In Flight Entertainment and Connectivity Market Growth and Segmentation Report 2024-2030

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

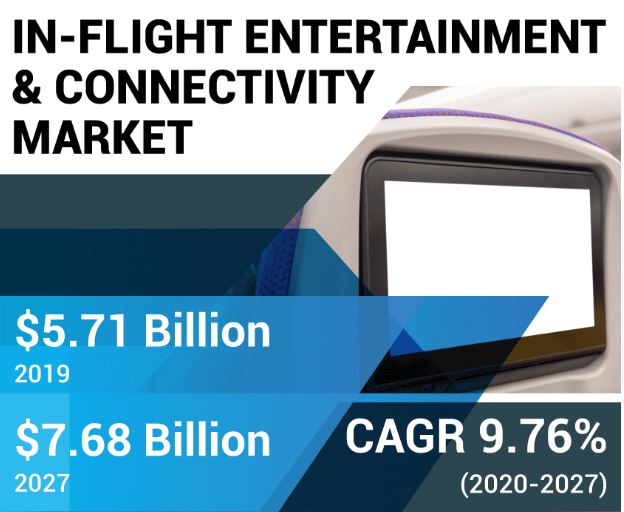

The global in-flight entertainment & connectivity market size was valued at USD 6.37 billion in 2022. The market is projected to grow from USD 7.48 billion in 2023 to USD 21.03 billion by 2030, exhibiting a CAGR of 15.9%.

The in-flight entertainment & connectivity system heightens a traveler’s experience along and makes the passenger feel comfortable and safe. This technology allows the passenger to use mobile devices in flight, using Wi-Fi-facility. In recent times, airlines have initiated to provide this technology to passengers to lure in more customers. Fortune Business Insights presents this information in their report titled "Global In-Flight Entertainment & Connectivity Market, 2023–2030."

Browse In-depth Summary of This Research Insight:

https://www.fortunebusinessinsights.com/in-flight-entertainment-connectivity-market-102519

Segmentation:

Satellite Communication and Internet Usage leads the IFE Connectivity Market

By type, the market is bifurcated into IFE connectivity and IFE hardware. Owing to the use of satellite communication and internet the IFE connectivity is projected to grow during the forecast period.

Non-Portable Segment Dominates the Market due to Enhanced Travel Experience

Based on IFE hardware the market is divided into non-portable IFE and portable IFE. The non-portable IFE segment dominates the market due to the demand for heightened travel experience by using advanced electronics systems.

Wired Connectivity Drives the Market due to Safety Features

By end-user the market is classified into wired connectivity and wireless connectivity. Wired connectivity dominates the market as it requires physical access from the flight-deck is more secure than wireless connectivity.

High Demand for Narrow Body Aircrafts Propels Market

By aircraft type the market is segmented into narrow body, wide body, business jets, and regional jets. The narrow body segment dominates the market due to the demand for narrow body aircraft and the rise in aircraft fleet size.

Rise in IFE Retrofits Bolsters the Segmental Growth.

By end-user, the market is divided into aftermarket and OEM. Rise in retrofit activities in commercial flights globally and increased maintenance contribute to the segment’s growth.

Geographically the market is segmented across North America, Europe, Asia Pacific, and Rest of the World.

Report Coverage:

The report offers:

Major growth drivers, restraining factors, opportunities, and potential challenges for the in-flight entertainment & connectivity market.

Comprehensive insights into regional developments.

List of major industry players.

Key strategies adopted by the market players.

Latest industry developments include product launches, partnerships, mergers, and acquisitions.

Drivers & Restraints:

High Maintenance of IFEC Equipment to Surge Growth

Bad handling of IFEC equipment in aircraft can cause damage to the hardware. This results in high maintenance and equipment replacement leading to high demand and increased revenue in the in-flight entertainment & connectivity system market share. Replacement of these electronic equipment costs high resulting in high revenue.

However, the trend of providing media entertainment services on passenger’s personal devices will likely hamper the in-flight entertainment & connectivity market growth.

Regional Insights: In-Flight Entertainment & Connectivity Market

Constant Initiatives by the Government to Maintain Europe’s Dominance

North America dominates the in-flight entertainment & connectivity market due to the presence of strong players such as Gogo LLC, Panasonic Avionics Corporation, and Collins Aerospace, among others. The region was valued at USD 2.07 billion in 2022. To increase the demand for IFEC the U.S. registered 13,000 jet aircraft during 2019.

Europe holds the second-largest in-flight entertainment & connectivity market share. The growth is due to the increasing adoption of 5G technology in the aviation sector.

Competitive Landscape

Key Companies Focus on R&D to Develop New Products for Global Expansion

The in-flight entertainment & connectivity market is fragmented with major players such as Collins Aerospace, Viasat Inc., Gogo LLC, and Panasonic Avionics Corporation, among others. Growing investment in R&D, enhanced travel experience, and strategic acquisitions are a few factors accountable for the growth of the companies.

Key Industry Development:

August 2021– West Entertainment (West) has extended its contract with All Nippon Airways (ANA) as an in-flight entertainment (IFE) Content Service Provider (CSP). As part of the partnership, now in its fourth year, West will work closely with ANA's programming team to present the IFE content portal that offers Hollywood, Western, International, and South Asian entertainment to passengers.

List of Key Players Profiled in the In-Flight Entertainment & Connectivity Market Report:

Astronics Corporation (U.S.)

Burrana Pty Ltd (Australia)

Collins Aerospace (U.S.)

FDS Avionics Corp. (U.S.)

Global Eagle Entertainment, Inc. (U.S.)

Gogo LLC (U.S.)

Honeywell International Inc (U.S.)

Lufthansa Systems GmbH & Co. KG (Germany)

Panasonic Avionics Corporation (U.S.)

Safran (France)

Sitaonair (Switzerland)

SmartSky Networks, LLC (U.S.)

Thales Group (France)

Viasat, Inc. (U.S.)

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.