Hydraulic Workover Unit Market 2024 | Size, Trends and Forecast by 2032

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

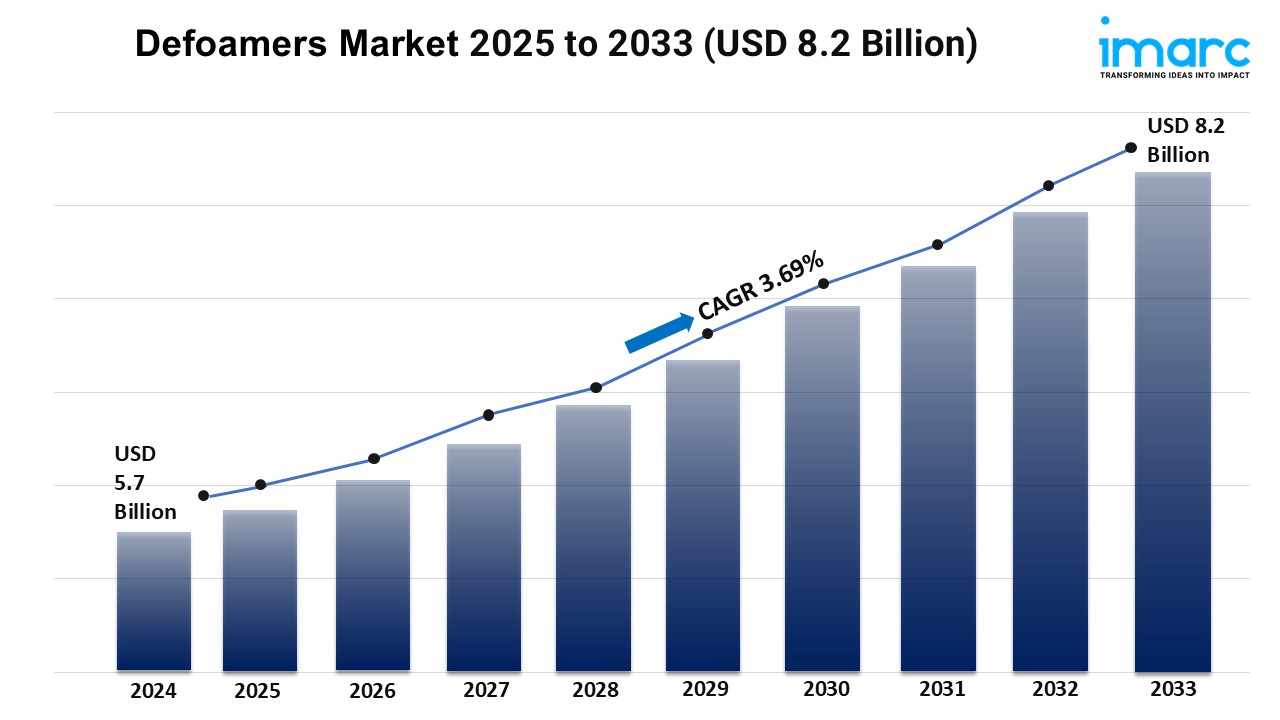

IMARC Group's report titled "Hydraulic Workover Unit Market Report by Service (Workover, Snubbing), Installation (Skid Mounted, Trailer Mounted), Capacity (50 Tons, 51 to 150 Tons, Above 150 Tons), Application (Onshore, Offshore), and Region 2024-2032", offers a comprehensive analysis of the industry, which comprises insights on the global hydraulic workover unit market share. The global market size reached US$ 9.4 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 14.1 Billion by 2032, exhibiting a growth rate (CAGR) of 4.61% during 2024-2032.

For an in-depth analysis, you can refer sample copy of the report: https://www.imarcgroup.com/hydraulic-workover-unit-market/requestsample

Factors Affecting the Growth of the Hydraulic Workover Unit Industry:

- Technological Advancements:

The integration of automation and advanced control systems in hydraulic workover units (HWU) to enhance precision and efficiency while reducing the potential for human error is impelling the market growth. Automation in HWUs facilitates more accurate drilling, consistent execution of workover tasks, and safer operations, especially in challenging or hazardous environments. Moreover, the incorporation of real-time data analytics and monitoring systems provides operators with immediate insights into various parameters, such as downhole conditions, equipment performance, and operational risks, allowing for swift and informed decision-making. Additionally, advancements in materials science are leading to the development of more robust and durable equipment capable of withstanding extreme pressures and corrosive environments, thereby extending the life of HWUs and reducing maintenance costs.

- Environmental and Regulatory Policies:

Governing agencies and international bodies are enforcing stricter regulations to mitigate the environmental impact of oil and gas operations. These policies often mandate reductions in carbon emissions, stricter controls on waste disposal, and enhanced safety protocols to protect ecosystems. HWU manufacturers and operators are adapting by integrating more eco-friendly technologies, such as low-emission engines and advanced systems for managing and reducing waste. Moreover, the push for compliance with these policies is fostering innovation in the sector, leading to the development of more efficient and less environmentally disruptive HWUs.

- Rise in Offshore Exploration and Production Activities:

The increasing focus on offshore oil and gas reserves, driven by the pursuit of untapped oil and gas reserves, is strengthening the market growth. Offshore fields, often located in deep-water and ultra-deep-water regions, present unique challenges that require specialized equipment and operations. HWUs are critical in these settings for their ability to perform complex workovers, drilling, and intervention tasks under challenging conditions. The shift towards exploring new offshore reserves and maximizing output from existing ones is catalyzing the demand for HWUs adept in offshore operations. This is further supported by technological advancements that enhance the capabilities of HWUs in offshore settings.

Leading Companies Operating in the Global Hydraulic Workover Industry:

- Basic Energy Services Inc.

- Canadian Energy Equipment Manufacturing FZE

- Cased Hole Well Services LLC

- CUDD Pressure Control Inc. (RPC Inc.)

- EEST Energy Services (Thailand) Limited

- Halliburton Company

- High Arctic Energy Services Inc.

- NOV Inc., PT Elnusa Tbk (PT Pertamina)

- Superior Energy Services Inc.

- Tecon Oil Services Ltd.

- Velesto Energy Berhad

- WellGear Group B.V.

Hydraulic Workover Unit Market Report Segmentation:

By Service:

- Workover

- Snubbing

Workover exhibits a clear dominance in the market due to the growing demand for maintenance and repair operations in aging oil fields.

By Installation:

- Skid Mounted

- Trailer Mounted

Trailer mounted represents the largest segment owing to its mobility, cost-effectiveness, and ease of deployment in various locations.

By Capacity:

- 50 Tons

- 51 to 150 Tons

- Above 150 Tons

Above 150 tons hold the biggest market share. They are needed to handle the increasing complexities and depths of modern oil and gas wells.

By Application:

- Onshore

- Offshore

Onshore accounts for the majority of the market share as the majority of the oil and gas reservoirs are situated on land.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America dominates the market attributed to the extensive oil and gas exploration and production activities in the region.

Global Hydraulic Workover Unit Market Trends:

The growing integration of advanced analytics and artificial intelligence (AI) in HWU is enabling predictive maintenance, which reduces downtime and operational costs. AI algorithms analyze data from HWU operations to predict equipment failures before they occur, allowing for timely maintenance and avoiding costly unplanned shutdowns. Additionally, advanced analytics are used to optimize workover operations, enhancing decision-making processes and improving the overall efficiency and effectiveness of HWU deployments. This trend not only supports operational efficiency but also drives innovation in HWU design and functionality.

Note: If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145 | United Kingdom: +44-753-713-2163

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.