in Parag Parikh Mutual Fund Schemes via SIP

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Investing in mutual funds has gained significant traction among individuals looking to grow their wealth over time. Among the various options available, Parag Parikh Mutual Fund schemes, including the popular Parag Parikh Tax Saver Fund, stand out due to their robust performance and investor-friendly approach. This article will guide you through the process of investing in Parag Parikh Mutual Fund schemes, particularly through the Systematic Investment Plan (SIP) method.

✍️ Wondering how to save taxes while growing your money? Learn how ELSS funds under the umbrella of mutual funds not only provide attractive returns but also help you claim deductions under Section 80C, making them a smart choice for Indian investors.

What is the Parag Parikh Mutual Fund?

Parag Parikh Mutual Fund is a well-established investment management company known for its strong investment philosophy and diversified range of mutual fund schemes. The fund house aims to provide investors with opportunities that align with their financial goals while focusing on long-term wealth creation.

Key Features of Parag Parikh Mutual Fund

1. Diverse Investment Options: Parag Parikh Mutual Fund offers a variety of schemes catering to different investment horizons and risk appetites. This includes equity funds, hybrid funds, and tax-saving funds.

2. Strong Track Record: The funds have a history of consistent performance, driven by a disciplined investment strategy.

3. Investor-Centric Approach: The fund house emphasizes transparency and regular communication with investors, ensuring they are well informed about their investments.

Understanding SIP (Systematic Investment Plan)

What is SIP?

A Systematic Investment Plan (SIP) is an investment method that allows individuals to invest a fixed amount in mutual funds at regular intervals (monthly, quarterly, etc.). SIPs help in averaging the cost of purchase and instilling a disciplined saving habit.

Benefits of SIP in Parag Parikh Mutual Fund

1. Rupee Cost Averaging: Investing a fixed amount regularly allows you to buy more units when prices are low and fewer units when prices are high, averaging your overall investment cost.

2. Compounding Benefits: Over time, the returns generated from your investments can be reinvested, leading to exponential growth through compounding.

