Hydraulic Workover Unit Market Report 2024 | Size, and Trends Forecast by 2032

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

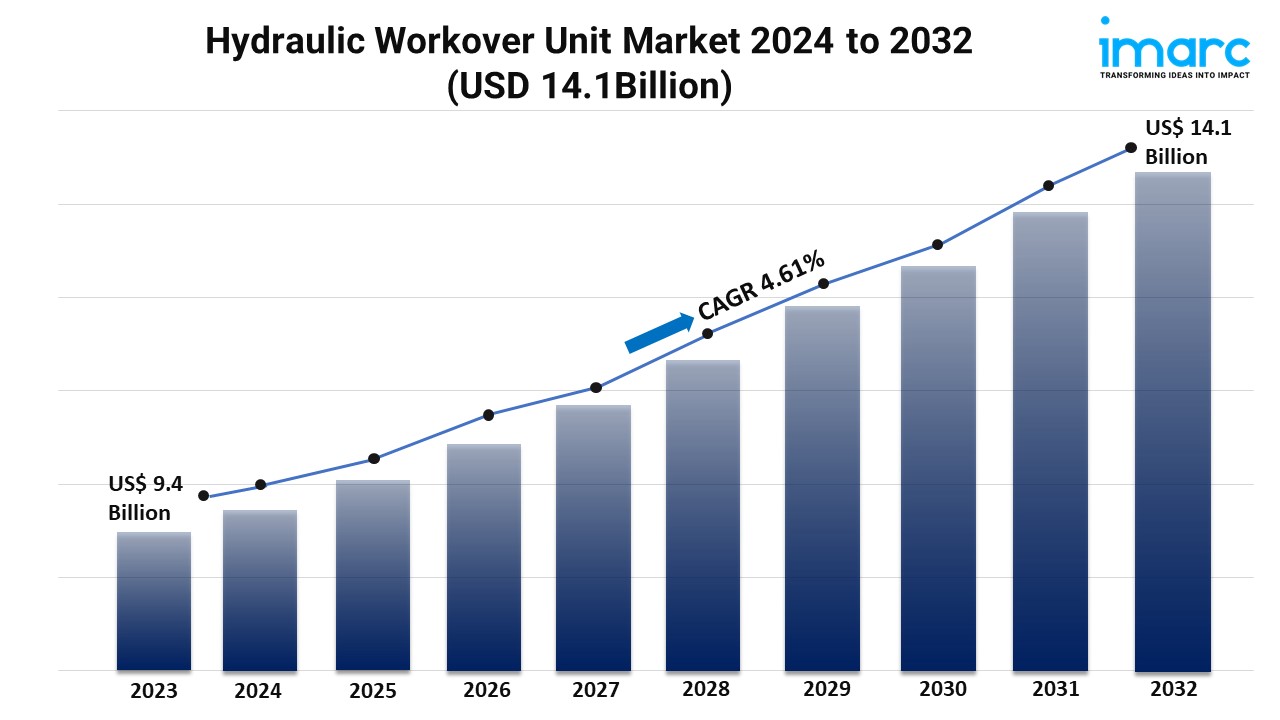

Global Hydraulic Workover Unit Market Statistics: USD 14.1 Billion Value by 2032

Hydraulic Workover Unit Industry

Summary:

- The global hydraulic workover unit market size reached USD 9.4 Billion in 2023.

- The market is expected to reach USD 14.1 Billion by 2032, exhibiting a growth rate (CAGR) of 4.61% during 2024-2032.

- North America leads the market, accounting for the largest hydraulic workover unit market share.

- Workover holds the majority of the market share in the service segment due to its ability to handle heavy lifting and well-completion tasks efficiently and safely.

- Trailer mounted exhibits a clear dominance in the hydraulic workover unit industry.

- Above 150 tons remain a dominant segment in the market, as they are highly durable, which makes them a long-term investment for oil and gas companies.

- Onshore represents the leading application segment.

- The growing activities of oil and gas exploration and production is a primary driver of the hydraulic workover unit market.

- Advancements in hydraulic workover technology are reshaping the hydraulic workover unit market.

Request for a sample copy of this report: https://www.imarcgroup.com/hydraulic-workover-unit-market/requestsample

Industry Trends and Drivers:

- Growing oil and gas exploration and production:

As oil and gas companies are exploring and developing new reserves, particularly in offshore and onshore fields, the demand for hydraulic workover units (HWUs) as efficient and reliable equipment to handle well interventions, repairs, and optimization activities is growing. HWUs allow for cost-effective, safe, and reliable servicing of wells without the need for full drilling rigs. With the expansion of oil and gas exploration, including the development of unconventional resources, the need for HWUs to maintain well integrity, enhance production, and prolong the life of wells is rising, thereby impelling the growth of the market.

- Advancements in hydraulic workover technology:

Innovations in hydraulic workover technology, aimed at improving the efficiency and reliability of well-intervention operations, are offering a favorable market outlook. New technologies, such as automation, real-time data monitoring, and more powerful hydraulic systems, are making hydraulic workover units (HWUs) more versatile and capable of handling a wider range of well interventions with greater precision. They allow for faster and more cost-effective operations, reducing downtime and increasing productivity. Additionally, innovations like enhanced control systems, better safety features, and advanced materials, which are making HWUs safer to operate, are driving the demand for HWUs.

- Rising concerns about safety and environmental compliance:

The growing concerns about safety and environmental compliance, which is encouraging the adoption of hydraulic workover units (HWUs) with reduced environmental impact of well-intervention activities, is positively influencing the market. HWUs offer advanced safety features, such as automated systems and remote operations, which reduce the need for personnel on-site and lower the risk of accidents and injuries. They are effective in minimizing surface disturbances, lowering emissions, and ensuring better control over wellbore fluids. As regulations surrounding safety and environmental protection are becoming stringent, oil and gas companies are turning to HWUs as more sustainable and compliant alternatives to traditional well-servicing methods, thereby supporting the market growth.

We explore the factors driving the growth of the market, including technological advancements, consumer behaviors, and regulatory changes, along with emerging hydraulic workover unit market trends.

Hydraulic Workover Unit Market Report Segmentation:

Breakup By Service:

- Workover

- Snubbing

Workover account for the majority of shares, which can be attributed to the rising focus on maintaining and enhancing well productivity.

Breakup By Installation:

- Skid Mounted

- Trailer Mounted

Trailer mounted dominates the market as it specifically designed to be transported easily on standard trailers.

Breakup By Capacity:

- 50 Tons

- 51 to 150 Tons

- Above 150 Tons

Above 150 tons represent the majority of shares due to their ability to handle more demanding and complex well operations.

Breakup By Application:

- Onshore

- Offshore

Onshore holds the majority of shares on account of the increasing need for cost-effective solutions.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America enjoys the leading position owing to a large market for hydraulic workover unit driven by regulatory standards and safety requirements.

Top Hydraulic Workover Unit Market Leaders:

The hydraulic workover unit market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies. Some of the key players in the market are:

- Basic Energy Services Inc.

- Canadian Energy Equipment Manufacturing FZE

- Cased Hole Well Services LLC

- CUDD Pressure Control Inc. (RPC Inc.)

- EEST Energy Services (Thailand) Limited

- Halliburton Company

- High Arctic Energy Services Inc.

- NOV Inc., PT Elnusa Tbk (PT Pertamina)

- Superior Energy Services Inc.

- Tecon Oil Services Ltd.

- Velesto Energy Berhad

- WellGear Group B.V.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145 | United Kingdom: +44-753-713-2163

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.