Important Elements of International Finance to Mention in Your Assignment

Finance on a global scale may be seen as a complex subject to tackle, but a handful of key points can help to make things easier for oneself. Therefore, whether you are a student at the beginning of your learning process or working on your assignment, you should first focus on learning the basics that will help you make it simpler for yourself. If any issues arise, you can rely on finance assignment help providers who are always ready to assist you.

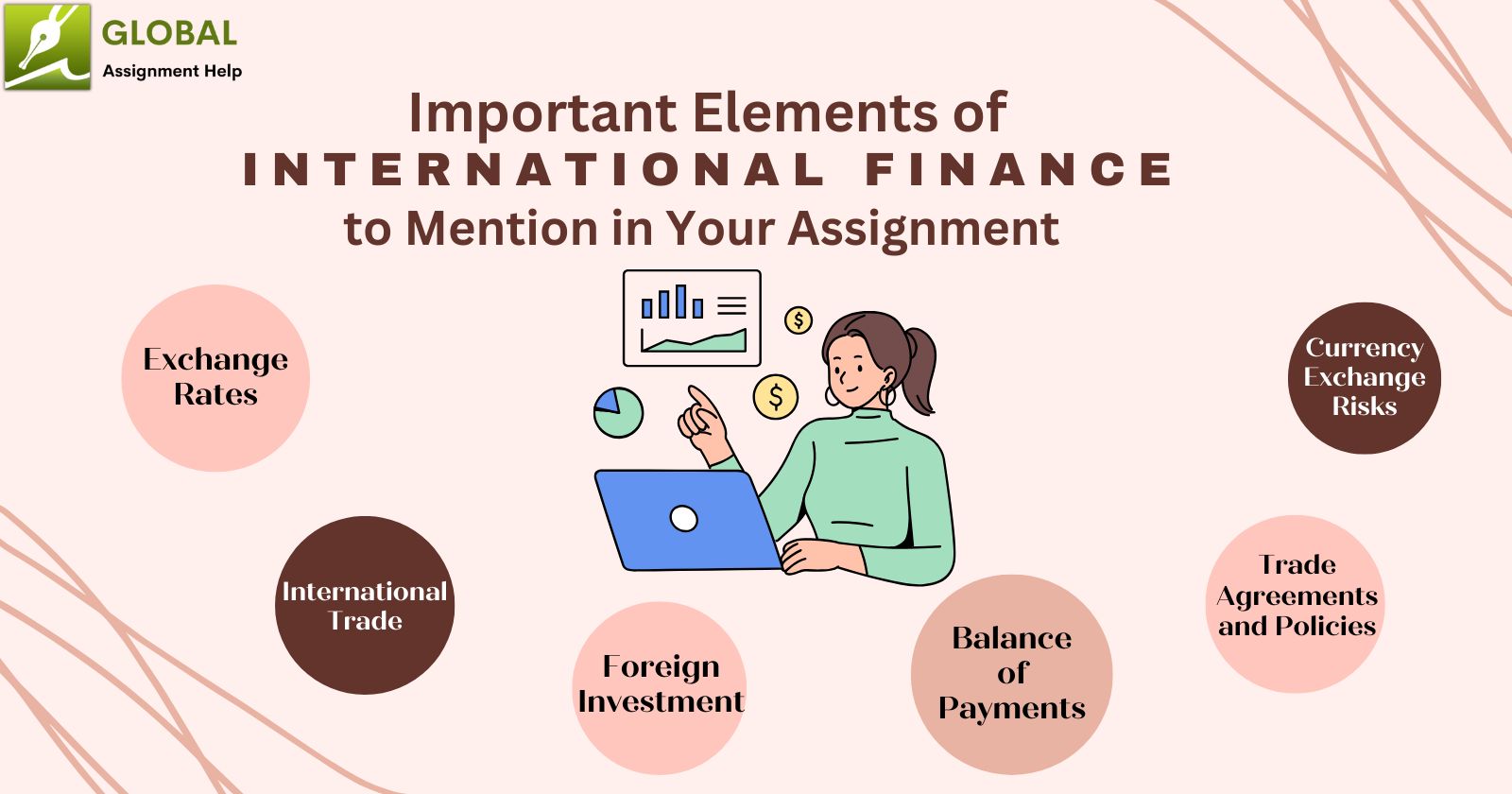

Essential Elements of International Finance to Mention in Your Assignment

Before analyzing the crucial components of international finance, it is important to comprehend the impact of this discipline on the world economy and how it relates to various organizations, states, and people.

