India Fintech Market Size, Share, Industry Trends, Growth and Report 2025-2033

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

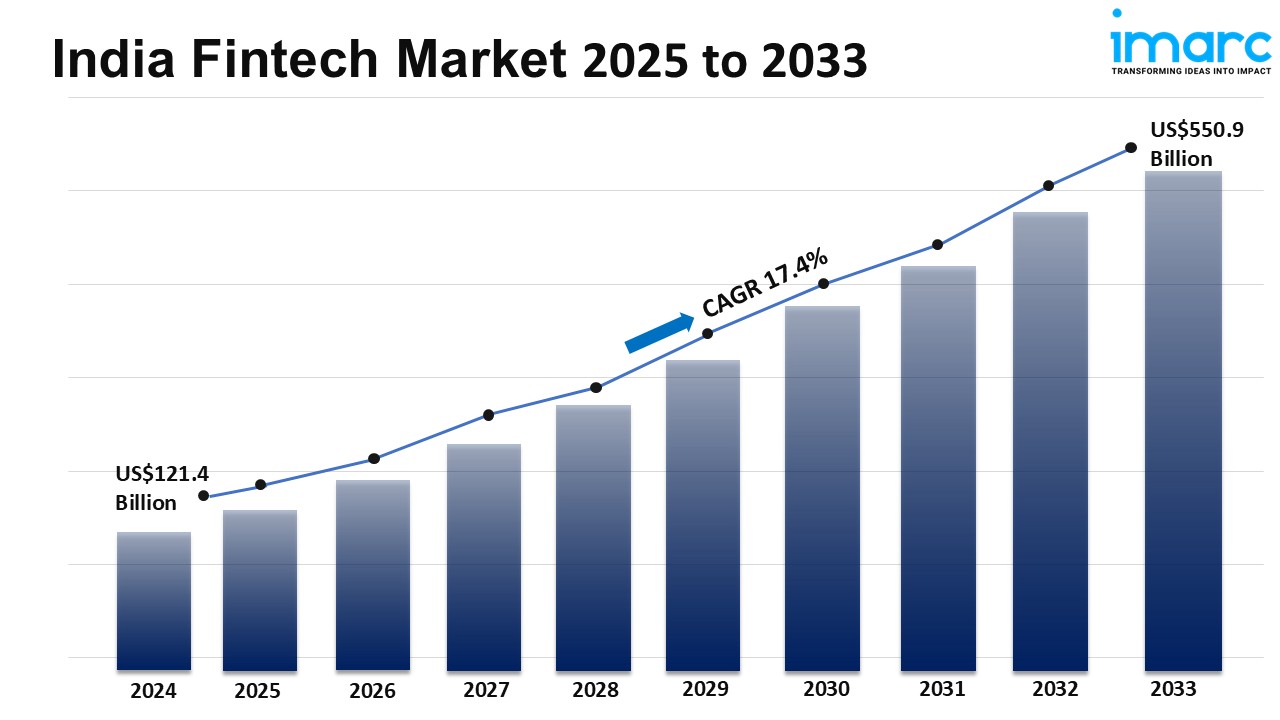

India Fintech Market Overview

Historical Years: 2019-2024

Forecast Years: 2025-2033

Market Size in 2024: USD 121.4 Billion

Market Forecast in 2033: USD 550.9 Billion

Market Growth Rate (2025-2033): 17.4%

The india fintech market size reached USD 121.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 550.9 Billion by 2033, exhibiting a growth rate (CAGR) of 17.4% during 2025-2033. The market is experiencing steady growth driven by increasing smartphone and internet penetration facilitating access to digital financial services, the implementation of regulatory frameworks encouraging innovation and consumer protection across the globe, and continuous technological advancements.

Request Sample For PDF Report: https://www.imarcgroup.com/india-fintech-market/requestsample

India Fintech Market Industry Trends and Drivers:

The India fintech market is witnessing unprecedented growth, driven by a robust digital infrastructure and proactive government policies. Authorities are actively promoting financial inclusion through initiatives like the Unified Payments Interface (UPI), which is revolutionizing peer-to-peer and merchant transactions. Simultaneously, the integration of Aadhaar-based authentication and the proliferation of low-cost internet connectivity are eliminating traditional barriers to financial services, particularly in rural and semi-urban regions. Regulatory bodies are further fostering innovation by introducing sandbox frameworks, enabling startups to test solutions in controlled environments. This ecosystem is empowering fintech firms to design hyper-localized products, from microloans for small businesses to insurance solutions tailored for informal sectors. As public and private stakeholders collaborate to build a cashless economy, the focus remains on scalability, security, and seamless interoperability between platforms.

A surge in smartphone penetration and a young, digitally native population are fundamentally altering financial service expectations. Consumers increasingly prioritize speed, convenience, and personalization, compelling fintech companies to innovate beyond basic payment solutions. Platforms offering embedded finance, such as buy-now-pay-later options and AI-driven wealth management tools, are gaining traction among urban millennials and Gen Z users. Meanwhile, the post-pandemic shift toward contactless transactions continues to influence spending habits, with sectors like edtech, healthtech, and e-commerce integrating fintech solutions into their ecosystems. Rural areas are not far behind, as vernacular-language apps and voice-enabled services bridge literacy gaps, driving adoption of digital wallets and micro-investment platforms. This behavioral shift is creating a fertile ground for niche segments, including insurtech and regtech, to address previously underserved needs.

The sector is attracting significant capital from global investors and venture capitalists, keen to capitalize on India’s position as a fintech innovation hub. Startups are leveraging these funds to enhance AI capabilities, blockchain integration, and cybersecurity frameworks, ensuring compliance with evolving regulations. Partnerships between fintechs and traditional banks are also deepening, with institutions adopting APIs to offer real-time services like instant loan disbursals and automated credit scoring. Furthermore, cross-border collaborations are opening avenues for Indian fintech players to export scalable models to Southeast Asia, Africa, and the Middle East. As the ecosystem matures, the emphasis is shifting toward sustainable monetization strategies and profitability, with subscription-based models and white-label solutions gaining prominence. This synergy between technology, capital, and regulatory support positions India’s fintech landscape for long-term, inclusive growth.

India Fintech Market Industry Segmentation:

The report has segmented the market into the following categories

Breakup by Deployment Mode:

On-Premises

Cloud-Based

Breakup by Technology:

Application Programming Interface

Artificial Intelligence

Blockchain

Robotic Process Automation

Data Analytics

Others

Breakup by Application:

Payment and Fund Transfer

Loans

Insurance and Personal Finance

Wealth Management

Others

Breakup by End User:

Banking

Insurance

Securities

Others

Breakup by Region:

North India

South India

West and Central India

East India

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Ask Our Expert & Browse Full Report with TOC & List of Figure: https://www.imarcgroup.com/request?type=report&id=10442&flag=C

Key highlights of the Report:

Market Performance (2019-2024)

Market Outlook (2025-2033)

COVID-19 Impact on the Market

Porter’s Five Forces Analysis

Strategic Recommendations

Historical, Current and Future Market Trends

Market Drivers and Success Factors

SWOT Analysis

Structure of the Market

Value Chain Analysis

Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.