India Industrial Packaging Market Trends, Growth Rate & Forecast 2024-2032

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Market Overview 2024-2032

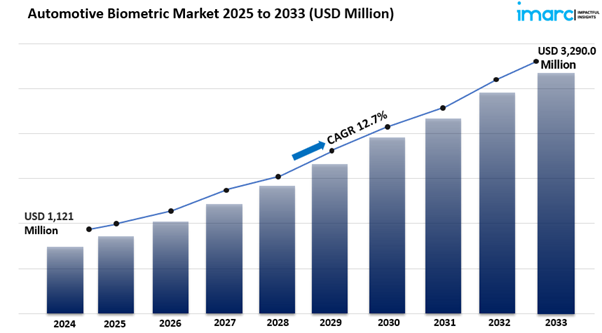

The India industrial packaging market size reached USD 4.56 Billion in 2023. Looking forward, IMARC Group expects the market to reach USD 8.74 Billion by 2032, exhibiting a growth rate (CAGR) of 7.20% during 2024-2032. The increasing demand for advanced materials, such as lightweight and high-strength composites, which have improved the efficiency of packaging solutions, is driving the market.

Key Market Highlights:

✔️ Strong market expansion driven by rapid industrialization & growing logistics sector

✔️ Rising demand for durable and cost-effective bulk packaging solutions

✔️ Increasing adoption of sustainable and biodegradable industrial packaging materials

Request for a sample copy of the report: https://www.imarcgroup.com/india-industrial-packaging-market/requestsample

India Industrial Packaging Market Trends and Driver:

The increasing pace of industrialization across sectors such as manufacturing, pharmaceuticals, chemicals, and food & beverage is significantly boosting the demand for industrial packaging in India. With the expansion of domestic production and exports, industries are seeking efficient and durable packaging solutions to ensure product safety during storage and transportation. Additionally, the rise of e-commerce and third-party logistics (3PL) services has further accelerated the need for bulk and protective packaging materials.

By 2024, the integration of smart tracking technologies, such as RFID and IoT-enabled packaging, is expected to enhance supply chain efficiency and reduce losses due to damage or pilferage. The ongoing infrastructural developments in warehousing and cold chain logistics are also contributing to the market's steady growth, making industrial packaging a crucial element in India's evolving trade landscape.

Industries are increasingly prioritizing cost-effective and durable packaging solutions that ensure product integrity while minimizing transportation costs. Flexible intermediate bulk containers (FIBCs), corrugated boxes, drums, and rigid plastic containers are gaining popularity across multiple sectors due to their high load-bearing capacity and efficiency in bulk handling.

The demand for lightweight yet strong packaging materials is also on the rise as companies seek to optimize freight expenses without compromising on safety. In 2024, advancements in packaging materials, including high-strength polymer composites and tamper-proof designs, are expected to drive further innovation in industrial packaging. Additionally, the emphasis on reducing material wastage and improving recyclability is encouraging manufacturers to explore cost-efficient yet sustainable bulk packaging alternatives to meet industry requirements.

Sustainability concerns and stringent environmental regulations are pushing industries towards adopting eco-friendly industrial packaging solutions. Businesses are actively shifting towards biodegradable, recyclable, and reusable packaging materials to align with global sustainability goals and reduce their carbon footprint. The use of paper-based, bio-plastic, and compostable materials is gaining momentum, particularly in sectors such as food processing, pharmaceuticals, and chemicals.

By 2024, the increasing enforcement of extended producer responsibility (EPR) policies and rising consumer awareness about sustainable practices are expected to further drive the adoption of green packaging solutions. Additionally, innovations such as water-soluble films, plant-based polymers, and minimalistic packaging designs are emerging as key trends, positioning sustainability at the core of India's industrial packaging evolution.

India Industrial Packaging Market Segmentation:

The India industrial packaging market forecast offers insights into future opportunities and challenges, drawing on historical data and predictive modeling.

Study Period:

Base Year: 2023

Historical Year: 2018-2023

Forecast Year: 2024-2032

Product Insights:

- Intermediate Bulk Containers (IBCs)

- Sacks

- Drums

- Pails

- Others

Material Insights:

- Paperboard

- Plastic

- Metal

- Wood

- Fiber

Application Insights:

- Chemical and Pharmaceutical

- Building and Construction

- Food and Beverage

- Oil and Lubricant

- Agriculture and Horticulture

- Others

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.