1. Exchange Rates

Exchange rates are the amount of money from one nation that is equal to money from another nation. For instance, $1 can be equal to ₹ $80 in India or €0.95 in Europe. Exchange rates fluctuate daily depending on a nation's demand, supply, or economic power.

Suppose you are trading toys with your friend. If everyone wants your toy car, your friend will exchange two toy robots. But if no one wants your toy car, you will receive half a robot. Exchange rates function similarly—value increases or decreases depending on what people want.

2. International Trade

Nations exchange and sell goods (e.g., cars, phones, or foodstuffs) and services (e.g., financial, tourism) to one another. This is referred to as international trade. For instance, the U.S. sells computer programs to Japan, and Japan sells cars to America.

Trade allows nations to acquire things they cannot produce. Occasionally, nations disagree over taxes (tariffs) or what is prohibited from trading. Those disagreements can impact prices and operate globally.

3. Balance of Payments

A nation's "balance of payments" is similar to a diary that accounts for all money entering and leaving. It consists of two components:

Current Account: Accounts for money from trade (goods/services) and gifts (e.g., foreign aid).

Capital Account: Accounts for investments, i.e., purchasing land or shares in another nation.

If a nation spends more than it earns, it has a "deficit." If it earns more than it spends, it has a "surplus."

4. Foreign Investment

Foreign investment refers to investing funds in companies or assets in another country. Two forms:

Direct Investment: Purchasing a factory or firm overseas.

Portfolio Investment: Purchasing shares or bonds (e.g., loans) of foreign companies.

If an American company installs a shoe factory in Vietnam, it is a direct investment. If someone from France invests in a Japanese technology company shares, it is a portfolio investment.

5. International Financial Institutions

Some institutions assist nations with monetary issues. The most popular ones are:

International Monetary Fund (IMF): Lends nations money when needed.

World Bank: Loans money for poverty-alleviating projects (such as constructing hospitals or schools).

They are somewhat like "money doctors" for nations. If a nation cannot pay its loan, the IMF proposes a solution. If you have no time, you can buy assignment online from better websites. Just ensure they present ideas in a clear format without any complicated jargon. You can also find tools, such as videos or guidelines, to learn quickly.

6. Currency Exchange Risks

Companies that do business in numerous other nations have a dilemma: currency exchange rates fluctuate at random. Consider, for instance, that a German company is exporting bicycles to the U.S. If the dollar devalues, more euros will be needed to exchange for dollars when the bicycles are sold.

Companies prevent losses by employing devices such as "hedging" (insurance against currency changes) or holding reserves in a different currency.

7. Trade Agreements and Policies

Nations enter into trade agreements to facilitate business. Trade agreements lower taxes and trade restrictions. Some well-known trade agreements are:

NAFTA (Now USMCA): Trade agreement among the U.S., Canada, and Mexico.

EU Trade Agreements: Agreements between European Union nations and the rest of the world.

WTO (World Trade Organization): Facilitates resolving trade disputes and establishes international trade rules.

8. How Technology Impacts International Finance

Technology has revolutionized the way international finance operates. Digital payments and online banking facilitate cross-border transactions more quickly. Cryptocurrencies such as Bitcoin also impact global finance. Most businesses now utilize digital tools to handle their finances in various countries. International finance does not necessarily have to be a nightmare to write about. Begin by defining the six factors in your own words. Use real-life examples (like how a weak currency impacts travel expenses) to support your points.

Conclusion

International finance is an important topic for students. Covering exchange rates, trade, balance of payments, investment, international institutions, and currency risks, your assignment will be done with the fundamentals. And remember, if you get stuck, finance assignment help is at your fingertips. Keep it simple, do it one step at a time, and you'll be fine!

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.