3. Affordability: SIPs make it easier for investors to enter the market without needing a large sum of money upfront.

4. Flexibility: Investors can start, stop, or modify their SIP investments based on their financial circumstances.

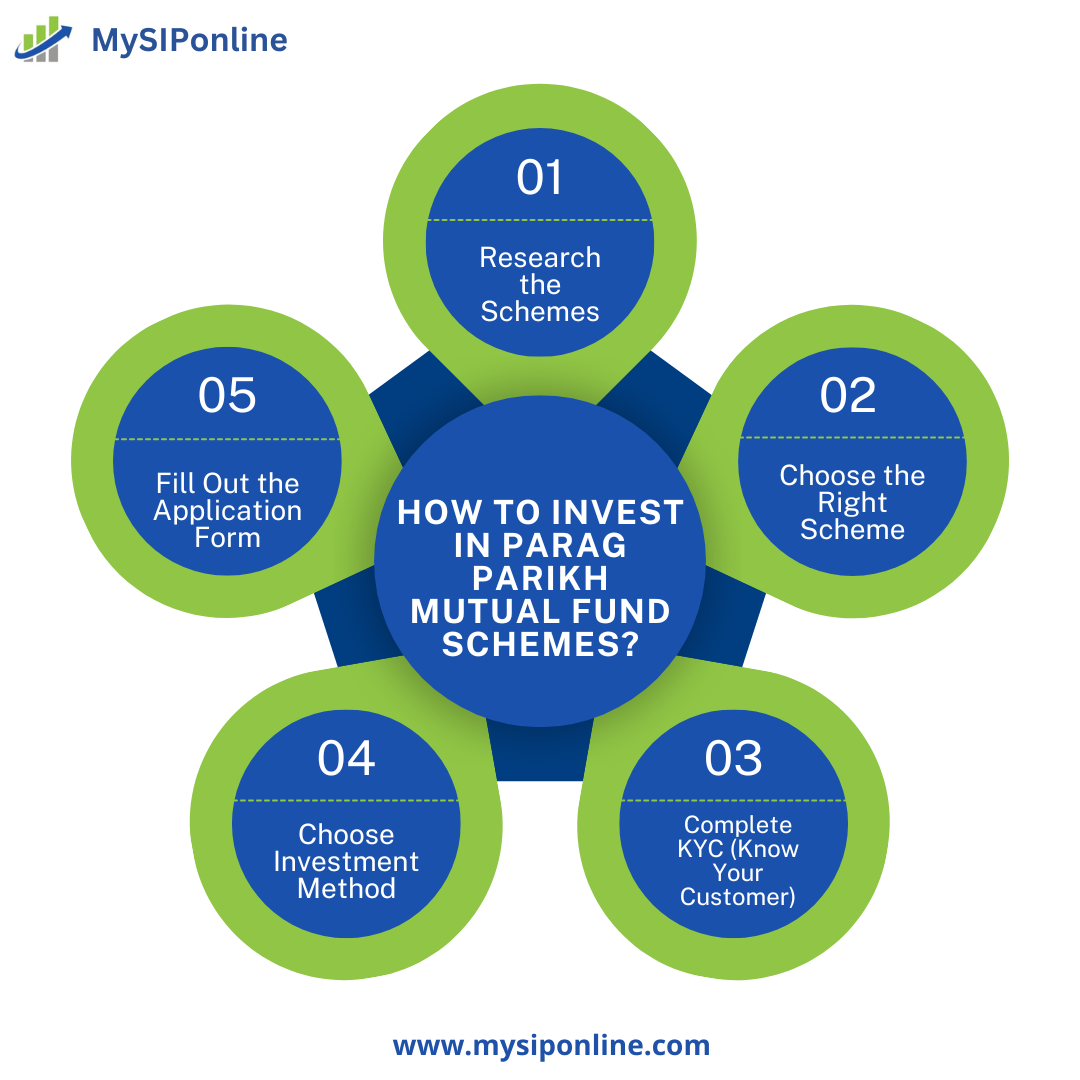

How to Invest in Parag Parikh Mutual Fund Schemes via SIP

Investing in Parag Parikh Mutual Fund schemes through SIP is a straightforward process. Here’s a step-by-step guide to get you started:

Step 1: Research and Choose a Scheme

Before investing, it’s essential to understand the different schemes offered by Parag Parikh Mutual Fund. The Parag Parikh Tax Saver Fund is an excellent option for those looking to save on taxes under Section 80C while benefiting from equity investments. Review the scheme’s performance, risk factors, and investment strategy to ensure it aligns with your financial goals.

Step 2: Get Your KYC Done

To invest in mutual funds in India, you must complete the Know Your Customer (KYC) process. You can do this online through the mutual fund’s website or various KYC registration agencies. Ensure you have the necessary documents, such as:

1. PAN Card

2. Aadhar Card

3. Address proof

4. Passport-sized photographs

Step 3: Choose Your Investment Platform

You can invest in Parag Parikh Mutual Fund schemes directly through their official website or through various third-party platforms such as:

1. Mutual Fund Registrars: These platforms allow direct investments.

2. Investment Apps: Many fintech applications provide an easy way to invest in mutual funds.

3. Financial Advisors: Consulting a financial advisor can help tailor your investments based on your needs.

Step 4: Set Up Your SIP

Once you’ve chosen your platform, follow these steps to set up your SIP:

1. Fill Out the Application Form: Provide your personal details, scheme choice (e.g., Parag Parikh Tax Saver Fund), and SIP amount.

2. Choose the SIP Frequency: Decide whether you want to invest monthly, quarterly, or at another interval.

3. Provide Bank Mandate: Fill out the auto-debit mandate to allow the investment amount to be deducted from your bank account automatically.

4. Submit the Application: After verifying the details, submit your application along with the necessary documents.

Step 5: Monitor Your Investments

After setting up your SIP, it’s essential to monitor your investments periodically. Keep track of how the Parag Parikh Mutual Fund schemes are performing and make adjustments as necessary based on market conditions and your financial goals. Most platforms provide easy access to your investment performance through dashboards.

Conclusion

Investing in Parag Parikh Mutual Fund schemes, especially through the Parag Parikh Tax Saver Fund, is an excellent way to grow your wealth while enjoying tax benefits. Utilizing the SIP method allows for disciplined investing, making it easier for individuals to participate in the equity market without needing a large capital outlay.

By following the outlined steps, you can embark on your investment journey confidently, knowing you have chosen a reputable fund house with a track record of success. Always remember to review your investments periodically and stay informed about market trends to make the most of your investment strategy. Happy investing!

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.