How to Write a Cancelled Cheque Correctly to Avoid Mistakes

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

In a world where digital transactions are becoming ubiquitous, the traditional cancelled cheque still holds its significance in various financial dealings. Whether you're applying for a loan, setting up an Electronic Clearance Service (ECS), or activating a new payment card, a cancelled cheque might be required to validate your bank details. Understanding how to write a cancelled cheque correctly can prevent errors and ensure smooth financial operations.

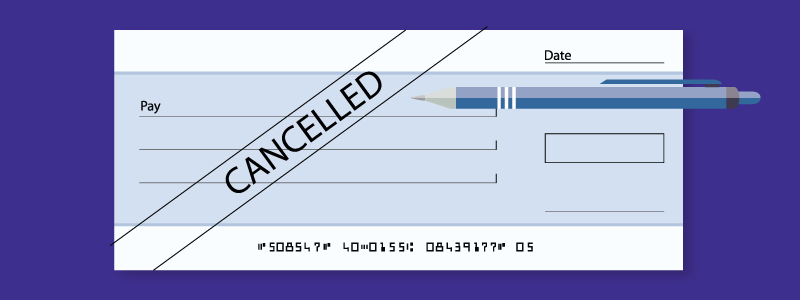

What is a Cancelled Cheque

A cancelled cheque is simply a cheque that is crossed out with the word 'CANCELLED' written across it. This serves as proof that you hold an account with the bank and ensures legitimacy for various purposes like ECS mandates, verifying bank account details, or even applying for certain financial products. While a cancelled cheque doesn’t authorise any withdrawal or transaction, it holds enough power to prove the existence of your account.

Steps to Write a Cancelled Cheque Correctly

- Take a Blank Cheque: Start with a blank cheque from your chequebook. Ensure that the essential details like your name, account number, IFSC code, and branch details are clearly visible.

- Write the Word ‘CANCELLED’: Across the cheque, write the word 'CANCELLED' in bold letters from one corner to the opposite corner. Make sure to use a pen with dark ink, usually blue or black, to guarantee that it is legible.

- Avoid Signing the Cheque: Unlike other cheques, do not sign the cancelled cheque. Your signature is not necessary and it prevents any misuse of the cheque for financial transactions.

- Keep Vital Details Visible: Ensure that the bank's name, branch details, and your account number remain visible even after you’ve written ‘CANCELLED’ on the cheque.

Following these steps meticulously ensures that the cheque serves its purpose without being prone to fraudulent activities.

The Bajaj Finserv Insta EMI Card: Expanding Financial Flexibility

Speaking of financial products, if you frequently need cancelled cheques for generating EMI mandates, the Insta EMI Card from Bajaj Finserv could be your ideal match. This card acts as a gateway to smarter purchases through staggered payments.

Benefits of the Bajaj Finserv Insta EMI Card

- No-Cost EMI: One of the most attractive features of the Insta emi card is the ability to shop on no-cost EMIs. This means you can buy now and pay over time without any added interest.

- Wide Acceptance: Whether you're buying home appliances, electronics, or clothing, this card is recognised across numerous partner stores and online shopping platforms, adding to its versatility.

- Pre-Approved Loan: The card comes with a pre-approved loan limit which allows you to shop Instantly, eliminating the hassle of lengthy approval processes each time you make purchases.

- Digital Card: Free yourself from the worry of carrying another physical card, as the Insta emi card is digital. This increases ease of access and security, ensuring you have your card details wherever your phone is.

- Flexible Tenure: You can choose a repayment tenure that suits your financial condition, ranging from manageable short terms to comfortable longer durations.

How to Apply for the Bajaj Finserv Insta EMI Card

1. Visit the Website

Start by visiting the Bajaj Finserv website.

2. Eligibility Check

Ensure that you meet the eligibility criteria, which may involve being of a certain age and having a stable income.

3. Online Application

Follow the guidelines provided to fill out the online application form. This includes providing necessary personal and financial information.

4. Verification

Bajaj Finserv will verify your details, and upon successful validation, your Insta emi card will be issued. You can decide to have it available digitally for immediate use.

5. Activate and Use

Upon receiving your digital Insta emi card, follow the instructions to activate it. Afterwards, enjoy making purchases on your terms.

By writing a cancelled cheque correctly and embracing tools like the Insta emi card, you can foster an environment of financial empowerment and ease. As you navigate this financial landscape, the combination of traditional proof like cancelled cheques and modern instruments like the Insta EMI Card will ensure you remain ahead and secure in your dealings.

Conclusion

In conclusion, both the accurate writing of a cancelled cheque and the use of innovative financial products like the Insta emi card provide the foundation for trustworthy and convenient financial navigation. As you engage in various fiscal activities, let these tools elevate your experience, making transactions not only feasible but also a strategic endeavour.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.