ICICI PRUDENTIAL BHARAT CONSUMPTION FUND: HURRY TO MAKE YOUR RETURNS HIGH NOW

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Introduction to ICICI Prudential Bharat Consumption Fund

The ICICI Prudential Bharat Consumption Fund is a thematic mutual fund that focuses on companies benefiting from the growing consumption trends in India. With the country's economy rising and consumer spending increasing, this fund presents a compelling opportunity for investors looking to enhance their portfolios.

As we move into 2024, now is the perfect time to consider investing in this fund to capitalize on potential high returns.

In this article, you will see more useful insights about this stock. This will make it easy to decide if this is the right fund for you or not. Let's begin the analysis.

What is the ICICI Prudential Bharat Consumption Fund?

Launched on April 12, 2019, the ICICI Prudential Bharat Consumption Fund is an open-ended equity scheme that primarily invests in equity and equity-related securities of companies engaged in consumption and consumption-related activities. The fund aims to generate long-term capital appreciation by focusing on sectors that are expected to thrive as consumer demand grows.

Key Features of the ICICI Prudential Bharat Consumption Fund

To understand this stock better, let's learn its characteristics as well:

1. Investment Objective: The fund seeks long-term capital appreciation by investing at least 80% of its net assets in companies that are likely to benefit from domestic consumption.

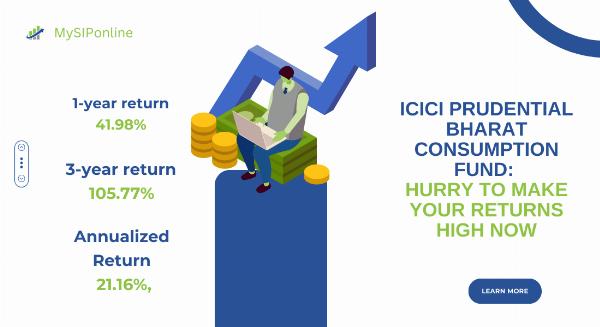

2. Performance: The fund has shown impressive returns, with a 1-year return of approximately 41.98% and a 3-year return of around 105.77%. Since its launch, it has delivered an annualized return of about 21.16%, indicating strong performance relative to its peers.

3. Expense Ratio: The expense ratio of the fund is 2.07%, which is slightly higher than the category average. This fee is charged for managing the fund and can impact overall returns.

4. Minimum Investment: Investors can start with a minimum investment of ₹5,000 for a lump sum or as low as ₹100 through a Systematic Investment Plan (SIP).

5. Diversified Portfolio: The fund invests across various sectors, including consumer staples, healthcare, automobiles, and services, providing diversification and reducing risk.

6. Benchmark Index: The fund is benchmarked against the NIFTY India Consumption Total Return Index, which tracks the performance of companies in the consumption sector.

Why Invest in ICICI Prudential Bharat Consumption Fund?

Here are some compelling reasons for you to consider this stock for your portfolio:

1. Rising Consumption Trends: With India’s growing middle class and increasing disposable incomes, the demand for consumer goods and services is expected to rise significantly. Investing in this fund allows you to tap into this growth potential.

2. Strong Performance History: The ICICI Prudential Bharat Consumption Mutual Fund has consistently outperformed its benchmark and peers, making it a reliable choice for investors seeking high returns.

3. Protection Against Volatility: The fund has demonstrated a strong ability to protect against market volatility, making it a safer option for investors concerned about market fluctuations.

4. Professional Management: Managed by experienced professionals, the fund employs a rigorous selection process to identify companies with strong growth potential in the consumption sector.

5. Long-Term Growth Potential: This fund is designed for long-term investors, providing the potential for substantial returns over time as the consumption landscape in India evolves.

Who Should Invest in ICICI Prudential Bharat Consumption Fund?

The ICICI Prudential Bharat Consumption Scheme is suitable for investors with the following characteristics:

1. Long-term investment horizon: The fund is designed for investors seeking long-term capital appreciation, typically with a horizon of 5 years or more.

2. Growth-oriented: The fund focuses on investing in companies that are expected to benefit from the growing consumption trends in India, making it suitable for investors with a growth-oriented approach.

3. Risk tolerance: As an equity fund, it carries market risks. Investors should have a moderate to high-risk tolerance and be prepared for potential volatility in the short term.

4. Diversification: The fund provides exposure to a diversified portfolio of companies across various sectors related to consumption, making it suitable for investors looking to diversify their portfolios.

5. Alignment with India's growth story: The fund allows investors to align their investments with the growing consumption trends in India, driven by factors such as rising disposable incomes, urbanization, and a growing middle class.

In summary, the ICICI Prudential Bharat Consumption MF is suitable for long-term, growth-oriented investors with a moderate to high-risk tolerance who want to participate in India's consumption growth story and diversify their portfolios.

Considerations Before Investing in ICICI Prudential Bharat Consumption Fund

The following points show the measures to be taken before investing:

1. Market Risks: As with all equity investments, the ICICI Prudential Bharat Consumption Fund carries market risks. Investors should be prepared for fluctuations in the fund's value.

2. Investment Horizon: The fund is best suited for long-term investors. If you require quick access to your funds, this may not be the ideal investment.

3. Exit Load: There is an exit load of 1% if units are redeemed within three months, which may affect short-term investors.

Conclusion

The ICICI Prudential Bharat Consumption Mutual Fund offers a unique opportunity for investors to capitalize on the growing consumption trends in India. To boost the overall flexibility of your portfolio, invest via a SIP.

With its strong performance history, professional management, and focus on long-term capital appreciation, now is the perfect time to consider investing in this fund.

By adding this stock to your portfolio, you can position yourself to benefit from the expanding consumption landscape in India and work towards achieving your financial goals. Don't miss out on the chance to make your returns high.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.